Top 5 Bitcoin ETFs to Watch Out For in 2026

Bitcoin ETFs have already reshaped how investors interact with crypto, but 2026 is set to be a different kind of year. Growing institutional appetite, global regulatory clarity, and tighter competition among asset managers mean these funds will play an even bigger role in how capital flows into Bitcoin.

Why Top 5 Bitcoin ETFs Will Matter Even More in 2026

Bitcoin ETFs aren’t just a convenience anymore. They’ve become the preferred entry point for institutions that want exposure without touching wallets, private keys, or the operational mess that comes with direct crypto custody.

As ETF ecosystems mature, a few trends are taking shape:

- Capital from pension funds, hedge funds, and corporate treasuries keeps rising.

- Fee wars among major issuers are driving more investor-friendly products.

- ETF inflows and outflows now influence Bitcoin’s short-term price more than retail trading does.

So if you want a sense of where smart money is moving, watch the ETF market.

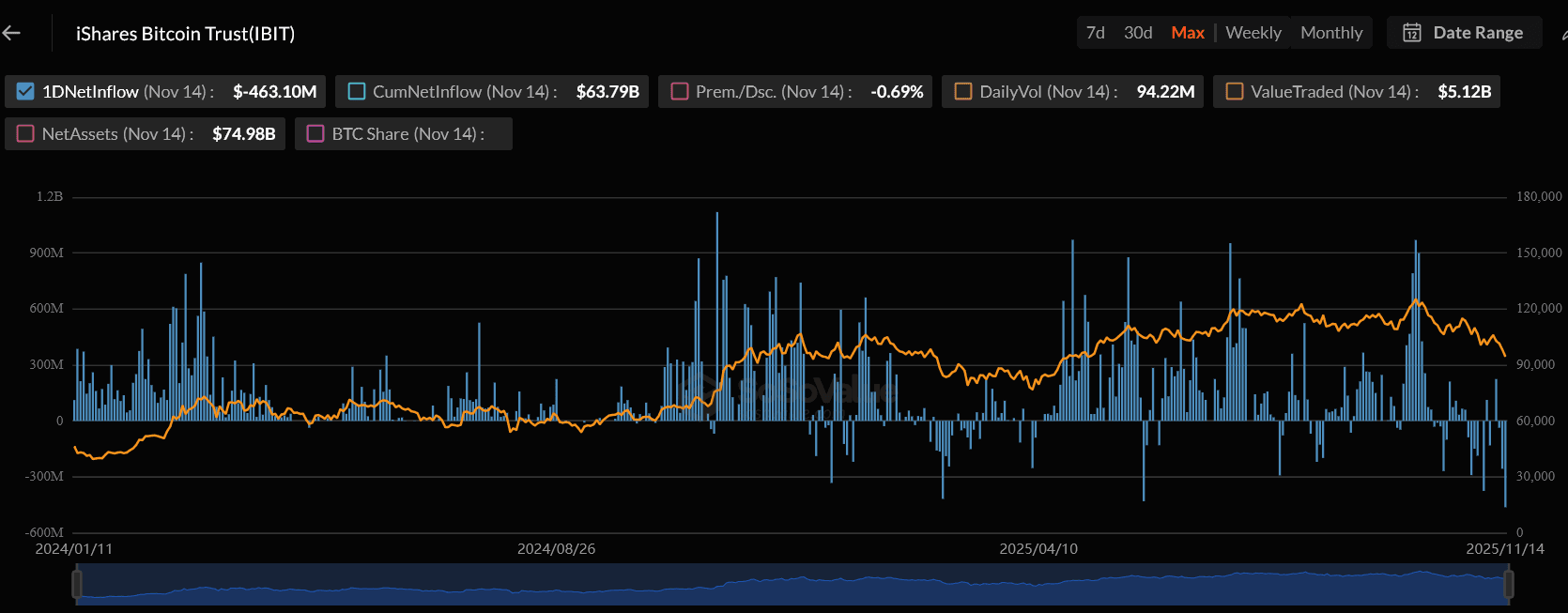

1. iShares Bitcoin Trust ETF (IBIT)

BlackRock’s IBIT: SoSoValue

BlackRock’s IBIT: SoSoValue

BlackRock’s IBIT is still the heavyweight champion. With over $74 billion in AUM and the deepest liquidity in the sector, it remains the go-to ETF for institutions that want scale and stability. If any ETF drives the market in 2026, it’s this one. Even modest inflow spikes here can move Bitcoin’s price noticeably.

