Last week, the leading long positions that bought the dip in BTC and ETH were liquidated with a loss of $7.3 million, followed by opening $33 million in new ETH long positions.

BlockBeats News, November 18, according to Coinbob Hot Address Monitor, in the past 4 hours, the whale (0x93c), who was the "largest BTC long position holder on Hyperliquid" last week, closed and stopped out of approximately $64 million worth of BTC long positions and $21.1 million worth of ETH long positions, recording a total loss of about $7.35 million. Afterwards, the whale used the remaining $1.3 million in the account to open a 25x leveraged ETH long position at an average price of $2,980, with a liquidation price of $2,919.

Since November 12, this address has transferred about $8 million to Hyperliquid, and then repeatedly attempted to bottom fish ETH, making a small profit of $700,000. From November 13 to 14, the whale heavily opened long positions in BTC and ETH, once becoming the largest BTC long position holder on Hyperliquid.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

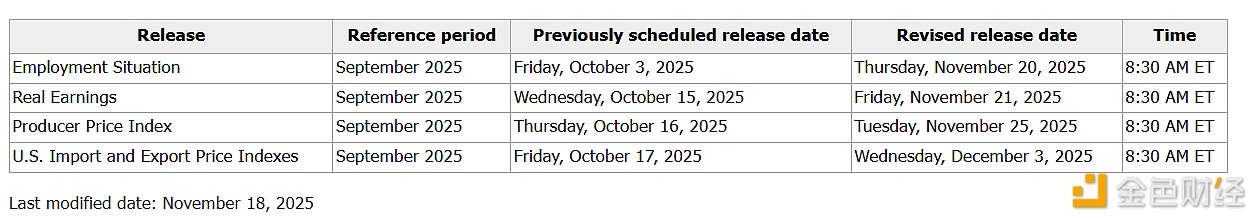

Release dates set for new batch of US data, including CFTC weekly report and PPI

The Dow Jones Index closed down 498.5 points, with the S&P 500 and Nasdaq also declining.

All three major U.S. stock indexes closed lower.