XRP Price Is One Step From a Breakdown — Or a Cycle Bottom?

The XRP price sits on one level that decides everything. Momentum has weakened, but a major support band and a fresh yearly low in NUPL suggest a bottom may be forming. If buyers defend $2.154, XRP can attempt a rebound. If not, the chart opens to $2.065 and deeper levels.

The XRP price is down almost 9% this week, showing clear weakness after failing to hold its recent rebound. Sellers remain in control for now, but one support level continues to hold.

Whether this level survives decides if XRP forms a cycle bottom or slides into a deeper correction.

Weakness Shows Up In Momentum, But Support Still Holds

The first sign of pressure comes from momentum. Between October 13 and November 10, the XRP price made a lower high while the Relative Strength Index (RSI) made a higher high. RSI tracks buying pressure, and this pattern is called a hidden bearish divergence. It shows buying strength was rising, but not enough to push the price up.

That explains the week’s decline.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP Flashes Bearish Divergence:

TradingView

XRP Flashes Bearish Divergence:

TradingView

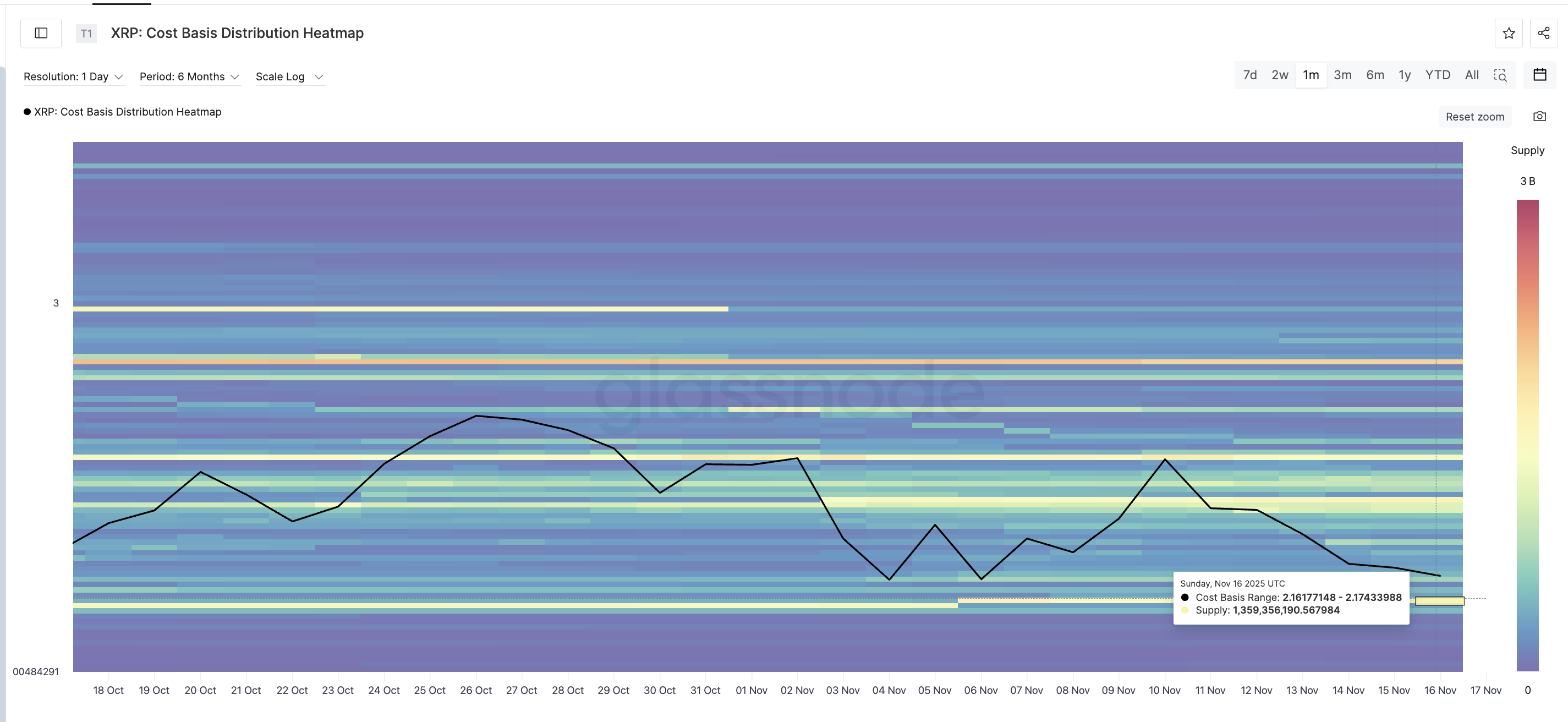

Even with that weakness, the $2.154 zone still holds. This is not just a chart level. The cost-basis heatmap confirms it. Between $2.161 and $2.174, XRP has a huge supply cluster of 1.359 billion tokens.

That makes this band the strongest support in the near term. The $2.154 level on the chart sits immediately under this cluster and could be the only thing standing between a bounce and a breakdown.

Support Cluster Could Limit Downside:

Glassnode

Support Cluster Could Limit Downside:

Glassnode

If this band holds, the divergence can be considered “played out,” opening the door for a recovery attempt.

Sentiment Shows A Bottom May Be Forming

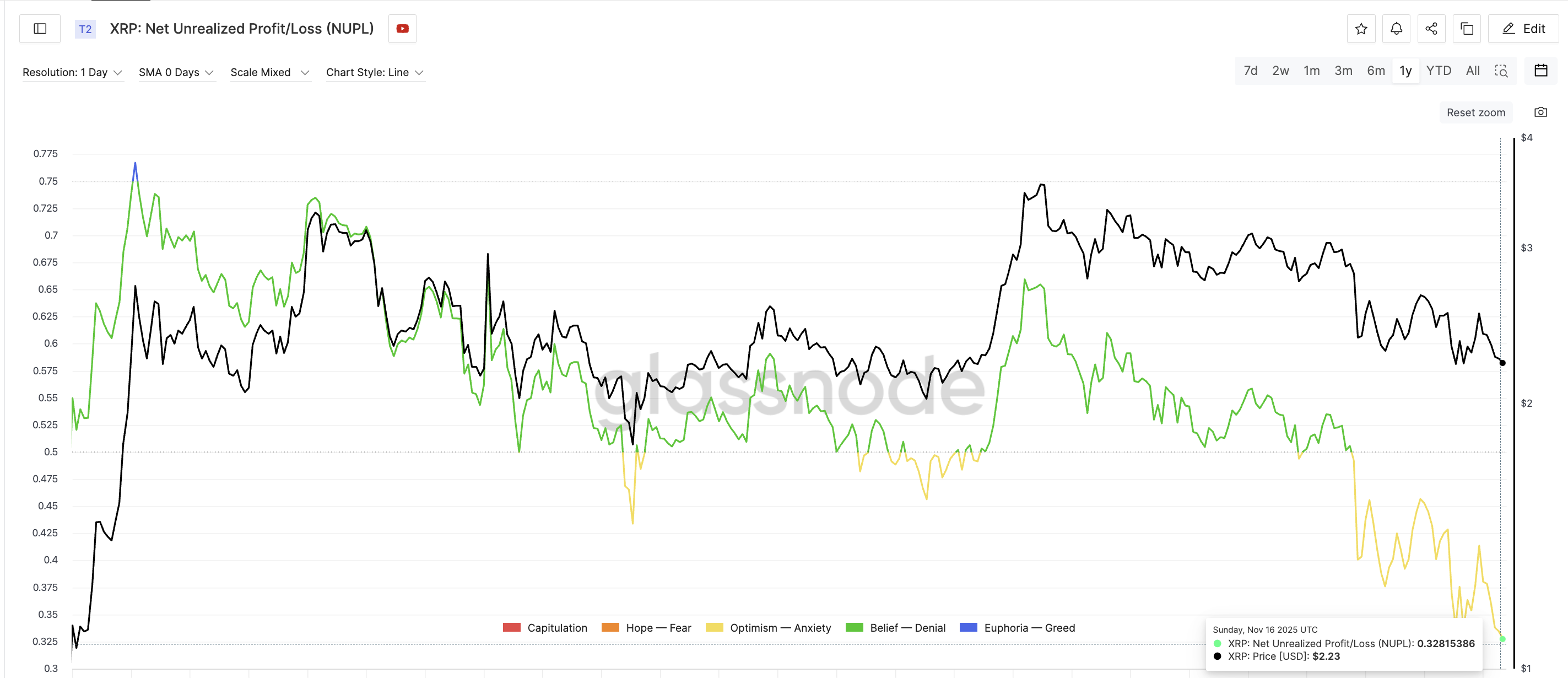

The second signal is psychological. XRP’s Net Unrealized Profit and Loss (NUPL) fell to 0.32 on November 16, its lowest reading in a year. NUPL measures investor sentiment—whether wallets hold paper profit or loss.