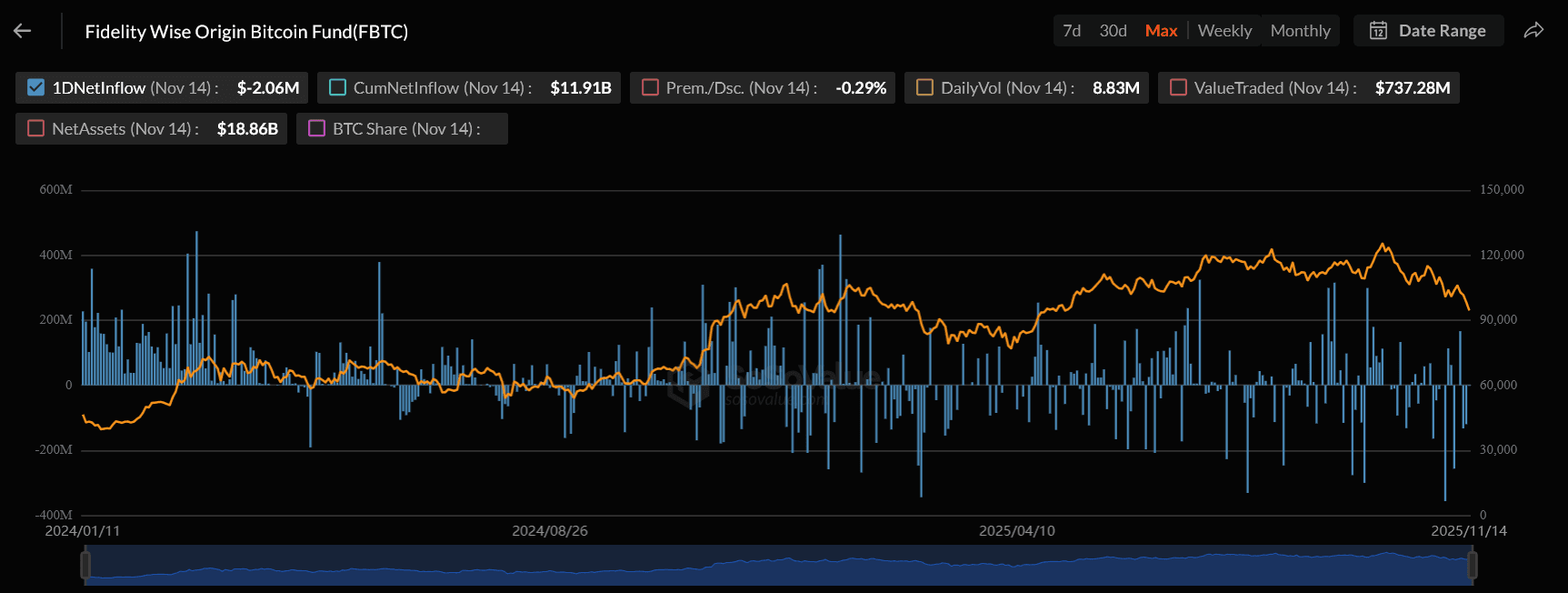

2. Fidelity Wise Origin Bitcoin Fund (FBTC)

FBTC: SoSoValue

FBTC: SoSoValue

Fidelity brings a long-standing reputation that appeals to conservative, traditional investors. Expect FBTC to shine in 2026 if retirement funds and long-horizon institutional players increase their Bitcoin allocations. Fidelity’s research-driven approach and low fee structure make this ETF a steady magnet for inflows.

