Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Mt. Gox just shook the crypto market again. After eight months of silence, the defunct exchange suddenly moved 10,608 Bitcoin worth almost 1 billion dollars, setting off a wave of speculation, fear, and on-chain detective work. The timing couldn’t be more dramatic: creditor repayments have already been pushed back to late 2026, leaving billions in locked-up BTC and a decade-long saga that refuses to end. The question now is simple. Was this just a routine shuffle, or a warning shot that more turbulence is coming?

What Triggered the Panic?

Mt. Gox suddenly shifted 10,608 BTC worth about 953 million dollars into a fresh wallet. This is the exchange’s biggest move in eight months, and the first transfer over the million-dollar mark since March. The crypto market wasn’t expecting any activity right now, especially because the exchange has once again pushed back creditor repayments to October 2026.

Why Is Mt. Gox Still Delaying Payments?

According to the trustee, creditor paperwork is still incomplete, so the repayment deadline has been officially extended by another year. This might sound frustrating, but it actually means one thing for the market: nearly 4 billion dollars worth of Bitcoin will stay locked up until late 2026. That delay reduces the immediate fear of a giant sell-off that could crush BTC’s price.

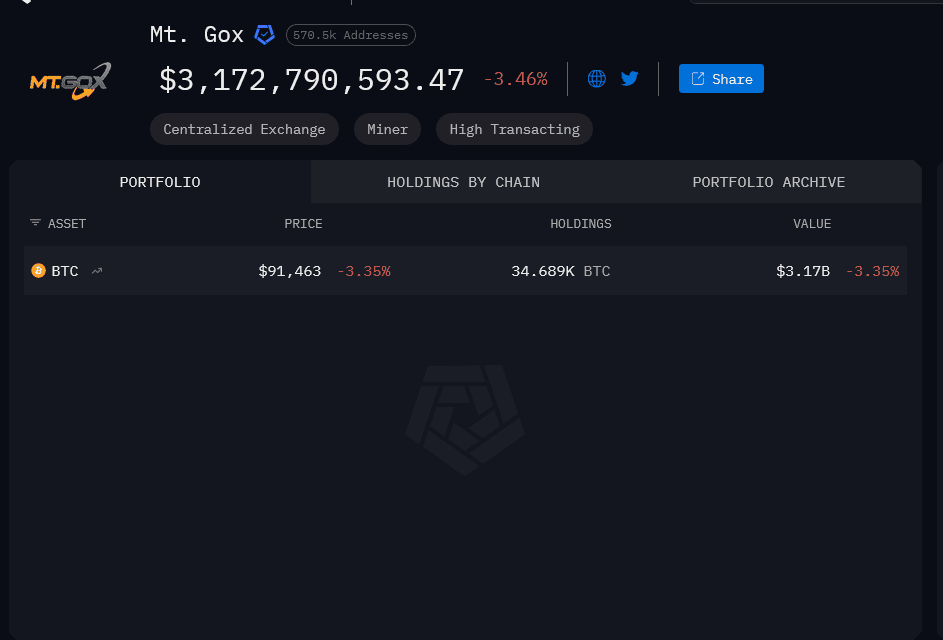

How Much Bitcoin Does Mt. Gox Still Hold?

Even after the latest transfer, Mt. Gox still controls 34,689 BTC valued at a little over 3.1 billion dollars. That stash hasn’t moved. And importantly, none of the newly transferred coins have been sent to exchanges. The receiving address labeled 1ANkD is just holding the 10,608 BTC for now, which suggests no sale is happening yet.

Is This a Sign They Are Preparing to Sell?

Some analysts think so. Jacob King from SwanDesk warned that Mt. Gox might be gearing up to dump the coins into a weak market.

This kind of speculation always shakes traders a bit, especially during corrections. But here’s the thing: on-chain data shows zero movements toward centralized exchanges. Until that happens, a sale isn’t confirmed.

Does Mt. Gox Still Affect Bitcoin’s Price?

Much less than before. Since the rehab process started releasing small batches of BTC in July 2024, Bitcoin has climbed from around 56,000 dollars to over 91,000 dollars today. Institutional buyers, corporate treasuries, and US spot ETFs are absorbing new supply far faster than Mt. Gox can release it.

Mt. Gox used to dominate the crypto world, handling more than 70 percent of all Bitcoin trades in its prime. Its collapse in 2014 after losing 850,000 BTC remains one of the largest disasters in crypto history. Since then, creditors have spent a decade waiting through endless delays, legal hurdles, and shifting repayment schedules.

The Bottom Line

Yes, the transfer grabbed headlines. Yes, people panicked. But the coins haven’t hit exchanges, and repayments are pushed to 2026, which actually keeps billions of dollars in Bitcoin off the market. For now, this is noise, not a threat. Investors should watch the wallets closely, but there’s no sign of a sell-off yet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BNB News Today: BNB Chain Integrates Classic Collectibles and Blockchain Through Tokenized Charizard Cards

- BNB Chain's SuperSuperRare launches a Gacha Point Leaderboard, tokenizing a PSA-graded Charizard Pokémon card as RWA. - Users can repurchase, trade, or redeem physical cards, bridging traditional collectibles with blockchain utility via FMV-based rankings. - Binance's partnership with BlackRock to tokenize U.S. Treasuries expands RWA adoption, enabling yield generation on custodied assets. - Collaborations like mXRP and institutional yield tools highlight BNB Chain's strategy to merge traditional and dec

COAI's Sudden Price Decline in Late November 2025: An In-Depth Analysis of Market Drivers and Investor Reactions

- COAI Index's 88% year-to-date plunge in late 2025 stemmed from C3.ai's $116.8M loss, CEO transition, and class-action lawsuits, triggering sector-wide panic over governance risks. - Regulatory ambiguity from the CLARITY Act and unclear AI/DeFi compliance rules exacerbated volatility, eroding investor confidence in speculative crypto AI projects. - Market flight to quality saw stable tech firms like Celestica outperform as investors prioritized proven infrastructure over speculative AI crypto assets amid

BNB News Today: Where Authenticity and Blockchain Converge: SuperSuperRare Connects Tangible Collectibles with Digital Asset Ownership

- BNB Chain's SuperSuperRare launches RWA card platform with a Gacha Point Leaderboard ranking users by card value. - The platform's first asset is a PSA-certified Charizard card, enabling NFT trading, physical redemption, and on-chain authentication. - BUIDL tokenized fund's collateralization on Binance highlights BNB Chain's role in tokenizing real-world assets like treasuries and collectibles. - Gamified RWA engagement through leaderboard mechanics aims to attract both crypto-native and traditional coll

Ethereum Update: ETH Reaches $3,000, Yet ETF Withdrawals and RSI Suggest Prudence Ahead of $15,000

- Ethereum (ETH) surged past $3,000 on Nov 15, 2025, sparking speculation about its potential to reach $15,000 amid institutional buying and market optimism. - ETF outflows of $259M and weak RSI (36) signal caution, while BitMine's $840M ETH purchase highlights strategic institutional support. - Cboe's 10-year Ethereum futures aim to boost liquidity, but macroeconomic uncertainty and Fed rate outlooks remain critical risks for sustained growth. - Technical indicators show mixed signals, with key resistance