- TEL’s daily chart shows higher highs and higher lows, indicating a shift from prolonged bearish trends to emerging bullish momentum.

- Monthly analysis reveals wick support holding above key diagonal levels, suggesting accumulation and potential price stabilization for upcoming periods.

- Analyst sentiment has shifted toward “Buy” recommendations, with price targets aligning near $242–$244, reflecting growing market confidence in Telcoin.

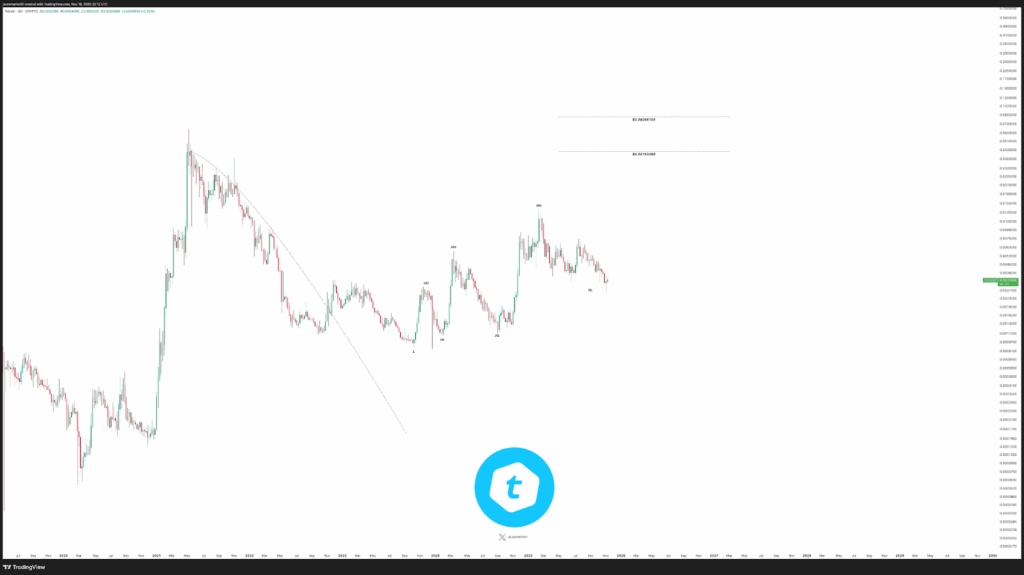

Telcoin (TEL) is maintaining higher lows, signaling that the crypto is following an upward trend after a prolonged accumulation phase. The recent price action suggests growing market confidence. Analysts note that buyers continue to assert control over key support levels.

Price Structure and Market Momentum

Telcoin’s daily chart shows a historical downtrend followed by a consolidation period, with multiple higher highs and higher lows forming. This structure points to a potential shift from bearish to bullish sentiment.

The latest higher low indicates that the uptrend remains intact unless broken.Two dotted resistance levels are currently observed around $0.0174 and $0.0248.

These zones may act as temporary selling pressure points, where market participants could take profits. A break above the latest higher high could confirm continued bullish momentum toward these targets.

A failure to hold the current higher low could lead to a retracement toward previous structure lows. Despite this, the accumulation phase suggests buyers are preparing for the next upward move.

Monthly Chart Dynamics and Support Levels

TEL recently wicked below its lowest diagonal support but remains above the candle-body support. Previous wick breaches have been followed by upward movements, suggesting potential bottom formation.

Analysts are monitoring this month as a pivot, with implications for short-term price stability.The monthly fair value gap (FVG) is approximately 50–70% filled, reducing immediate concerns about further downside.

Source: Javon Marks Via X

Source: Javon Marks Via X

Market participants are noting coiling patterns as the US government shutdown nears resolution.

Support levels are identified at $240.76 and $229.10, aligning with the higher lows pattern. Analysts remain attentive to these zones for potential accumulation opportunities.

Analyst Sentiment and Price Targets

Analyst sentiment for Telcoin has shifted notably from mid-2024 onward. Historically dominated by “Hold” ratings, the market now shows increased “Buy” recommendations, particularly through late 2025.

No “Sell” ratings have been recorded during this period, showing stabilizing confidence.The “TEL Price Targets by Month” chart indicates a gradual rise in consensus targets, accelerating sharply toward late 2025.

By November 2025, the price aligns with analyst targets near $242–$244. This reflects a narrowing gap between actual performance and expectations.JavonMarks noted that the price maintains higher lows and signaling potential for a 222% surge.

He also discussed long-term targets, highlighting continued bullish structure development. The combination of price action and analyst sentiment supports ongoing investor optimism.