Hyperliquid News Today: Crypto Whale Maintains $145M ETH Position After $4.9M Loss, Anticipates Surge to $3,860

- Hyperliquid's whale 0x9ee holds $145M ETH long with $4.9M loss, targeting $3,860 rebound despite market volatility. - Portfolio includes $52.2M XRP long and $44M ASTER short, highlighting leveraged crypto trading's mixed gains/losses. - Platform faces $5M liquidity loss from Popcat manipulation and 38% HYPE futures decline, signaling ecosystem instability. - High-leverage risks exposed by $168M liquidation and $100M BTC loss parallels, underscoring market fragility. - ASTER short turning to long position

Hyperliquid's "ETH Max Long" holding is now worth $145 million, with an average buy-in of $3,264 and an unrealized deficit of $4.9 million,

The dangers of high-leverage trading became clear this week when a degen trader on Hyperliquid was liquidated after shorting BTC, XRP, and

Hyperliquid's issues go beyond individual traders. The platform has recently halted its

While the ETH Max Long awaits a move to $3,860, the wider crypto market remains highly uncertain. The interaction of leveraged trades, liquidity challenges, and changing sentiment will likely determine Hyperliquid's direction in the near future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: In a Bold Move Against the IMF, El Salvador Ramps Up Bitcoin Purchases to Assert Independence

- El Salvador's government bought 1,098.19 BTC ($100M) amid market downturn, boosting total holdings to 7,474.37 BTC ($688M) as part of its "buy the dip" strategy. - President Bukele defies IMF criticism over public-sector Bitcoin purchases, emphasizing financial sovereignty through blockchain-based accumulation. - The country's aggressive accumulation has positioned it as the fifth-largest Bitcoin holder globally, inspiring other nations like the Czech Republic to explore crypto adoption. - Despite being

Bitcoin News Update: Short-Term Investors Face Losses as Bitcoin Falls Under $95K

- Bitcoin fell below $95,000 on Nov 15, erasing 23% from its October peak amid extreme fear signaled by a 10-point Fear & Greed Index. - 2.8 million BTC held under 155 days are underwater, with STHs driving 90% of recent sell volume as SOPR dipped below 1 repeatedly. - Institutional outflows ($870M from US ETFs) and Fed policy uncertainty (53.6% Dec rate cut chance) intensified liquidations exceeding $600M in hours. - Analysts split between bearish corrections to $85,000 if $92,000 support breaks or mid-cy

ALGO Gains 1.64% Following Stock Option Awards and Fluctuating Market Conditions

- Aligos grants 23,600 stock options to new hires under 2024 Inducement Plan, vesting over four years to retain talent. - ALGO shares rose 1.64% short-term but fell 53.66% annually amid market volatility and key economic data releases on Nov 19. - Eshallgo expands globally with U.S. subsidiary, hardware-software investments, and shelf registration to strengthen operations. - Upcoming FOMC minutes, oil inventories, and CPI data will shape monetary policy expectations and investor behavior. - Insider transac

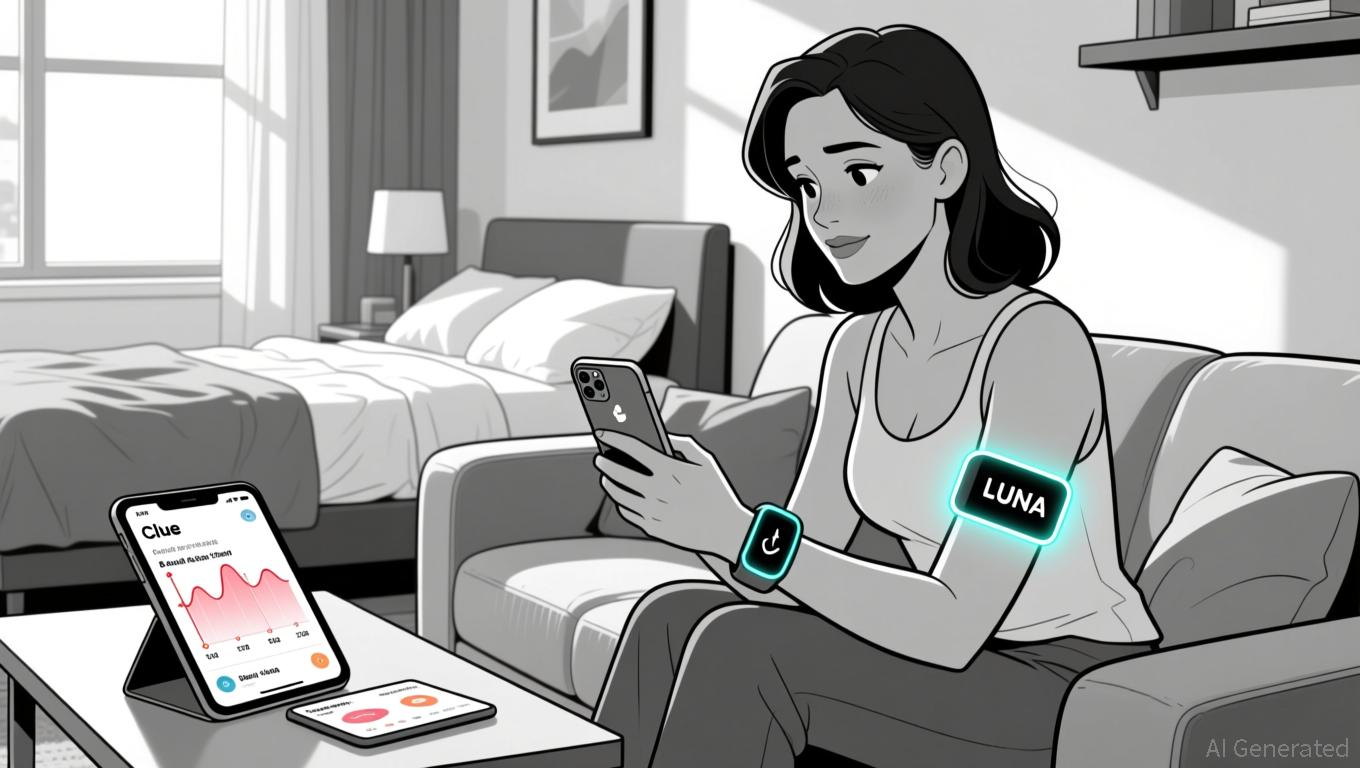

LUNA Value Remains Steady as Wearable Health Integration Broadens

- LUNA maintains stable price at $0.0774 despite 81.5% annual decline, driven by health-tech partnerships rather than crypto market shifts. - Expanded integration with Clue enables LUNA wearables to sync sleep/temperature data with 100M+ users for menstrual cycle tracking insights. - Strategic partnerships with leading wearables (Fitbit, Huawei) and exclusive discounts aim to boost adoption of cycle-aware health tracking devices. - 60%+ user demand for health wearables highlights growing market opportunity