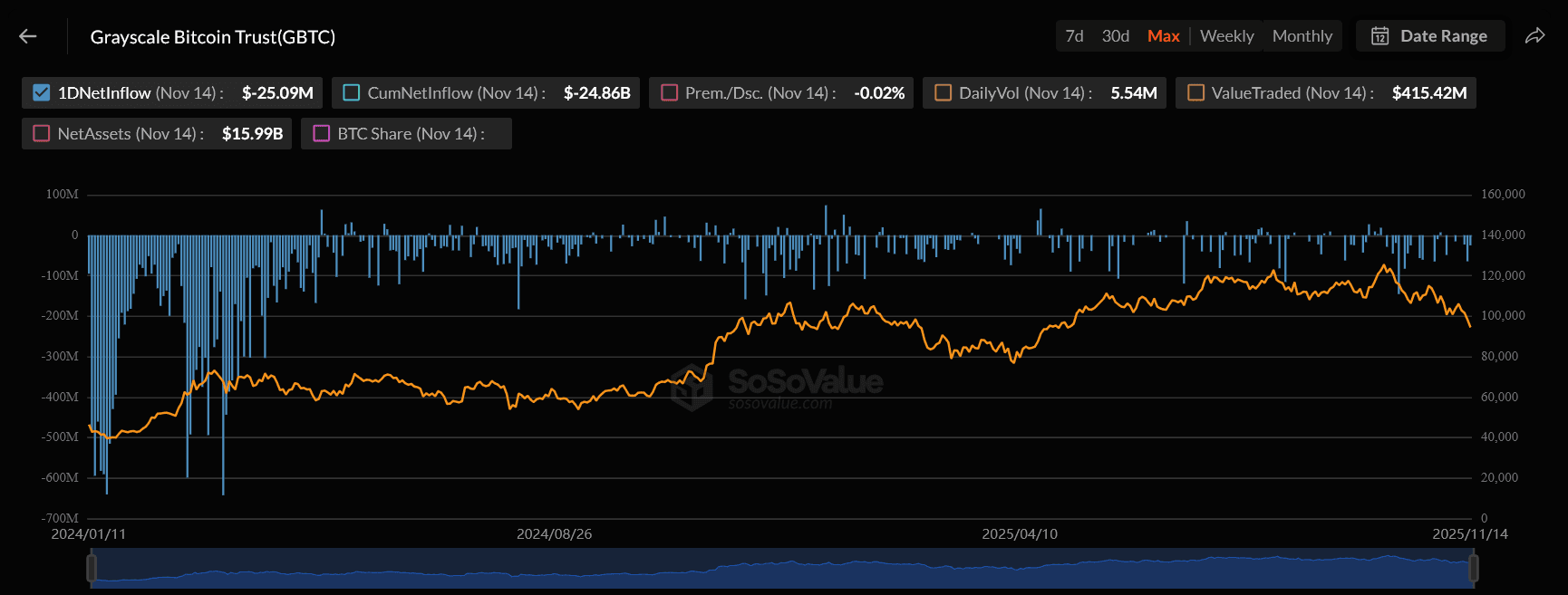

3. Grayscale Bitcoin Trust ETF (GBTC)

GBTC: SoSoValue

GBTC: SoSoValue

GBTC was once the linchpin of institutional Bitcoin exposure before ETFs were approved. Even though others have overtaken it, GBTC’s massive remaining asset base still gives it influence. In 2026, its impact will depend on whether Grayscale continues lowering fees and modernizing the structure to stay competitive.

