Will XRP Price Crash to 0.65?

XRP price is slipping again, and the mood across the market isn’t helping. With Nvidia, Walmart, Target, and Home Depot all reporting earnings this week—plus the return of US economic data after the historic 43-day government shutdown—risk sentiment is shaky. Traders are watching every candle with suspicion. In the middle of all this, XRP price has moved into a fragile zone, raising a tough question: is a drop to 0.65 even on the table?

XRP Price Prediction: Why the Market Mood Matters Right Now

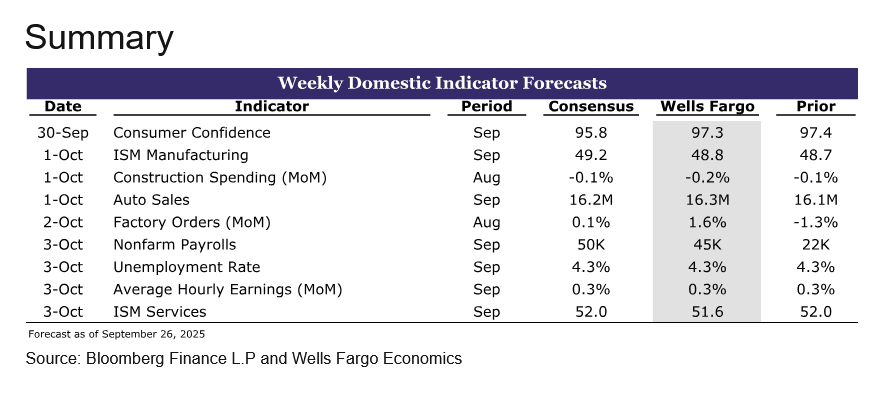

Before jumping into the technicals, it’s worth understanding the backdrop. The shutdown halted key economic reports for more than a month, leaving investors moving blind. As the data pipeline reopens, volatility tends to spike.

Add to that:

- Nvidia’s earnings, which heavily influence risk appetite

- Major retailers reporting results that reflect real consumer strength

- FOMC minutes that may hint at the next interest-rate shift

- Ongoing weakness in housing and sentiment data

This kind of week can easily pressure altcoins. XRP feels that pressure more than most when momentum is already leaning down.

What the XRP Price Daily Chart Is Actually Showing

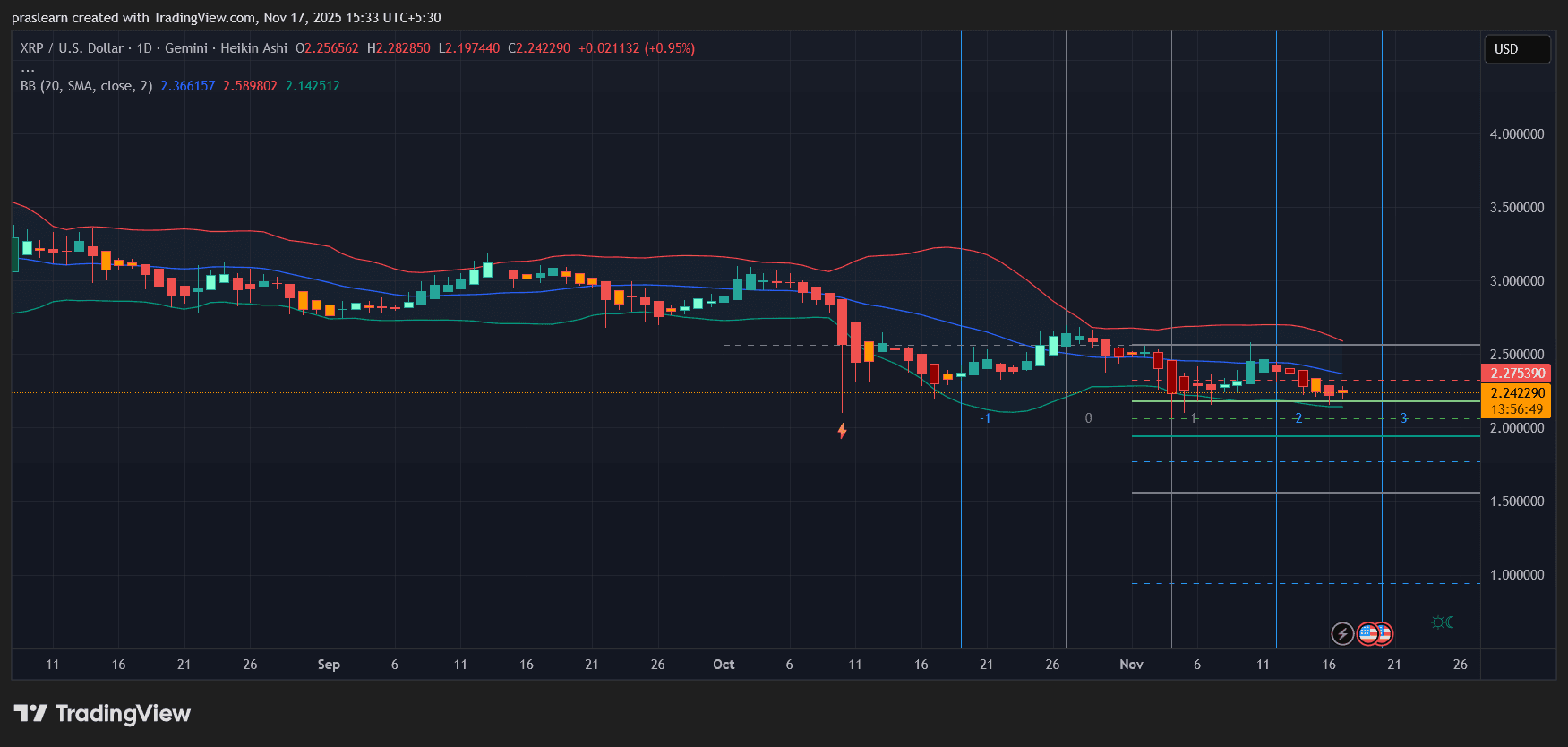

The daily candles tell a clear story: XRP is in a controlled downtrend, but not a freefall.

