Ethereum News Update: Ethereum Reaches Pivotal Moment as Large Holders Accumulate Amid Weakening Technical Indicators

- Ethereum (ETH) near $3,100 tests critical support as bearish technical indicators clash with aggressive whale accumulation of $53.91 million in a week. - Key metrics show price below 200-day EMA and RSI near oversold levels, while whale positions grew by 180K ETH amid $107M ETF outflows. - Institutional buyers like Tom Lee's BitMine add $29.14 million to holdings despite $120M unrealized losses, contrasting BTC's $523M ETF inflows. - Macroeconomic risks persist with Fed hawkishness and declining network

Ethereum (ETH) is currently challenging a major long-term support level as traders contend with a blend of negative technical patterns and significant whale buying. The altcoin, which is trading close to $3,100, has

Technical signals point to continued bearish momentum. Ethereum's value has slipped beneath important moving averages, such as the 200-day EMA at $3,584, while the Relative Strength Index (RSI)

Nonetheless, whales are taking advantage of the market weakness.

Institutional moves add further complexity. While U.S. spot

Wider market conditions add to the unpredictability.

As Ethereum trades near a crucial support level, the balance between institutional accumulation and macroeconomic challenges will determine its short-term direction. With whales continuing to buy and ETF flows evolving, the market is waiting for a decisive event to resolve the current stalemate—whether that means a further decline or a lasting recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: In a Bold Move Against the IMF, El Salvador Ramps Up Bitcoin Purchases to Assert Independence

- El Salvador's government bought 1,098.19 BTC ($100M) amid market downturn, boosting total holdings to 7,474.37 BTC ($688M) as part of its "buy the dip" strategy. - President Bukele defies IMF criticism over public-sector Bitcoin purchases, emphasizing financial sovereignty through blockchain-based accumulation. - The country's aggressive accumulation has positioned it as the fifth-largest Bitcoin holder globally, inspiring other nations like the Czech Republic to explore crypto adoption. - Despite being

Bitcoin News Update: Short-Term Investors Face Losses as Bitcoin Falls Under $95K

- Bitcoin fell below $95,000 on Nov 15, erasing 23% from its October peak amid extreme fear signaled by a 10-point Fear & Greed Index. - 2.8 million BTC held under 155 days are underwater, with STHs driving 90% of recent sell volume as SOPR dipped below 1 repeatedly. - Institutional outflows ($870M from US ETFs) and Fed policy uncertainty (53.6% Dec rate cut chance) intensified liquidations exceeding $600M in hours. - Analysts split between bearish corrections to $85,000 if $92,000 support breaks or mid-cy

ALGO Gains 1.64% Following Stock Option Awards and Fluctuating Market Conditions

- Aligos grants 23,600 stock options to new hires under 2024 Inducement Plan, vesting over four years to retain talent. - ALGO shares rose 1.64% short-term but fell 53.66% annually amid market volatility and key economic data releases on Nov 19. - Eshallgo expands globally with U.S. subsidiary, hardware-software investments, and shelf registration to strengthen operations. - Upcoming FOMC minutes, oil inventories, and CPI data will shape monetary policy expectations and investor behavior. - Insider transac

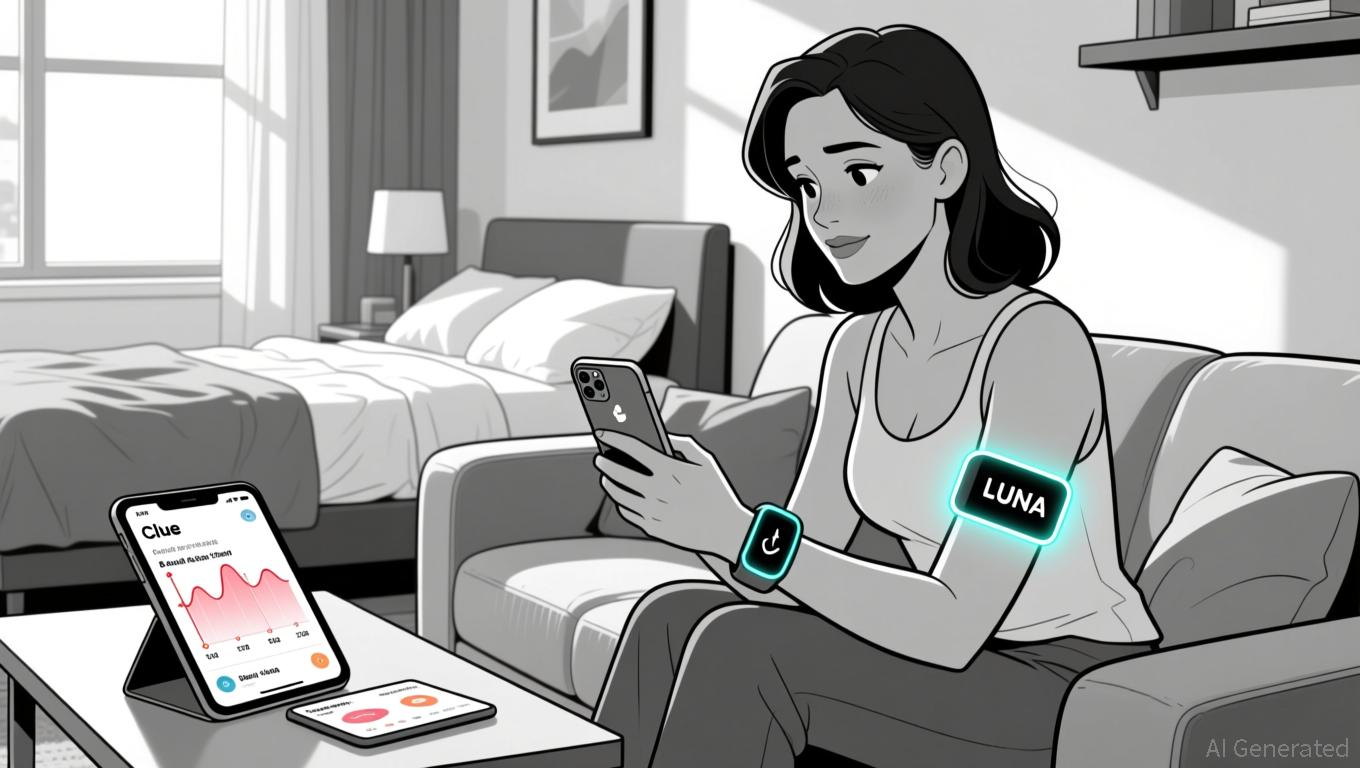

LUNA Value Remains Steady as Wearable Health Integration Broadens

- LUNA maintains stable price at $0.0774 despite 81.5% annual decline, driven by health-tech partnerships rather than crypto market shifts. - Expanded integration with Clue enables LUNA wearables to sync sleep/temperature data with 100M+ users for menstrual cycle tracking insights. - Strategic partnerships with leading wearables (Fitbit, Huawei) and exclusive discounts aim to boost adoption of cycle-aware health tracking devices. - 60%+ user demand for health wearables highlights growing market opportunity