3 Bitcoin Mining Stocks To Watch In The Third Week Of November 2025

BMNR, BTDR, and HIVE face heavy declines but oversold conditions and strong fundamentals hint at possible rebounds in the third week of November.

When we look at Bitcoin’s price, the concern extends to the altcoins as well; however, it should also extend to the companies associated with BTC-related activities.

In line with the same, BeInCrypto has analysed three Bitcoin mining companies’ stock performance and what lies ahead for them.

BitMine Immersion Technologies (BMNR)

BMNR has dropped 24% this week and trades at $30.95. Despite the decline, Bitmine has continued accumulating ETH, adding 54,156 ETH worth more than $170 million over the past seven days. This signals a strong long-term conviction from the company.

The RSI is nearing the oversold zone, which often precedes a reversal. If conditions stabilize, BMNR could rebound from the $30.88 support and climb toward $34.94 or even $37.27, offering relief after a week of heavy losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BMNR Price Analysis. Source:

TradingView

BMNR Price Analysis. Source:

TradingView

If Bitcoin weakens further, BMNR may follow the broader downturn. A deeper decline could send the stock below $27.80, with potential downside extending to $24.64. This would invalidate the bullish outlook and signal intensified bearish momentum.

Bitdeer Technologies Group (BTDR)

Bitdeer has recorded some of the steepest losses among Bitcoin mining stocks, falling 53% over seven sessions. The share price now sits at $10.63, reflecting intense selling pressure as broader market weakness continues to weigh on mining companies.

BTDR’s RSI is deep in the oversold zone, signaling conditions that often precede a reversal. If buyers step in, the stock could rebound from $9.56 and move toward $11.92, with potential upside extending to $15.24 if momentum strengthens.

BTDR Price Analysis. Source:

TradingView

BTDR Price Analysis. Source:

TradingView

If market conditions fail to improve, BTDR could continue its decline. A breakdown below $9.56 may drive the price toward $7.96. This would invalidate the bullish outlook and signal an extended downside for the mining firm.

