Ethereum Updates: SEC Guidelines Allow Cryptocurrencies to Achieve Commodity Classification

- SEC Chair Paul Atkins proposed a crypto regulatory framework exempting ETH, SOL, and XRP from securities classification using the Howey Test to clarify market roles. - The framework categorizes crypto assets into four groups, allowing tokens to "graduate" from securities to commodities as ecosystems decentralize and utility emerges. - It introduces "super apps" for mixed-asset trading and a six-month compliance grace period, aiming to balance innovation with fraud prevention and reduce regulatory fragmen

SEC Chair Paul Atkins has introduced a comprehensive set of regulations for digital currencies that could transform the U.S. crypto sector, excluding leading tokens such as

Atkins’ guidelines divide crypto assets into four main categories: securities, commodities, collectibles, and utilities. Tokens that support decentralized networks will typically not be considered securities once their ecosystems are sufficiently developed, as users interact with them for their practical use rather than to gain profits from centralized control

The foundation of this framework is the Howey Test, which determines if an asset involves a monetary investment in a shared venture with profits coming from the work of others. Atkins explained that tokens are only deemed securities if there are clear, direct promises of profit linked to managerial actions. As networks become more decentralized and tokens shift from investment contracts to functional assets, they may be freely traded as commodities

The framework also introduces a six-month transition period for issuers to resolve compliance issues, aiming to decrease enforcement actions and promote timely adjustments as networks develop

Experts have welcomed this policy shift as a possible driver for institutional participation, with Chainalysis reporting that over 80% of major digital assets now operate in decentralized networks

Atkins’ comments reflect a wider philosophical perspective: the SEC’s original mission, established during the Great Depression, was never meant to cover all digital assets. “Securities laws were crafted to address issues involving reliance on others’ expertise,” he noted. “They were not intended to govern every new type of digital value”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Disney and YouTube TV finalize agreement to restore service after blackout

Jury determines Apple must pay Masimo $634 million for violating patents

Aster News Today: Major Investors Place Bold Wagers on ASTER's Surge While Questions About Sustainability Persist

- Whales accumulate ASTER tokens, pushing price toward $1.21 resistance amid mixed on-chain signals. - Derivatives volume jumps 34.47% to $1.89B, with open interest rising to $550.87M as traders speculate on breakout. - Technical analysts highlight a key ascending triangle pattern, but sustainability concerns linger due to stagnant adoption and low fees. - Market optimism grows with bullish tweets and 10% price surge, yet $2.14M in liquidations underscores volatility risks.

Bitcoin Latest Updates: While Cryptocurrencies Decline, Major Institutions Reinforce Their Commitment to Long-Term Prospects

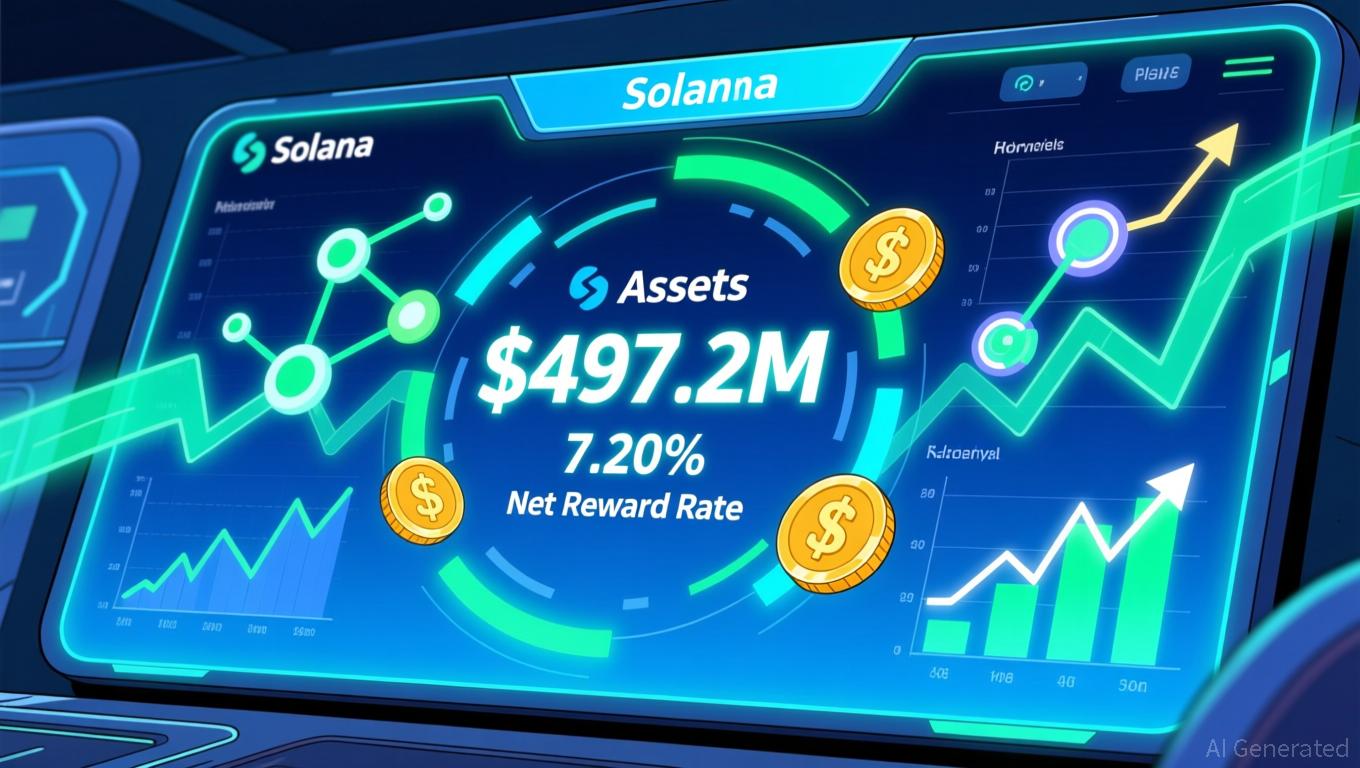

- Bitwise CEO Hunter Horsley asserts crypto's long-term fundamentals remain strong despite recent market selloffs, citing ETF growth and regulatory progress. - Bitwise's $497M Solana Staking ETF (BSOL) dominates 98% of Solana ETF flows, offering 7.20% staking rewards and options trading since November. - U.S. regulators advance crypto-friendly measures including leveraged spot trading plans, while institutions like BlackRock expand digital asset offerings. - Despite Bitcoin's $95k dip and bearish technical