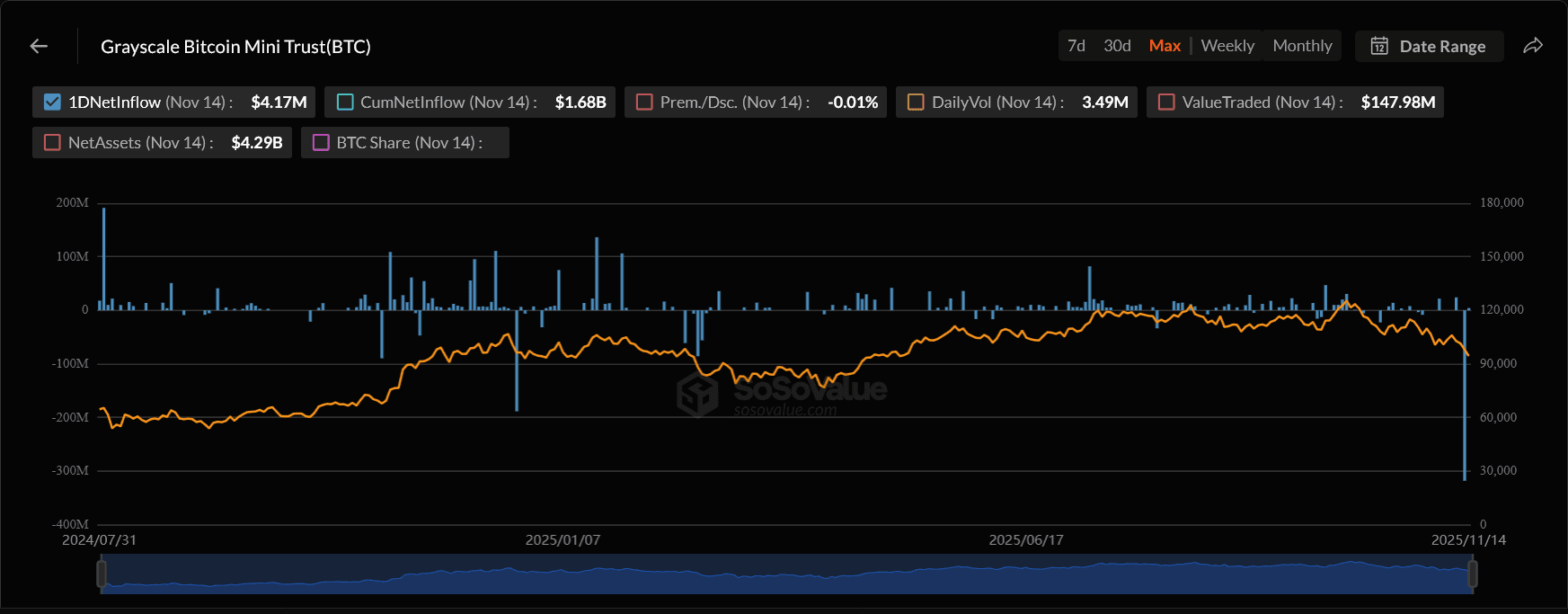

4. Grayscale Bitcoin Mini Trust (BTC)

BTC:SoSoValue

BTC:SoSoValue

The Mini Trust is designed to be leaner and cheaper than GBTC, and that simplicity has helped it find its own audience. As fee competition heats up next year, this ETF could see a noticeable surge from cost-conscious investors and smaller institutions entering the Bitcoin market for the first time.