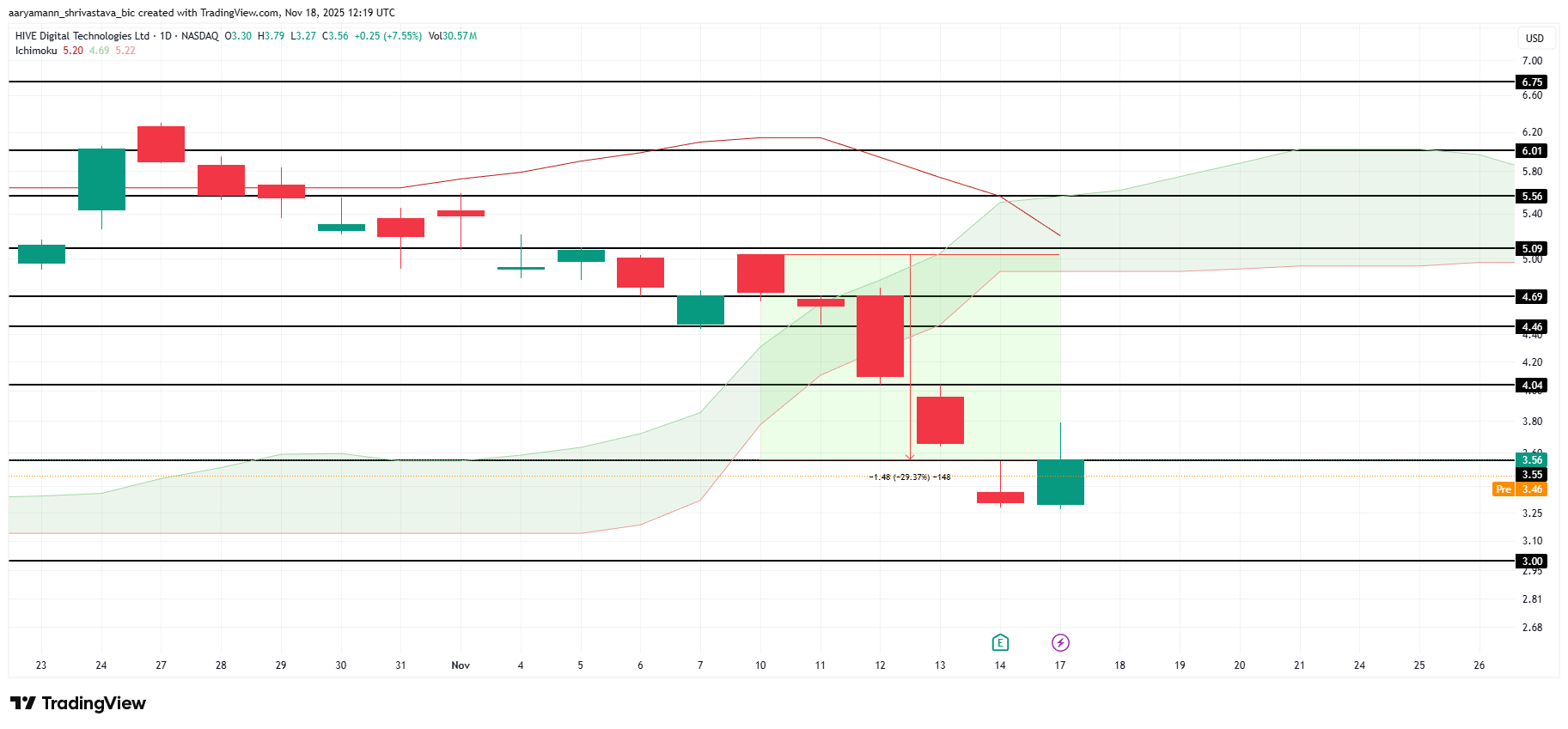

HIVE Digital Technologies Ltd. (HIVE)

Bitcoin mining company HIVE has dropped 29% over the past week but now trades at $3.56 after gaining 7.5% today. The surge follows the company’s announcement of 285% revenue growth in Q2, which has boosted investor confidence despite recent volatility.

This strong performance could fuel a broader recovery and lift HIVE toward $4.04. Restoring recent losses would require a move to $5.09. Reaching this target may take time, but it remains possible if momentum and sentiment continue improving.

HIVE Price Analysis. Source:

TradingView

HIVE Price Analysis. Source:

TradingView

If the stock fails to capitalize on the company’s earnings strength, HIVE may resume its decline. A drop toward the $3.00 support level or lower would invalidate the bullish thesis and signal renewed weakness.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Litecoin Faces Crucial $101.50 Barrier—Will It Surge or Retreat?

- Litecoin tests $96 support with $101.50-$105 levels critical for breakout/consolidation. - Technical analysis highlights multi-year accumulation patterns and Bitcoin correlation influencing price action. - Analysts debate $100-$125 near-term targets vs. $140-$400 long-term goals depending on Bitcoin stability. - Market remains divided between bullish historical parallels and caution over potential 20-30% retracements.

Solana News Update: Solana Weighs ETF Hopes Amid Intensifying Bear Market Challenges

- Solana (SOL) faces critical juncture with ETF inflows ($357.8M for Bitwise BSOL) contrasting 15.6% 7-day price decline to $141.10. - Technical indicators show mixed signals: oversold RSI (33.66) suggests short-term rebound potential, but key support levels ($134.79) remain vulnerable. - Institutional staking yields ($342K Q3 rewards) and disciplined capital management highlight resilience amid broader crypto ETF outflows ($492M for Bitcoin). - Market focus on $130–$140 range: sustained rebound could reig

XRP News Today: Institutional Trust in XRP ETFs Fuels Hope Despite Widespread Crypto Slump

- XRP , Bitcoin , and Ethereum face sharp declines amid crypto market correction, with XRP dropping 15% to $2.17 as of November 14. - Analysts highlight XRP's $2.15 support level and potential $2.40–$2.70 rally if ETF inflows and institutional demand sustain momentum. - XRP ETFs attracted $243M net inflows despite whale selling 200M tokens post-launch, signaling mixed short-term pressure and long-term institutional confidence. - Franklin Templeton and Grayscale list XRP ETFs in DTC pipeline, while Bitget's

Bitcoin News Update: Impact of Leverage: $215 Million in Crypto Liquidations Reveal Market’s Underlying Vulnerabilities

- Crypto markets saw $215M+ Bitcoin futures liquidations as prices plummeted below $95,000, triggering panic across digital assets. - Analysts attributed the crash to profit-taking, macroeconomic uncertainty, and leveraged long positions wiping out 77.71% of Bitcoin's liquidations. - Despite turmoil, MicroStrategy's CEO Michael Saylor reaffirmed Bitcoin bullishness, denying claims of selling holdings amid $1.8M in company stock sales. - Tether's $1B robotics investment highlighted shifting capital flows, w