Aster Clarifies Tokenomics After Confusion Over Token Unlock Delays

Aster clarified its tokenomics after a CMC update caused confusion over unlocks, saying no changes were made and unused tokens remain out of circulation.

Aster moved to calm its community after a miscommunication on CoinMarketCap (CMC) led users to believe the project had quietly changed its token unlock schedule.

The team said the tokenomics remain unchanged and blamed an update on CMC for creating the confusion.

ASTER Token Unlock Confusion

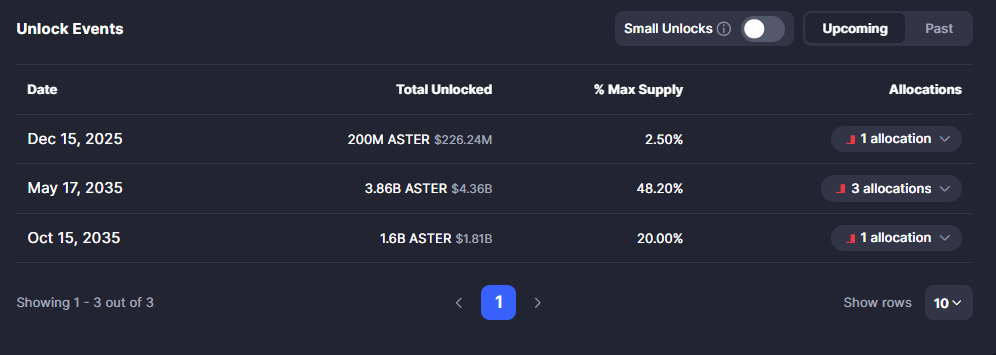

The clarification came hours after Aster community members noticed major upcoming unlocks listed on CMC — including one for December 2025 and two massive releases scheduled for 2035.

This contradicts earlier statements from the exchange about delaying 2025 unlocks to mid-2026.

A recent update to the tokenomics of ASTER on CoinMarketCap (CMC) has caused confusion within the community. This confusion stemmed from a miscommunication, and we sincerely apologize for the inconvenience caused. We want to clarify that the ASTER tokenomics remain unchanged.…

— Aster (@Aster_DEX) November 15, 2025

The uncertainty started when updated CMC data showed 200 million ASTER scheduled to unlock on December 15, 2025, followed by 3.86 billion ASTER and 1.6 billion ASTER unlocks in 2035.

Those figures implied that 75% of the token supply was still locked, with 24% currently circulating.

Aster said the CMC update was meant to correct circulating supply information and clarify how unused ecosystem tokens were being treated.

Original Post That Caused Confusion About Aster Tokenomics. Source:

Original Post That Caused Confusion About Aster Tokenomics. Source:

The team said the tokens that unlock monthly under the ecosystem allocation have never entered circulation and have remained untouched in a locked address since TGE.

To avoid further confusion, Aster will now transfer these unlocked-but-unused tokens to a public, dedicated unlock address to separate them from operational wallets.

The team said it has no plans to spend from this address.

Why This Matters for ASTER Holders

The episode highlights a recurring issue in crypto markets. Inconsistent or unclear circulating supply data can influence price action, investor expectations, and perceived dilution risk.

Upcoming ASTER Token Unlocks. Source:

Upcoming ASTER Token Unlocks. Source:

Aster’s circulating supply sits around 2.017 billion ASTER, with 6.06 billion still locked. Market cap is roughly $2.28 billion, while the fully diluted value exceeds $9 billion.

A sudden interpretation that large unlocks were imminent may have fueled speculation about dilution, especially as the project recently saw heavy trading volume and rising volatility.

