Global trade barriers and increasing expenses lead to Japan's initial economic downturn after six consecutive quarters of growth

- Japan's Q3 2025 economy contracted 1.8% annually, first decline in six quarters, driven by 0.4% GDP drop and weak private consumption amid global trade tensions and domestic cost pressures. - Nexon Co. defied downturn with ¥118.7B revenue and 61% growth in MapleStory, showcasing digital innovation's resilience despite broader economic headwinds. - BOJ faces balancing act as growth wanes, with U.S. tariffs and rising energy/food costs constraining domestic demand while capital spending remains supported b

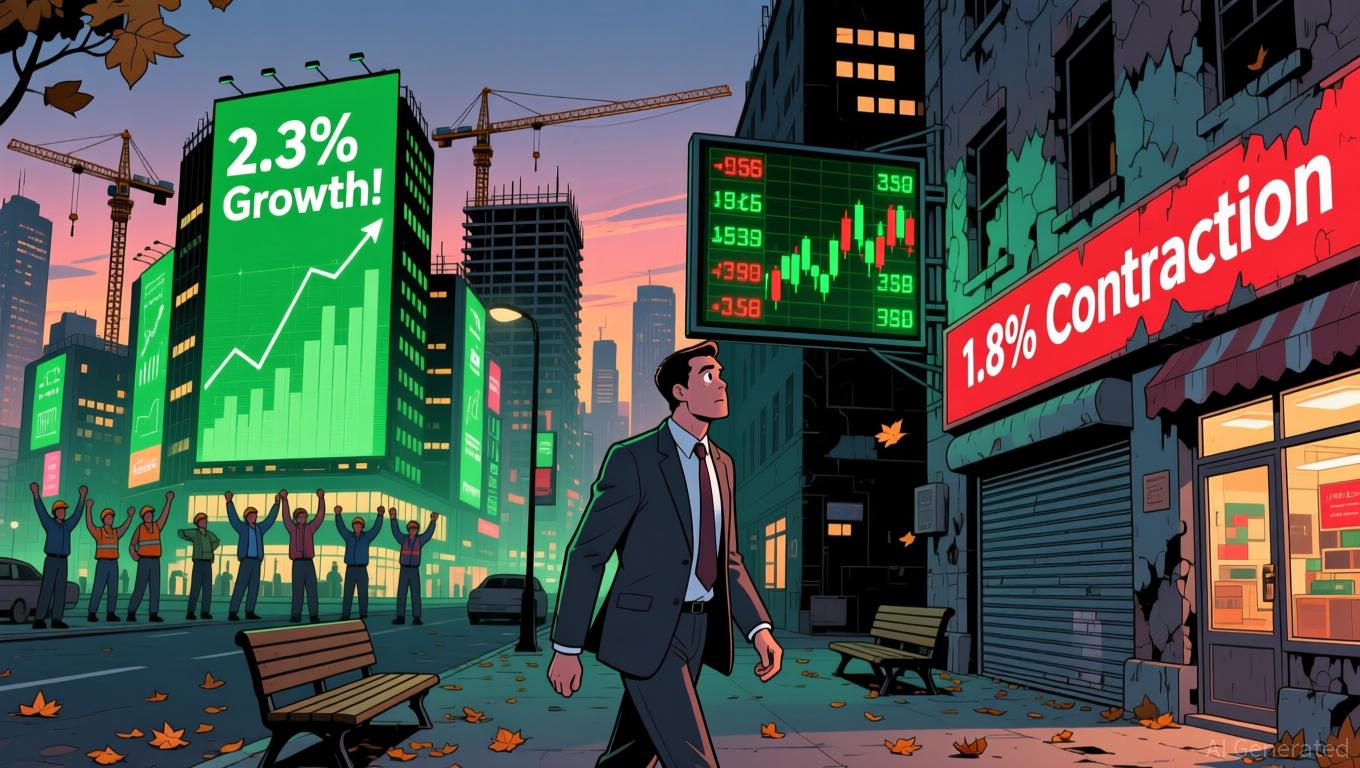

Japan's economy shrank by 1.8% on an annualized basis in the third quarter of 2025, ending a streak of six consecutive quarters of growth. This downturn highlights increasing threats to the country's recovery as it faces both international trade disputes and rising domestic costs

The economic contraction stands in contrast to the results of some Japanese companies. Nexon Co., a major player in the online gaming industry,

Experts caution that the GDP contraction could make it harder for Japan to achieve sustainable growth. The nation’s heavy dependence on exports leaves it exposed to shifts in global trade,

The BOJ’s future policy decisions may depend on whether this downturn proves to be a short-term issue or points to more fundamental problems. While the 1.8% annualized decrease in Q3 was less severe than some had feared, the government’s recent stimulus actions—including rice subsidies and energy price support—might need to be broadened to prevent a deeper slump.

Currently, attention is centered on

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin ETFs See $1.1B Outflow, While New Investments Flow Into XRP and Solana Funds

- U.S. Bitcoin ETFs lost $1.11B in three weeks, with BlackRock's IBIT and Grayscale's BTC leading outflows amid Bitcoin's six-month low at $95,200. - Analysts link redemptions to macroeconomic uncertainty and profit-taking after October's $126,000 rally, while Harvard tripled its IBIT holdings to $442.8M. - XRP and Solana ETFs attracted $255M in new capital, highlighting crypto diversification as Ethereum ETFs also faced $259M in single-day outflows. - Market debates Bitcoin's $94,000 support level amid th

Chainlink's Value Plummets Even as Ecosystem Surges by $26 Trillion

- Chainlink (LINK) plummeted to a 2.5-month low below $14.50, breaking critical support with 118% 24-hour volume spikes signaling institutional selling pressure. - A 360,000-token liquidation cascade and 27% unrealized loss in Chainlink Reserve holdings highlight market fragility despite $26T+ oracle-driven transaction value. - Institutional adoption via Stellar partnerships and tokenized bonds offsets short-term bearishness, yet RSI at 41.72 and 58.79% Bitcoin dominance signal ongoing altcoin weakness. -

Meme Coin Frenzy Sparked by Whale’s $19 Million Wager and Trump’s Support for Crypto

- A crypto whale injected $19.86 million into 22 meme coins in one hour, reflecting heightened speculative activity amid Trump-era crypto-friendly policies. - Trump-linked Bitcoin miner Hut 8 Corp reported 460% revenue growth, leveraging low-cost operations and 4,004 bitcoins ($400M value) to capitalize on market trends. - Canary Capital's MOG ETF filing triggered a 17% market cap surge for the meme token, highlighting institutional interest in community-driven crypto assets. - Analysts warn of regulatory

India’s Blockchain Strategy: National Tokenisation to Upgrade Financial Infrastructure

- India's economic advisor meets Polygon and Anq Finance to discuss tokenisation frameworks and sovereign digital assets for financial modernisation. - Proposed Asset Reserve Certificate (ARC) model uses government securities as collateral, aiming to create secure, sovereign-backed digital settlement units. - Discussions highlight tokenisation benefits like faster settlements and reduced risks, while stressing regulatory alignment with existing financial infrastructure. - Collaboration positions Polygon as