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

1. Price Is Stuck Under the Mid-Bollinger Band

The mid-band has acted like a ceiling for nearly the entire month. Every attempt to reclaim it has failed, which shows sellers remain in control.

2. The Lower Bollinger Band Has Started to Slope Down

A downward-angled lower band often precedes another leg lower. It signals room for volatility to expand on the downside.

3. Repeated Taps of the 2.20–2.00 Support Zone

This region is being tested over and over without a convincing rebound. When support becomes a lounge chair instead of a trampoline, breakdowns happen.

4. Heikin Ashi Candles Are Softening

The candles are losing body size, with more flat-bottomed reds showing up. That’s a classic continuation signal in Heikin Ashi analysis. The chart is weak. But weak does not automatically mean catastrophic.

Is 0.65 a Realistic Scenario?

0.65 is nowhere near the current structure. To reach that level, XRP price would need to slice through several major supports that haven’t even been threatened on this timeframe.

For a move toward 0.65, you would need:

- A macro shock hitting all risk assets

- Bitcoin breaking its macro higher-low structure

- Altcoins entering a broad capitulation

- XRP-specific negative catalysts (legal, liquidity, exchange delistings, etc.)

- None of those conditions are present right now.

So while traders often float extreme targets in fear-heavy markets, the chart doesn’t justify a scenario that dramatic.

The More Likely Downside Path

Based on the current structure, the realistic progression looks closer to this:

- 2.20 – First support, already weakening

- 2.00 – Stronger shelf, but vulnerable if momentum stays negative

- 1.75–1.50 – Next demand zone if volatility widens

- 1.00–0.85 – Panic zone, possible only during market-wide distress

A crash straight into 0.65 would require an event far bigger than anything visible on the chart.

What Would Invalidate the Bearish Bias?

XRP needs to prove strength, not hint at it.

A real reversal begins only if:

• It closes a daily candle above the mid-Bollinger band: This would show buyers are finally taking back control.

• It forms two consecutive strong Heikin Ashi green candles: This isn’t happening yet.

• It reclaims the blue moving-average zone: That band has rejected price multiple times. A reclaim would shift the short-term trend.

Until these conditions appear, the bias stays bearish with controlled downside.

XRP Price Prediction: Will XRP Price Crash to 0.65?

The chart points to more downside, but not a collapse to 0.65. $XRP is weak, momentum is fading, and support is slowly eroding. But the structure does not support a multi-level crash that deep unless the entire crypto market enters a panic phase.

For now, the most realistic scenario is a drift toward the lower supports between 2.00 and 1.75, not a meltdown into the 0.60s.

If market conditions worsen after this week’s earnings and economic data flood back, those lower levels become more likely—but 0.65 remains a distant extreme, not an imminent threat.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

APAC Leads Global AI Growth with Emphasis on Human-Focused Approaches

- APAC leads global AI adoption with 26% of firms investing $400k-$500k in generative AI, driven by CEO-led strategies (33% APAC vs 18% North America). - 91% APAC employees receive AI training, supporting rapid deployment as energy management markets grow from $56B to $219B by 2034 via AI analytics and blockchain. - Pegasystems and Ambarella showcase AI integration in enterprise automation and computer vision, while SoundHound AI leverages $269M liquidity for strategic acquisitions. - Challenges persist fo

Republican Party Splits and Inflation Issues Created Internally Complicate Trump’s Plans for a Second Term

- Trump's second-term agenda faces GOP internal divisions and affordability crises as inflation and tariff policies strain public support. - Republican lawmakers like Rep. Massie challenge Trump's Epstein file stance, exposing party fractures despite official "America First" alignment. - Tariff rollbacks on staples address self-inflicted inflation but fail to resolve core affordability concerns undermining Trump's economic legacy. - Constitutional term limits and waning influence in Trump's "lame duck" per

Dogecoin News Today: Institutional Altcoin ETFs Resist Crypto Market Downturn

- Grayscale and VanEck launch Dogecoin/Solana ETFs as crypto markets decline, defying broader outflows. - U.S. spot Bitcoin ETFs see $870M outflows; Ethereum ETFs lose $259.7M amid third-week withdrawal streak. - Institutional altcoin ETFs gain traction with $550M+ assets, signaling growing crypto legitimacy in portfolios. - Ethereum's 3.6M token treasury and Fusaka upgrade optimism contrast with 4% ETF outflows of AUM. - Persistent retail caution contrasts with institutional adoption, as crypto's traditio

Bitcoin News Update: Blockchain.com’s Co-CEOs Steer Through Crypto Market Fluctuations as Company Relocates Headquarters to Texas

- Blockchain.com appoints Lane Kasselman as co-CEO alongside Peter Smith, adopting a dual leadership model to enhance operational efficiency during transition. - The firm relocates its U.S. headquarters to Dallas, Texas, leveraging the state's tax incentives, regulatory flexibility, and proximity to the Texas Stock Exchange. - This move aligns with broader corporate trends in Texas, as companies like Coinbase and McKesson shift operations to capitalize on business-friendly policies and innovation hubs. - T