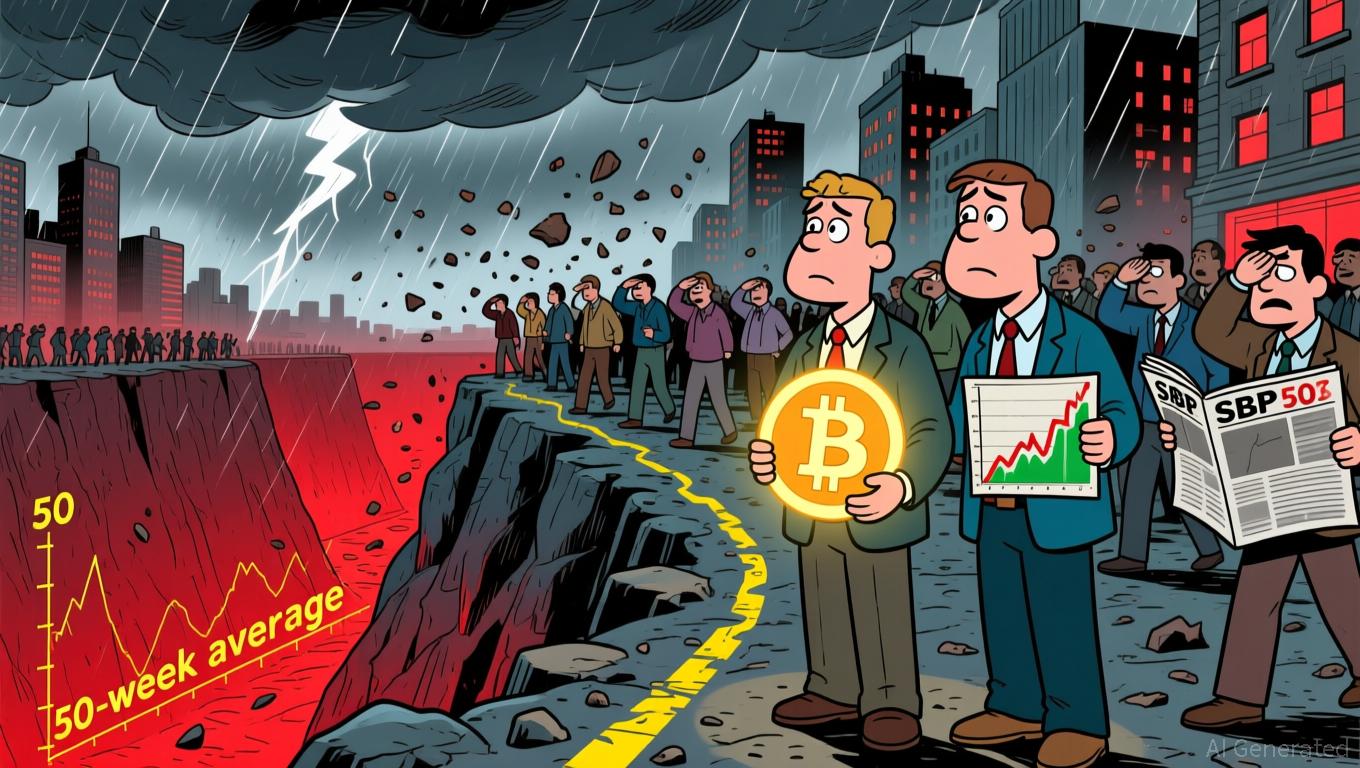

Bitcoin Updates Today: Is Bitcoin’s Drop Indicating a Bear Market or Revealing Foundational Strength?

- Bitcoin's drop below $95,000 triggered a 2.8% S&P 500 decline, raising fears of synchronized market downturns. - American Bitcoin (ABTC) reported $3.47M profit but shares fell 13% as BTC price erosion offset mining gains. - 43-day U.S. government shutdown created information vacuum, while $869M Bitcoin ETF outflows highlighted investor panic. - Fed rate cut odds dropped to 45% amid inflation concerns, with analysts warning of cascading price drops below $90,000. - Institutional ETF adoption and $835M Mic

The recent drop in Bitcoin’s value has heightened worries about its potential impact on U.S. stocks, as some experts caution that both markets could decline in tandem. Last week, the cryptocurrency slipped under $95,000—the lowest level since March—after a combination of fading optimism for Federal Reserve rate cuts, tightening liquidity, and profit-taking by long-term investors led to a steep selloff

This downturn has taken a toll on

Market confidence deteriorated further as the release of U.S. government data was halted during a 43-day shutdown,

Analysts attributed the crypto market’s slide to wider economic jitters.

Still, some analysts believe a bottom may be forming. Gautam Chhugani from Bernstein pointed out that institutional buying through ETFs and the pro-crypto stance of the Trump administration offer structural support.

Technical signals indicate a pivotal moment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Citigroup Achieves Earnings Growth Despite Obstacles, Analysts Raise Ratings as Regulatory Hurdles Persist

- Citigroup reported Q3 adjusted EPS of $2.24, exceeding estimates, with $22.09B revenue up 9.3% YoY, prompting analyst price target upgrades. - The bank declared a $0.60 quarterly dividend (2.4% yield) and saw institutional ownership growth, including 100%+ stake increases by key firms. - Despite 14.14 P/E ratio and 1.37 beta volatility, Citigroup maintains 7.91% ROE and 8.73% net margin, though faces regulatory scrutiny and macroeconomic risks. - Analysts remain divided: Cowen reiterates "hold" at $110,

Trump’s Lack of Response to Antisemitism Creates Tension Between GOP Supporters and Established Party Principles

- Trump criticizes GOP members for opposing his Epstein ties but avoids condemning antisemites Tucker Carlson and Nick Fuentes, deepening GOP divisions. - Carlson's 2025 interview with white nationalist Fuentes, who spread antisemitic tropes, drew ADL reports showing 15% of Republicans justify violence against Jews. - Jewish conservatives and Heritage Foundation resignations demand Trump address antisemitism, comparing inaction to Nazi-era parallels as GOP fractures over free speech vs. extremism. - Trump'

Cloudflare Maintenance Causes Technical Disruption, Revealing Infrastructure Vulnerabilities

- X platform restored services after outage linked to Cloudflare's Santiago data center maintenance, impacting 11,500+ U.S. users. - OpenAI reported partial access issues to ChatGPT and website during the incident, alongside crypto platform disruptions. - Cloudflare's 3.7% pre-market stock drop highlighted infrastructure vulnerabilities, while X Corp's antitrust lawsuit against Apple/OpenAI resurfaced. - The outage exposed systemic risks in tech ecosystems, with major services like PayPal and League of Leg

Xiaomi's Electric Vehicle Profit Recovery Fails to Ease Concerns Over Production as Stock Falls

- Xiaomi Corp. reported 22.3% YoY revenue growth to 113.1B yuan in Q3, driven by EV and IoT expansion, but missed analyst forecasts of 116.5B yuan. - EV division posted first 700M yuan profit, selling 108,796 vehicles, but faces production delays and nine-month delivery waits. - Smartphone revenue grew 1.6% to 84.1B yuan amid rising chip costs; IoT revenue rose 5.6% to 27.6B yuan as subsidies declined. - Shares fell 2.81% to 41 HKD despite 80.9% net profit surge, as investors worried about revenue shortfal