A $170 million buyback and AI features still fail to hide the decline; Pump.fun is trapped in the Meme cycle

Facing a complex market environment and internal challenges, can this Meme flagship really make a comeback?

Author: Frank, PANews

Pump.fun, known as the "Meme Minting Factory" in the Solana ecosystem, has accumulated staggering revenue and wealth. However, the platform token PUMP has been struggling under continuous selling pressure. To reverse the downturn, Pump.fun is attempting a two-pronged approach: aggressive token buybacks and the experimental introduction of a new AI agent feature called "Mayhem Mode."

Facing a complex market environment and internal challenges, can this meme aircraft carrier really make a comeback?

Noticeable Data Decline, Still Resilient Compared to the Industry

To understand Pump.fun's predicament, one must look closely at its complex data.

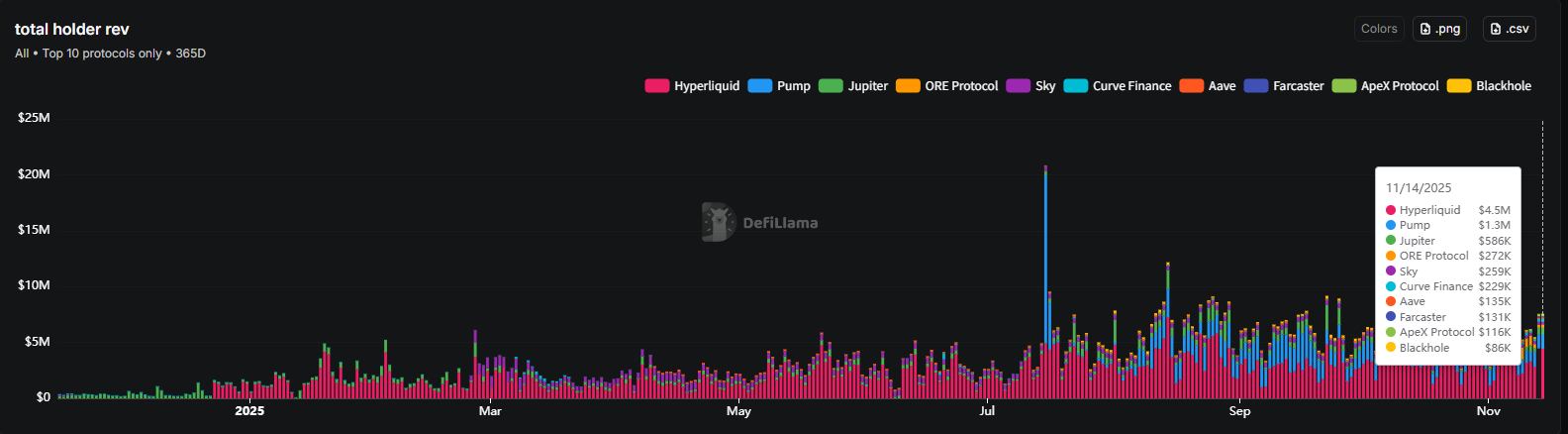

As of November 14, Pump.fun's daily average revenue still remains above $1 million, ranking in the top five among all protocols. However, compared to the $4 million daily revenue at the beginning of the year, this figure has seen a significant decline.

