Bitcoin News Update: Recent Cloud Outages Highlight Systemic Risks, Fueling DePIN Adoption

- Cloudflare's 2025 global outage disrupted major websites and crypto platforms, exposing centralized infrastructure vulnerabilities and boosting DePIN interest. - The incident caused 500 errors and API failures, impacting services like ChatGPT, X, and crypto exchanges, while pushing Cloudflare's stock down 3.5%. - DePIN advocates argue decentralized infrastructure reduces single-point failures, with projects like Gaimin promoting distributed cloud models using global resources. - Blockchain's operational

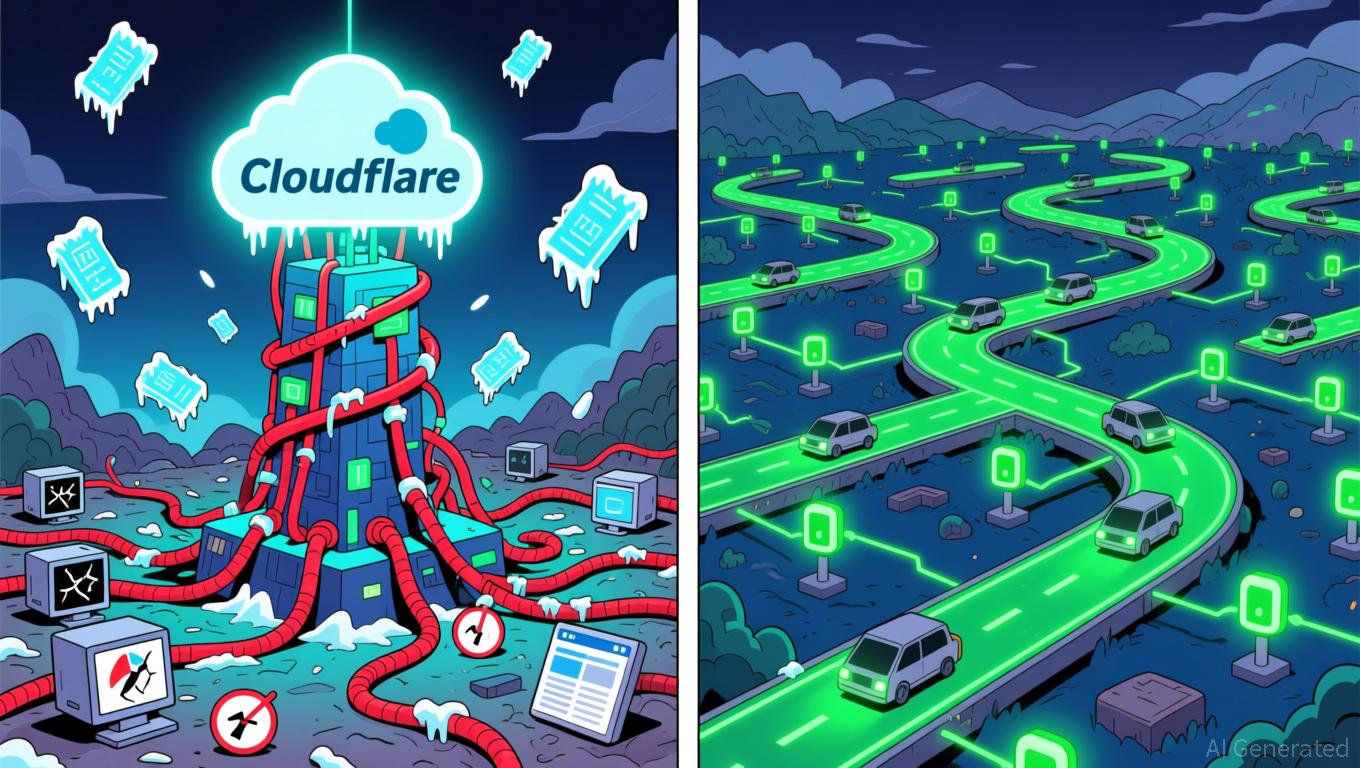

On November 18, 2025, a worldwide outage at Cloudflare disrupted numerous prominent websites and crypto platforms, sparking renewed discussions about the weaknesses of centralized internet systems and increasing attention on decentralized alternatives like DePIN. The disruption, which stemmed from an "unexpected surge in traffic" targeting one of Cloudflare’s services, led to widespread errors that impacted platforms such as OpenAI’s ChatGPT, Shopify, Elon Musk’s X, and several crypto services including BitMEX and

The outage’s effects rippled through the crypto sector, causing downtime for block explorers like Arbiscan and DefiLlama

At the same time, blockchain networks demonstrated their robustness during the outage, in stark contrast to the failures seen in Web2 services. While centralized platforms struggled, on-chain transactions continued without interruption,

The event also brought broader infrastructure issues into focus. Tata Consultancy Services (TCS) and its partners recently launched projects to develop sovereign cloud infrastructure in East Africa and Australia,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Token Technical Review: Managing Immediate Market Fluctuations and Blockchain Indicators

- PENGU token faces critical juncture with conflicting technical indicators and accumulating on-chain activity in November 2025. - Short-term bearish signals (RSI 38.7, 12 sell signals) clash with bullish MACD/OBV divergence and whale accumulation ($273K acquired). - On-chain patterns suggest potential breakout above $0.0235 resistance, with $0.026 target if volume supports, but $0.01454 support remains vulnerable. - Risks persist due to unquantified NVT score and bearish pressure from broader indicators,

Bitcoin News Update: Retail Investors Panic While Whales Remain Confident as Bitcoin Hits Lowest Point in Seven Months

- Bitcoin fell to a seven-month low near $89,250, sparking debates over a potential bottom or prolonged correction amid mixed technical and institutional signals. - Analysts highlight a possible 40% rebound by year-end, driven by bullish figures like Michael Saylor and whale accumulation of 345,000 BTC since October. - Retail investors flee as fear metrics hit extremes, contrasting with institutional confidence seen in Czech National Bank's $1M Bitcoin pilot and ETF inflows. - Technical indicators warn of

COAI Experiences Significant Price Decline in Early November 2025: Combined Impact of Disappointing Earnings and Changing Market Sentiment

- COAI Index fell 88% YTD in 2025, sparking debates over AI/crypto AI sector revaluation vs. overreaction. - Mixed Q4 earnings: Cisco showed $14.7B revenue growth, while C3.ai reported $31.2M operating loss despite 26% revenue rise. - C3.ai's leadership crisis (CEO change, lawsuit) and governance issues amplified COAI's decline amid regulatory uncertainty. - CLARITY Act's ambiguous crypto regulations and institutional flight to stable tech stocks worsened sector sentiment. - Market re-rating of speculative

Hyperliquid (HYPE) Price Rally: Institutional Embrace and Changing Market Sentiment in Decentralized Trading

- Hyperliquid's HYPE token surged due to institutional adoption and shifting market sentiment, defying broader crypto slumps. - A $1B HYPE Digital Asset Treasury merger with Rorschach I LLC and partnerships like Hyperion DeFi's HAUS protocol boosted token utility and capital inflows. - Q3 2025 analysis shows HYPE trading between $35-$60 with strong on-chain metrics, though manipulation risks and Fed policy remain critical factors. - 21Shares' HYPE ETF application and Hyperliquid's expanded $1B fundraising