VISA May Integrate with Ripple’s ILP as XRP Holds $1.85–$2 Support

VISA Transactions Could Soon Flow Through Ripple’s Interledger Protocol

A recent report, highlighted by renowned crypto observer SMQKE, reveals a potential breakthrough in payments infrastructure that VISA transactions may soon be integrated with Ripple’s Interledger Protocol (ILP).

Therefore, this development could mark a significant milestone in bridging traditional financial systems with blockchain-based payment networks.

Ripple’s ILP, a protocol designed for seamless, cross-ledger payments, enables instant transfers across different payment networks without relying on intermediaries.

By connecting traditional financial rails like VISA to ILP, financial institutions could achieve faster, more efficient, and cost-effective transaction processing. The integration promises to reduce the friction and delays that often plague cross-border payments, which currently rely on legacy systems such as SWIFT.

The report indicates that VISA could leverage Ripple’s Interledger Protocol to enable near-instant, transparent payments across banks, digital wallets, and financial networks, offering faster fund access, lower fees, and a seamless payment experience for businesses and consumers.

Notably, Ripple’s Interledger Protocol is built for seamless interoperability, enabling real-time connections across diverse ledgers. This positions VISA to modernize its payment infrastructure while maintaining regulatory compliance and operational reliability, bridging traditional finance and digital assets.

Beyond speed and efficiency, integrating Ripple’s ILP with VISA could bridge traditional finance and blockchain, creating a seamless hybrid ecosystem. This move could drive mainstream adoption of digital currencies, positioning ILP as a key infrastructure for global payments.

Therefore, the report highlights the rising convergence of traditional finance and decentralized networks. Integrating VISA transactions with Ripple’s ILP could usher in a new era of cross-border payments, delivering unmatched speed, transparency, and scalability.

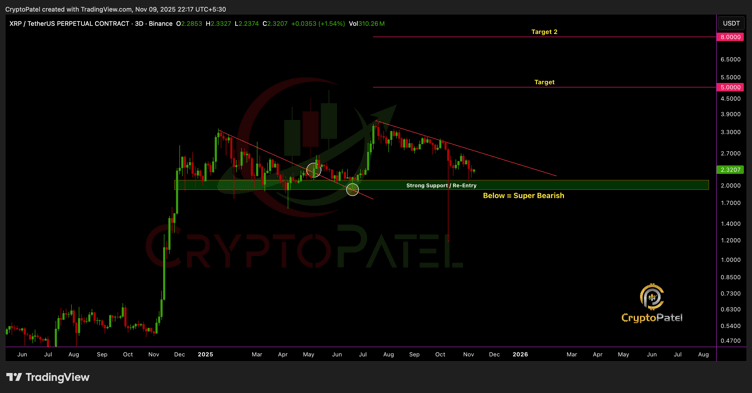

XRP Eyes $5–$8 as Strong Support Zone Bolsters Institutional Confidence

According to prominent market analyst Crypto Patel, XRP has established a decisive support zone between $1.85 and $2, signaling a robust foundation for both retail and institutional investors. This range, Patel notes, represents a strong liquidity and accumulation base, creating a favorable environment for potential price expansion in the months ahead.

XRP’s $1.85–$2 support zone is proving pivotal with the current price being $2.27. Historically, areas of high liquidity and concentrated institutional accumulation absorb selling pressure and anchor markets during volatility.

As Crypto Patel notes, XRP’s consolidation here reflects strong investor confidence and positions the coin for potential structural growth.

XRP continues its bullish momentum across multiple timeframes, with strong trading volumes and clear institutional accumulation signaling strategic positioning. Analyst Patel suggests that if the $1.85–$2 support holds, XRP could see a structural surge toward $5–$8, representing substantial upside potential.

Therefore, XRP’s $1.85–$2 support zone is more than a floor, it signals strong institutional backing, deep liquidity, and bullish momentum. If trends hold, a structural move toward $5–$8 is well-supported by market dynamics and investor activity, reinforcing XRP’s upward trajectory.

Conclusion

Integrating VISA transactions with Ripple’s Interledger Protocol could transform payments, combining traditional network reliability with blockchain’s speed, transparency, and interoperability. This leap promises a faster, more efficient ecosystem and marks a major step toward a truly connected global financial landscape.

On the other hand, XRP’s $1.85–$2 support zone highlights strong institutional interest and deep liquidity. With bullish momentum intact, this level not only defends current valuations but also positions XRP for a potential surge toward $5–$8.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Bitcoin Declines While XRP ETF Gains Transform Approaches to Passive Income

- Bitcoin's 2025 price drop below 50-day support and 33.4% MSTR underperformance highlight market volatility amid Trump-era regulatory shifts. - XRP's $250M ETF debut (XRPC) drives institutional demand, with analysts forecasting $7-$24 price range amid mixed whale activity. - Mint Miner introduces XRP cloud mining with $5,500/day returns, leveraging AI and renewable energy to democratize passive income. - Market shifts show Bitcoin's waning "treasury" narrative and XRP's growing role in cross-border paymen

BCH rises 5.15% as institutions invest, prompting analysts to revise their forecasts

- Institutional investors boosted stakes in Banco de Chile (BCH), led by Campbell & CO’s 185.3% share increase to $794K. - Yousif Capital, Parallel Advisors, and Farther Finance Advisors also raised holdings, with the latter adding 3,009 shares (1,355.4% surge). - BCH’s Q3 earnings missed estimates but maintained strong profitability (23.25% ROE), while analysts raised price targets to $33–$35. - Institutional ownership now covers 1.24% of shares, reflecting confidence in BCH’s resilience despite short-ter

Ethereum News Today: CoinFello Bridges DeFi Gap by Translating and Automating Smart Contracts into Everyday Language

- HyperPlay Labs launches CoinFello, an AI-powered DeFi tool automating smart contract interactions via natural language commands. - Built on EigenCloud and MetaMask, it maintains user custody while enabling cross-chain transactions and risk mitigation through self-sovereign AI agents. - The platform's verifiable AI infrastructure and plain-language interface aim to reduce DeFi barriers, with a Q1 2026 public release planned. - Critics highlight governance challenges, but CoinFello's deterministic automati

2026 Energy Forecast: Renewable Energy Grows, Emissions Steady as AI Expands

- U.S. wholesale electricity prices projected to rise 8.5% in 2026 due to AI/data center demand surging in Texas. - Renewables to reach 26% of U.S. generation in 2026, but CO₂ emissions remain flat at 4.8 billion metric tons. - Tech giants invest $40B+ in AI infrastructure, driving innovations like Airsys' zero-water cooling systems and MiTAC's liquid-cooled clusters. - Natural gas maintains 40% generation share despite $4.00/MMBtu price surge, while oil prices fall to $55/barrel amid stable production. -