Date: Sat, Nov 15, 2025 | 05:40 PM GMT

The cryptocurrency market has shown a slightly steady tone today, with both Bitcoin (BTC) and Ethereum (ETH) trading mildly in the red. This minor pullback has extended pressure onto several altcoins , including the RWA token Ondo (ONDO).

ONDO has recorded a modest dip today, but something far more important is unfolding beneath the surface. A well-defined harmonic structure is emerging on the chart, hinting that a potential rebound may not be too far away.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Signals More Upside

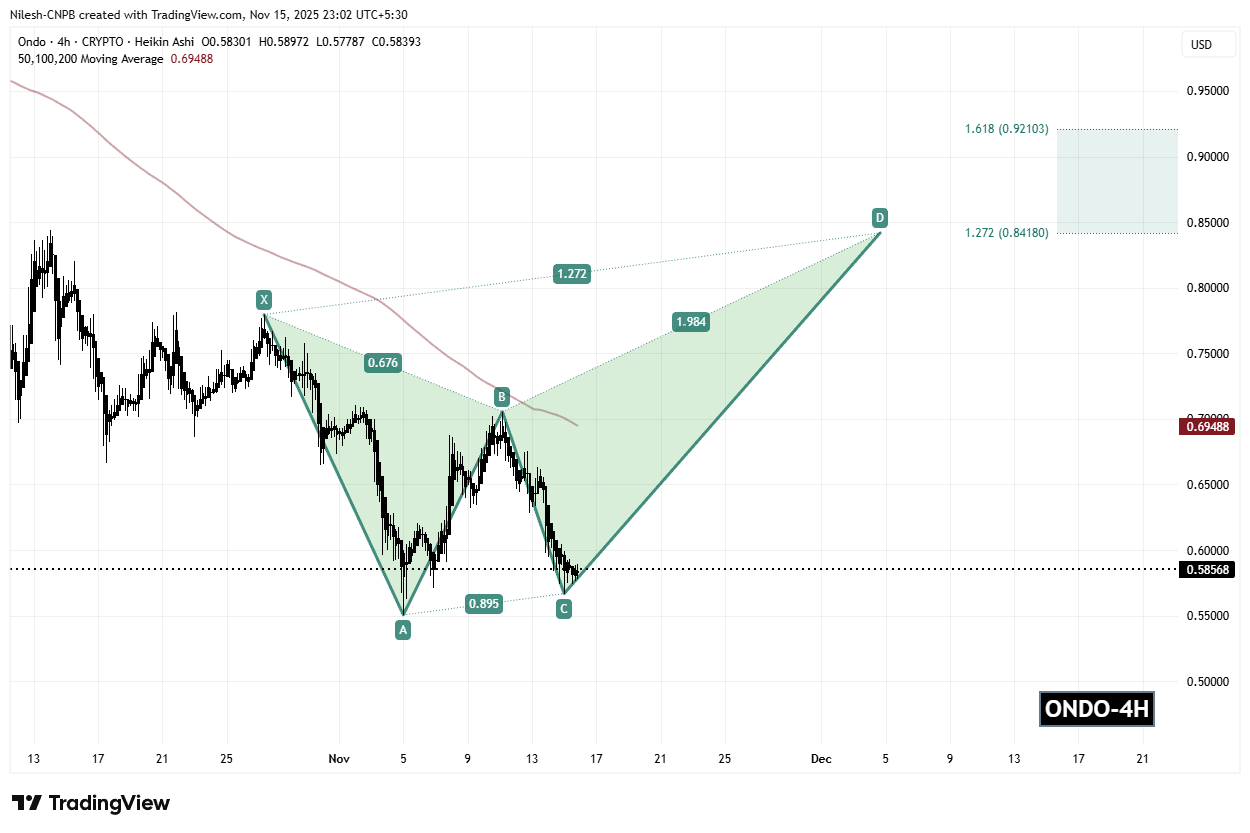

On the 4H timeframe, ONDO is forming a Bearish Butterfly harmonic pattern—a structure that typically pushes price higher until the final D-point completes. While the ultimate reversal happens at the PRZ, the journey toward that level often brings measured upside momentum.

The pattern began from point X at the $0.77 region before sliding into A and then rebounding to B near the 0.676 retracement. After that, ONDO corrected sharply into C around $0.56675, forming the base for a potential upward leg.

Ondo (ONDO) 4H Chart/Coinsprobe (Source: Tradingview)

Ondo (ONDO) 4H Chart/Coinsprobe (Source: Tradingview)

Since touching C, ONDO has begun stabilizing and is now trading around $0.5856, signaling early recovery signs but still awaiting confirmation of strength.

What’s Next for ONDO?

The immediate key lies at the C-support zone around $0.56675. Holding this level is crucial for keeping the harmonic structure intact. If ONDO maintains this support and gathers momentum, the next major challenge sits at the 200-day moving average around $0.69488. Reclaiming this dynamic resistance would be a strong bullish signal and could trigger the continuation of the CD-leg.

From there, ONDO’s path points toward the Potential Reversal Zone (PRZ) between the 1.272 Fibonacci extension at $0.8418 and the 1.618 extension at $0.92103. Historically, this is where the Butterfly pattern completes before facing larger resistance or a potential trend reversal.

However, losing the C-support at $0.56675 would weaken the structure and delay the bullish scenario, exposing ONDO to deeper testing before any meaningful recovery can resume.