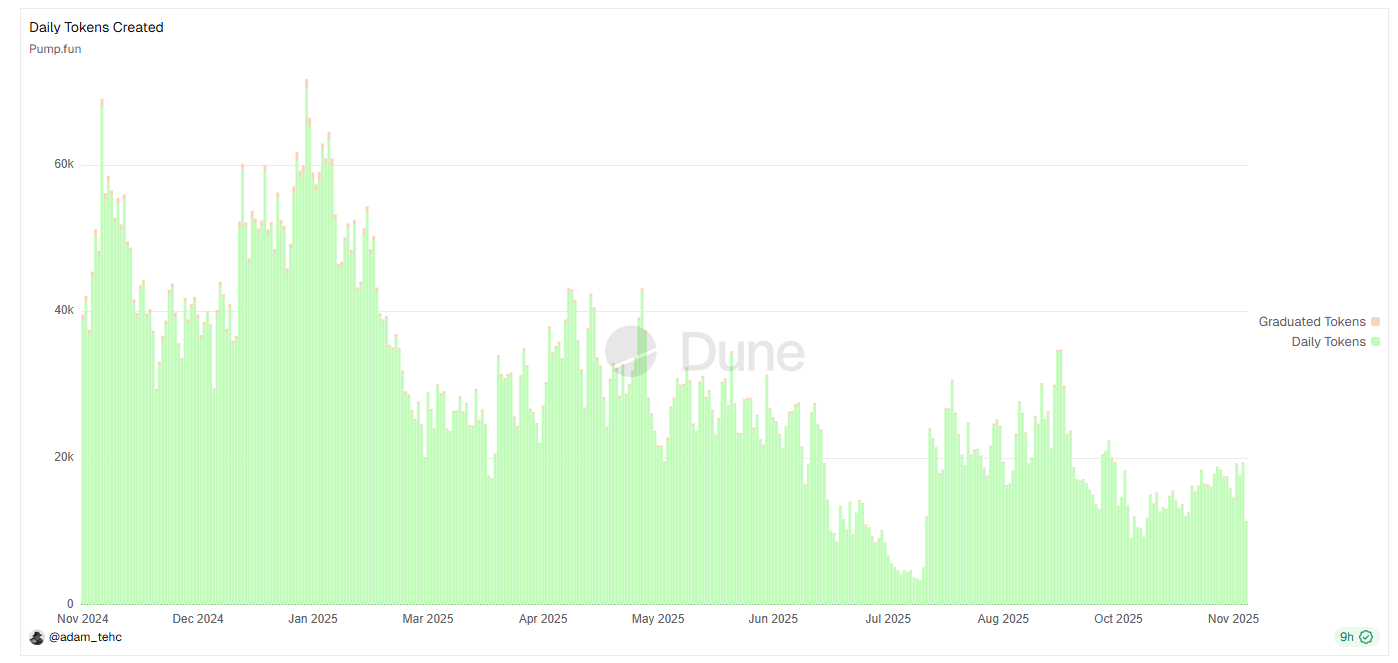

Meanwhile, the number of new tokens issued daily on Pump.fun has dropped from a peak of 70,000 to less than 20,000. The number of daily active wallets has also declined, but over the past three months, this figure has generally stayed above 100,000, so the drop is not severe. The graduation rate for issued tokens has clearly decreased; since February this year, the graduation rate for tokens on Pump.fun has long been below 1%, and in September it once fell to 0.58%. This indirectly reflects that the success rate for speculation in the meme market is getting lower and lower.

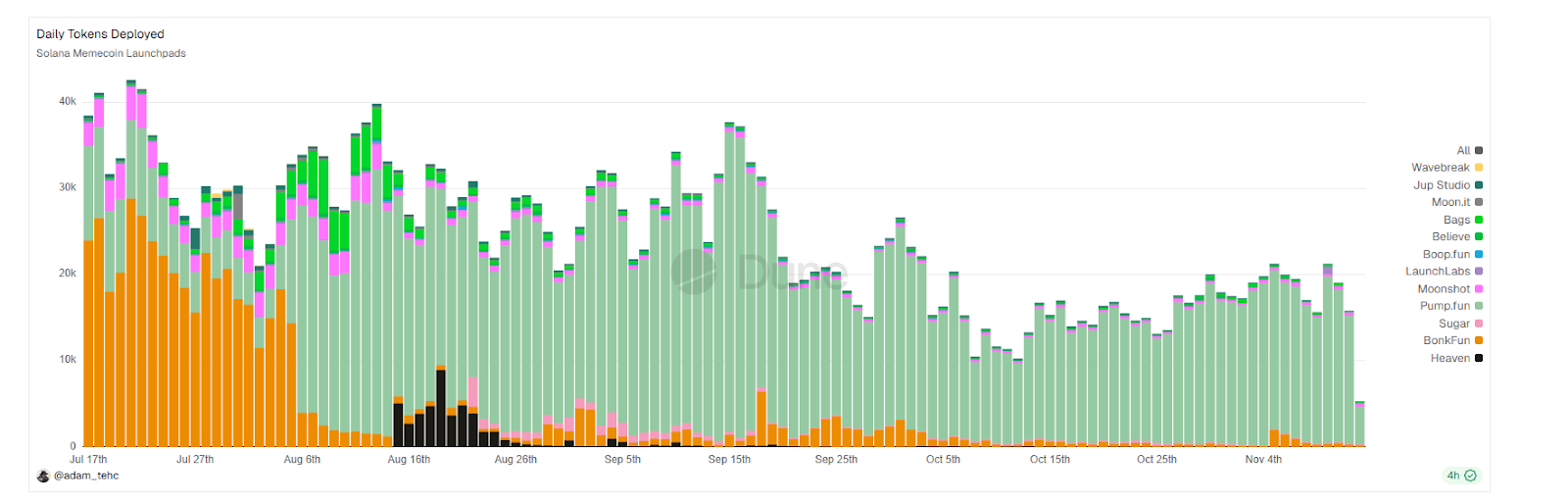

However, much of this data decline is due to the overall industry's downturn. Compared to its peers, Pump.fun's market share has actually increased. For example, on November 12, Pump.fun's token issuance on Solana's meme launch platforms was 14,800, accounting for about 93.4%. During the previous meme launch platform wars, its share once dropped to as low as 16.8%.

Overall, while Pump.fun's data has declined significantly compared to its peak, it appears more resilient than its competitors.

"Buyback" and "Pullback": The Ineffective Token Business Model

Facing slowing platform growth and the continued decline in PUMP token price, the Pump.fun team has tried to revive the market through "cash power" buybacks and the launch of "Mayhem Mode."

