AAVE Drops 13.95% Over 7 Days Amid Strategic Changes Triggered by Euro Stablecoin Regulatory Approval

- Aave becomes first DeFi protocol to secure EU MiCA regulatory approval for euro stablecoin operations across 27 EEA states. - The Irish subsidiary Push Virtual Assets Ireland now issues compliant euro stablecoins, addressing ECB concerns about USD-dominance in crypto markets. - Aave's zero-fee Push service generated $542M in 24-hour trading volume, contrasting with typical 1-3% fees on centralized exchanges. - With $22.8B in borrowed assets, the platform's regulatory milestone is expected to accelerate a

As of November 15, 2025,

Aave has achieved a milestone as the first decentralized finance (DeFi) platform to obtain comprehensive regulatory authorization under the European Union’s Markets in Crypto-Assets (MiCA) regulations. This approval, granted by the Central Bank of Ireland to Aave’s Irish entity, Push Virtual Assets Ireland Limited, allows the DeFi protocol to issue and manage euro-backed stablecoins throughout all 27 countries in the European Economic Area (EEA). This development represents a significant step forward for regulated DeFi operations in Europe.

With MiCA-compliant euro stablecoins now available, users can transact in a regulated and transparent environment, addressing the European Central Bank’s (ECB) concerns about the prevalence of U.S. dollar-based stablecoins like

The platform has introduced a new fiat-to-crypto feature called Push, enabling users to instantly convert euros into stablecoins without incurring any fees. This is a notable contrast to the typical 1–3% conversion charges found on most centralized exchanges. The zero-fee approach has already attracted considerable attention, with Aave reporting $542 million in trading volume within 24 hours of the launch.

Currently, the platform has $22.8 billion in outstanding loans, reflecting strong confidence from its user base. Experts believe that this regulatory and operational achievement will accelerate the use of euro-based DeFi products, establishing Aave as a frontrunner in compliant digital finance across Europe.

The MiCA authorization also highlights Ireland’s emergence as a key regulatory center for DeFi. Earlier this year, Kraken received similar regulatory approval in Ireland, indicating a growing trend of DeFi platforms seeking compliance in regions with progressive crypto regulations. This movement may increase competition among European regulators to attract crypto firms, further strengthening the legitimacy of the DeFi sector.

Backtest Hypothesis

An evaluated trading method involves buying AAVE after a 15% surge and holding it for a single day. However, this strategy has delivered weak results, with a 30-day return of -12.96%, falling well short of broader market indices. Although the approach aims to benefit from short-term momentum, it fails to account for overall market trends and volatility, resulting in disappointing outcomes. This underscores the risks of relying on short-term speculative strategies in a highly volatile and interconnected market. Both investors and analysts may need to prioritize longer-term perspectives and integrate market sentiment and fundamental analysis to achieve better performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

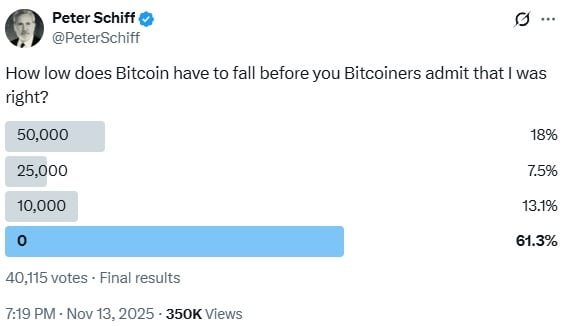

Peter Schiff Warns Bitcoin May Keep Sinking as Sentiment Tests Major Thresholds

Bitcoin Updates: As Crypto Markets Waver, Founder’s BTC Acquisition Reflects Enduring Confidence

- Cryptocurrency markets fell for a third day, with Bitcoin dropping below $100,000, erasing $130B in value as panic spread. - Equation founder's BTC purchase signaled long-term confidence despite bearish sentiment and a "consolidation limbo" trapping Bitcoin. - Macroeconomic uncertainty from the U.S. government shutdown and $1B in liquidations worsened the selloff, while the Crypto Fear and Greed Index hit "Extreme Fear." - Institutional interest in crypto products like Canary XRPC ETF and decentralized p

DCR is currently trading at $37.04, up 10.6% in the last 24 hours.

STRK broke through $0.23, with a 24-hour increase of 29.3%.