The last time NUPL hit a yearly low (0.43 on April 8), the XRP price rallied from $1.80 to $3.54 by July 22. That was a 96% rise.

XRP Flashes A Bottoming Signal:

Glassnode

XRP Flashes A Bottoming Signal:

Glassnode

This time, the NUPL is even lower, which means sentiment has reset more deeply. If the $2.154 support holds, the same type of bottoming behavior could form here, too.

XRP Price Levels To Watch Next

If the XRP price loses $2.154, the support zone breaks. In that case, there is little strong demand until $2.065, and falling under $2.06 opens a path toward even lower levels.

If buyers defend support instead, the first upside test sits at $2.394, a level with several prior rejections. A move above $2.394 starts a real rebound attempt.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

If momentum improves further, XRP can push toward $2.696, and breaking that level brings a much stronger recovery into view.

For now, everything comes down to one question: Can the $2.154 support band survive long enough for sentiment to flip? If yes, the XRP price may be forming the same kind of bottom that drove its last major rally.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Japan's Bond Turmoil Triggers Worldwide Crypto Sell-Off Amid Yen Carry Trade Reversal

- Japan's $135.4B stimulus package triggered a 3.41% surge in 30-year bond yields, destabilizing the $20T yen carry trade and sparking global crypto/stock selloffs. - Rising yields threaten Japan's 230% GDP debt load with higher servicing costs, creating a "debt death spiral" risk as BOJ hesitates to tighten policy. - Forced deleveraging by financial institutions intensified Bitcoin's 26% drop, with Ethereum/XRP/Solana also falling 3-5.6% amid margin calls and capital repatriation. - Upcoming 40-year bond

Bitcoin News Today: Bitcoin ETFs See $523M Outflow as Investors Weigh Fear Against Long-Term Strategies

- BlackRock's IBIT ETF recorded a $1.26B net outflow in Nov 2025, its largest redemption since 2024 launch. - Bitcoin price fell 16% to $52, triggering $2.59B outflows across 11 spot ETFs as bearish options demand surged. - Put-call skew hit 3.1% (7-month high), reflecting heightened pessimism and capitulation pressures in Bitcoin's price action. - Gold ETFs gained $289M as investors sought safe havens, contrasting with $1B inflows to tech/healthcare sector funds. - Year-to-date Bitcoin ETF inflows ($27.4B

YFI Drops 1.7% After Subpar Weekly Results as Edgewater Showcases AI-Powered Wi-Fi at Canada’s Leading Semiconductor Conference

- Edgewater Wireless will showcase AI-powered Wi-Fi 8 solutions at Canada’s premier semiconductor symposium in November 2025. - The company’s CEO will highlight ultra-reliable wireless roadmaps and a $2.4M commercialization initiative supported by $921K in government grants. - Its patented Spectrum Slicing technology claims 10x performance gains and 50% latency reduction, aligning with Canada’s semiconductor self-sufficiency goals. - Despite a 11.85% monthly stock decline, Edgewater positions itself at the

Ethereum Updates Today: Ethereum Transforms into Digital Bonds, Soaring Above $3,000 Driven by Institutional Interest

- Ethereum surged past $3,000 in late 2025 driven by institutional demand, ETF approvals, and technical upgrades like the Fusaka upgrade. - BlackRock's staked Ethereum ETF attracted $13.1B inflows since 2024, reclassifying staked ETH as "digital bonds" for institutional investors. - Over 69 corporations now hold 4.1M ETH in treasuries, but ETF outflows highlight ongoing market differentiation from Bitcoin . - Fusaka's focus on layer-1 scalability aims to redirect economic activity to Ethereum's base layer