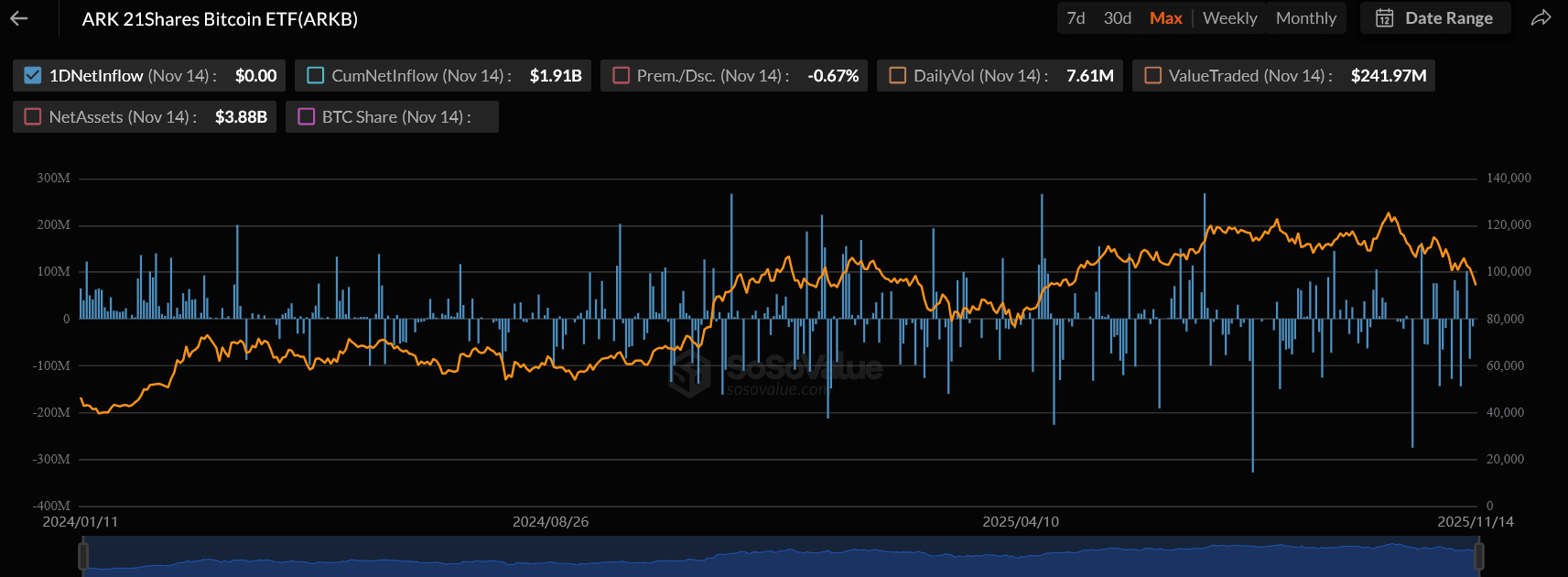

5. ARK 21Shares Bitcoin ETF (ARKB)

ARKB:SoSoValue

ARKB:SoSoValue

ARK Invest has built a brand around innovation, and ARKB fits that theme perfectly. Cathie Wood's consistent bullish outlook on crypto attracts growth-focused investors who want more than just passive exposure. If Bitcoin enters another expansion phase in 2026, ARKB is likely to outperform in inflows thanks to its audience and strategy.

Top 5 Bitcoin ETFs: What This Means for Investors in 2026

Watching these ETFs isn’t just about knowing where the big money sits. It’s about reading the market’s mood. Inflows usually hint at rising institutional confidence. Outflows often signal caution. And because ETFs now hold such a large share of circulating Bitcoin, their movements can amplify both rallies and corrections.

Whether you’re trading short term or thinking long term, paying attention to the ETF landscape gives you a real advantage. These five funds will shape the narrative in 2026 more than any others.

The Bottom Line

These top 5 Bitcoin ETFs have become the bridge between traditional finance and digital assets. In 2026, that bridge gets even busier. IBIT sets the pace, Fidelity brings credibility, Grayscale fights to retain its legacy, the Mini Trust keeps costs competitive, and ARKB taps into the innovation crowd.

If you want a clear picture of where institutional capital is heading next year, start by watching these five ETFs closely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Unexpected Bitcoin Plunge in November 2025: Causes Behind the Drop and Future Prospects for Cryptocurrency Investors

- The November 2025 BTC crash resulted from Fed tightening, lingering FTX trust erosion, and institutional outflows. - Fed's hawkish liquidity controls and inflation focus created toxic conditions for Bitcoin's low-rate-dependent market. - FTX's unresolved $7.1B payouts and $20B institutional exodus since 2022 amplified panic selling through trust deficits. - Crypto investors must now wait for Fed policy clarity and prioritize transparent platforms with regulatory compliance.

Bitcoin Updates Today: Fed Navigates Uncertainty as December Rate Cut Remains Unclear

- Market expectations for a Fed rate cut in December dropped to 52% from 95% a month ago, reflecting deepening policymaker divisions. - Hawks like Collins emphasize inflation risks, while doves argue easing is needed to avoid restrictive policies amid weak labor data. - A government shutdown delayed critical economic reports, complicating decisions as structural shifts demand nuanced policy responses. - Bitcoin gains were capped by reduced cut odds, while broader markets remain sensitive to Fed signals on

Solana News Update: Solana’s Fast Network Draws $1.5 Billion in Stablecoin Growth as USDC and USDT See Significant Increases

- Circle mints $500M USDC on Solana , leveraging its 4,000 TPS speed and $0.002 fees to boost DeFi liquidity. - Solana's 2.4M active addresses and 83M transactions highlight its appeal as Ethereum's high-throughput rival. - Tether simultaneously issues $1B USDT on Ethereum , contrasting with Solana's retail-friendly low-cost model. - Institutional adoption grows via Solana Staking ETF and major firm participation, challenging Ethereum's upgrades. - $1.5B stablecoin surge reflects demand for cross-chain sta

Fed's Policy Direction Shifts: Balancing Prudence and Swift Action in Crucial December Decision

- Fed faces 52% market odds of 25-basis-point rate cut at Dec 10 meeting, down sharply from 95% a month ago amid internal divisions. - Key officials like Collins and Kashkari oppose further easing without clearer labor market deterioration or inflation control below 3%. - Government shutdown delays critical data, forcing policymakers to rely on incomplete information and private-sector indicators. - Uncertainty risks asset markets: Bitcoin stagnates near $103k while real estate and growth stocks face headw