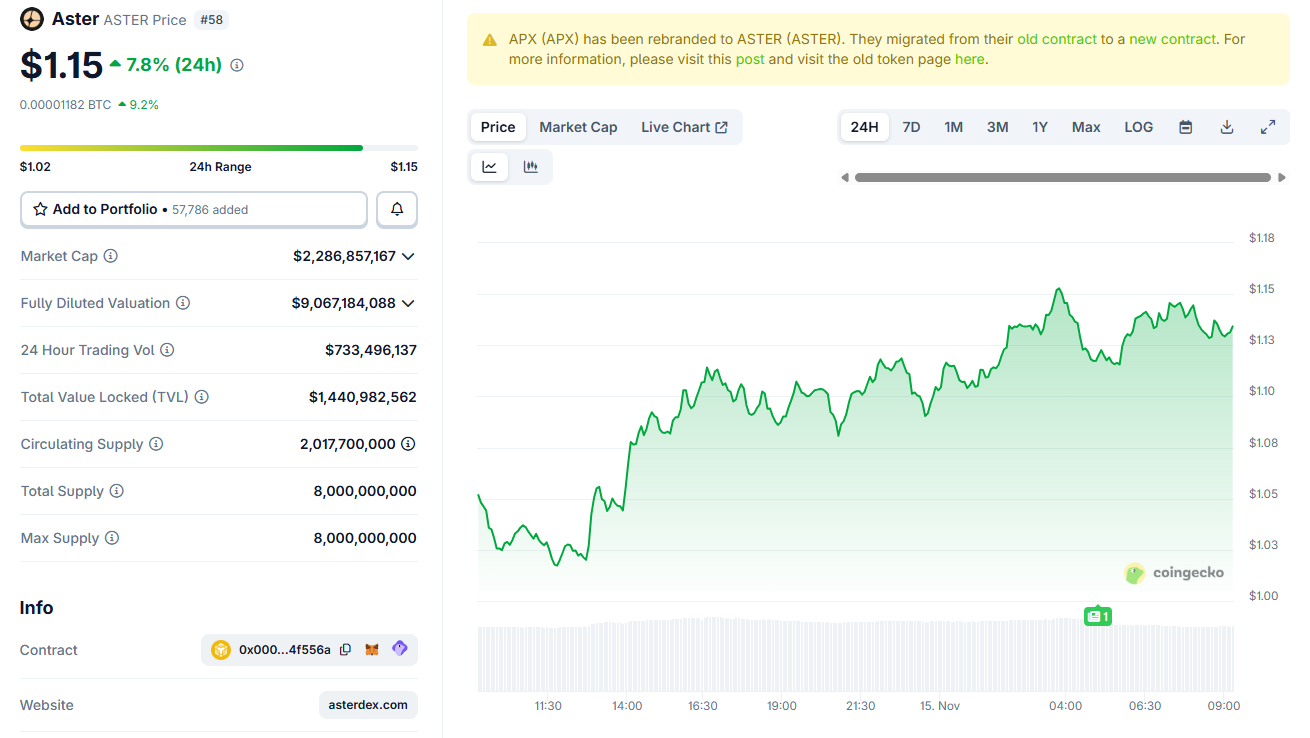

ASTER Daily Price Chart. Source:

ASTER Daily Price Chart. Source:

Despite the confusion, ASTER traded higher on the day, moving around $1.14, up about 8% in 24 hours. The price has fluctuated between $1.02–$1.15, stabilizing after an early-morning sell-off.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Investors Exit Cryptocurrency Market Amid Fed’s Reluctance to Lower Rates

- Fed officials including Lorie Logan and Neel Kashkari oppose rate cuts, citing persistent inflation and weak economic data, dampening December easing expectations. - Tightening liquidity and shifting Fed policy triggered Bitcoin's six-month low at $93,000 and record $866M ETF outflows amid heightened defensive positioning in crypto derivatives. - Market pricing for a 25-basis-point December cut dropped to 52% from 94%, driving capital reallocation to cash, bonds, and gold as macro uncertainty persists. -

Bitcoin’s Latest Steep Drop and Its Impact on the Market: Broader Economic Drivers and Changes in Institutional Outlook

- Bitcoin fell to $94,000 in November 2025, entering a bear market driven by macroeconomic pressures, institutional redemptions, and regulatory uncertainty. - The Czech National Bank's $1 million Bitcoin purchase signaled growing institutional acceptance, reducing its existential risk in asset models. - Investors face recalibrating strategies as Bitcoin's liquidity declines and Fed policy, regulatory shifts, and FTX-related trust deficits shape near-term volatility. - A dual approach of hedging volatility

Pi Network's 770,000 Coin Increase Indicates Mainnet Launch is Imminent

- Pi Network mapped 770,000 coins in one day, signaling mainnet readiness as blockchain infrastructure advances toward smart contract support. - Testnet 1's low failure rates and v23 protocol testing confirm stability, while developers prepare liquidity pools and token creation tools. - Pi's price rose above $0.22 amid new Pi App Studio features and AI partnerships, expanding its decentralized ecosystem beyond finance. - Fast-track KYC and OpenMind collaboration highlight growth strategies, though regulato

Bitcoin Updates: Bitcoin Holdings Compared to Declining Stocks—Strategy’s Shrinking NAV Raises Concerns

- Michael Saylor dismissed rumors of Strategy selling Bitcoin , reaffirming its long-term "HODL" strategy despite recent wallet transfers sparking speculation. - Strategy holds 642,000 BTC ($61.3B value) but its $59.92B market cap now trails Bitcoin holdings, triggering "NAV compression" concerns. - Analysts note mNAV dropped to 1.24x from 1.8x in 2024, predicting further decline as investor appetite wanes and debt-funded buying sustainability is questioned. - Saylor's euro-denominated $702M funding aims t