Since the launch of the PUMP token in July, Pump.fun has used about 98% of its platform revenue to buy back more than $173.7 million worth of PUMP tokens, equivalent to 11.19% of the total circulating supply.

This buyback effort ranks second among all buyback protocols, with daily buyback volume second only to Hyperliquid.

However, the price performance of PUMP does not seem proportional to the scale of the buybacks. The token price has fallen all the way from its September high, with the lowest pullback reaching $0.0015, a maximum drop of over 83%. The current pullback is about 60%, while bitcoin's maximum pullback during the same period was about 23%, and HYPE's was about 40%.

With the "cash power" failing, the team is trying to create a new narrative through product innovation. On November 12, the platform launched the experimental "Mayhem Mode." This feature aims to introduce AI agents that automatically participate in trading new tokens. According to the documentation, these AI agents will mint an additional 1 billion tokens for selected tokens (doubling the total supply to 2 billion), then conduct "random trades" within 24 hours to increase early liquidity, and finally burn the unsold portion.

However, this highly anticipated update encountered "mayhem" as soon as it went live. Community feedback indicated that the new feature was not user-friendly and actually introduced many bugs, including "over-minting token supply," "draining creator funds," and "user funds being locked."

Meme sector KOL pepe boost bluntly stated: "In reality, there isn't more trading volume than regular tokens," and "I thought it would be a big deal, but actually it's just some experimental AI messing around on pump."

The Market Is Selling Off the "Meme Sector," Not Pump.fun

Why can't daily buybacks of millions of dollars support the price? Why did the highly anticipated new feature become a laughingstock? The fundamental reason for the market's lack of confidence may not lie with Pump.fun as a company, but rather with broader narratives, structural flaws, and cyclical forces.

First, the general trend is inescapable.

Recently, the market pullback has intensified, with almost all tokens declining. In this environment, buybacks can only "slow the decline" rather than "reverse the trend." As mentioned earlier, Hyperliquid has similarly strong revenue and buyback mechanisms, but its token also experienced a significant 40% pullback. This proves that in a bear market, relying solely on protocol revenue buybacks cannot counteract macro selling pressure.

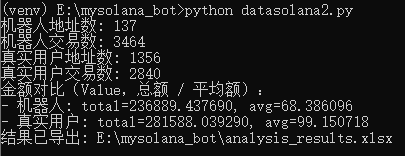

Second, there has always been skepticism in the market: Pump.fun's high revenue and high trading volume are seen as a huge "bubble," generated by high-frequency trading bots rather than real users.

Once this bubble bursts, the corresponding price will be hard to support. PANews conducted a special investigation, randomly sampling the last few hundred trades of 10 ungraduated tokens for behavioral analysis. It found that bot trading volume now accounts for about 54.7% of these tokens, with a single bot contributing an average of 22 trades per token, while real users only contribute 1.8 trades. In terms of trading volume, each bot trade contributes $68, with bots accounting for about 45.6% of total trading volume. In fact, this proportion is even lower than previous investigations. Therefore, from this perspective, the "bot bubble" is a long-standing structural issue for Pump.fun, but it has not worsened recently. It does not seem to be the main factor behind the token's decline.

Third, after ruling out macro and bot factors, the core reason may not be that Pump.fun is failing, but that the meme sector itself is failing.

The fundamental reason for the market's lack of confidence is that investors have lost faith in the entire "meme coin" sector. As the infrastructure of this sector, Pump.fun's token price reflects the overall sector's future expectations. Currently, those expectations are pessimistic.

This is evident from the performance of the Solana ecosystem, where overall activity on the Solana chain is shrinking. Data shows that Solana's overall active wallet count recently hit a 12-month low. As the main battleground for meme coins, Solana's "fuel" is running out.

It's not just Pump.fun; other meme launch platforms are performing even worse. LetsBonk.fun, which once threatened Pump.fun's position in July, saw its activity "collapse" rapidly after August, and now only about 200 new tokens are issued daily. In this industry-wide downturn, Pump.fun is actually "the most resilient one."

Therefore, we can seemingly draw this conclusion: the decline of the PUMP token is not the market selling off Pump.fun, but rather selling off the meme sector.

Pump.fun is just the most luxurious first-class cabin on the "sinking meme Titanic."

Recommended Reading:

Rewriting the 2018 script: Will the end of the US government shutdown = a bitcoin price surge?

$1 billion stablecoin evaporates: What's the truth behind the DeFi domino crash?

MMT short squeeze review: A carefully orchestrated money grab

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Uniswap Labs Faces Pushback as Aave Founder Highlights DAO Centralization Concerns

Ethereum Interop Roadmap: How to Unlock the “Last Mile” for Mass Adoption

From cross-chain to "interoperability," many of Ethereum's fundamental infrastructures are accelerating towards system integration for large-scale adoption.

Saylor Dismisses Sell-Off Rumors as Strategy Increases Bitcoin Holdings Amid Market Drop