Canada’s Stablecoin Strategy: Taking on U.S. Dollar Dominance in the Wake of the 2025 Crash

- Canada's 2025 budget grants Bank of Canada authority to regulate stablecoins, challenging USD dominance in crypto markets. - October crash saw $1.58B stablecoin inflows to Binance and Ethereum's record 24,192 TPS, highlighting market volatility and network strain. - U.S. regulators intensified enforcement, charging crypto ATM operator with $10M money laundering amid global scrutiny of stablecoin risks. - Circle's USDC saw $9.6T Q3 transaction volume and $73.7B circulation, demonstrating stablecoins' resi

The cryptocurrency crash in October 2025 sparked a worldwide reassessment of stablecoins, often referred to as "digital dollars" that form the foundation of much of the crypto market. As

Canada’s national government has just approved a budget that

Data from October 2025 illustrates the market’s turbulence. Binance

Amid the upheaval, certain stablecoin providers excelled.

Progress in innovation continued. Wirex and

The crash has also led to reflection within the industry.

As the situation stabilizes, the events of October 2025 stand as a warning. Stablecoins remain central to the crypto world, but their continued success will depend on clear regulations, robust technology, and sustained market trust—factors that will shape the next era of digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

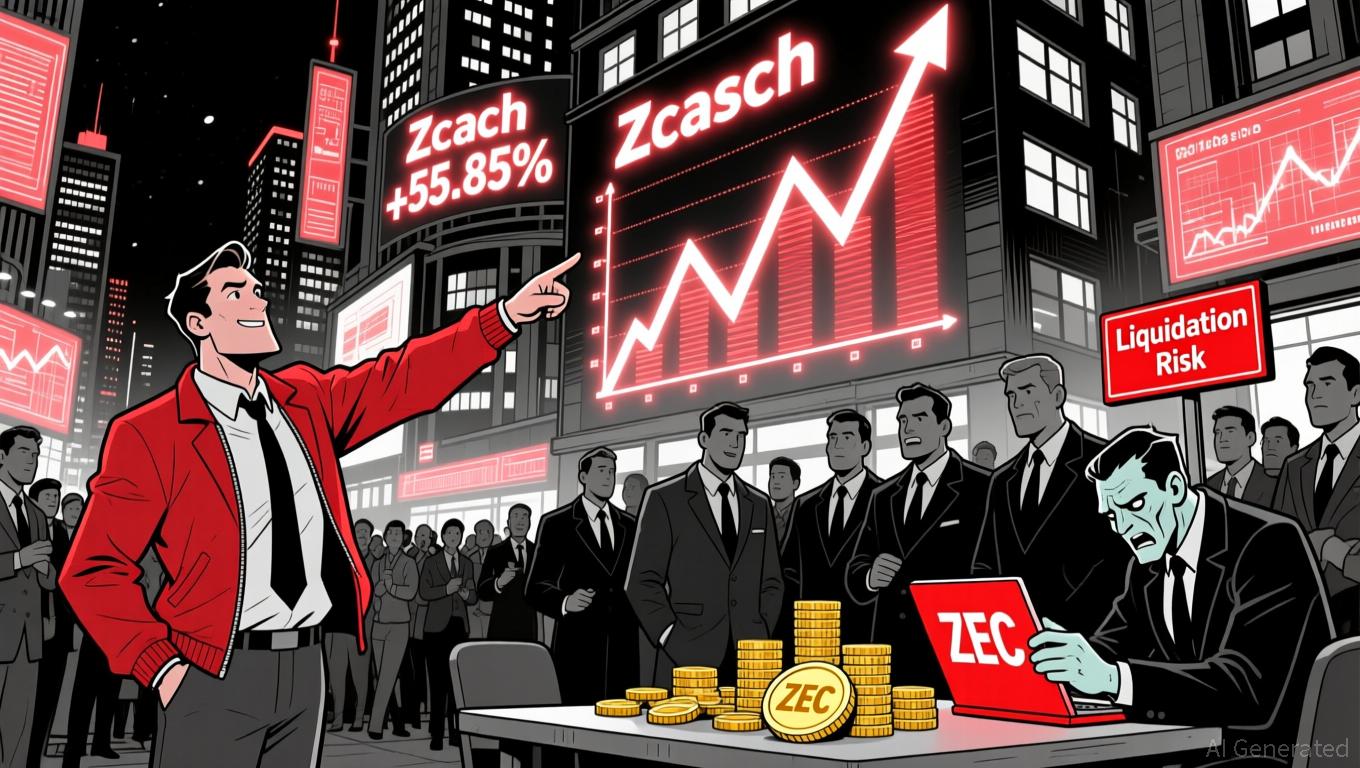

ZEC has surged by 55.85% over the past month as large investors engage in short selling while institutions are making purchases

- ZEC surged 55.85% in one month amid whale shorting and institutional buying, hitting $621.6 on Nov 19, 2025. - Whale address 0x7b7 opened a $19M ZEC short with 134% unrealized gains, while three $20M+ short positions face $653–$655 liquidation risks. - Cypherpunk Technologies added 29,869 ZEC ($18M) to its holdings, now owning 1.43% of ZEC supply, aiming for 5% long-term ownership. - Market dynamics highlight conflicting bearish whale activity and institutional bullish accumulation, with ZEC up 1020.67%

Panic Rising, Miners Buying: Is Bitcoin Near Its Breaking Point?

Crypto Airdrops' Growing Centralization Threatens the Principles of Decentralized Fairness

- aPriori's crypto airdrop sparked controversy after one entity claimed 60% of tokens, raising transparency and centralization concerns. - Airdrop farming tactics, like Arbitrum's $3. 3M consolidation across 1,496 wallets, undermine decentralized fairness for retail investors. - HTX DAO's 90% growth in token subscriptions ($9B total) highlights deflationary strategies boosting scarcity and market value. - IPO market volatility and regulatory risks have pushed projects toward airdrops for liquidity, despite

Bitcoin News Today: Bitcoin ETFs Offload $2.96 Billion in November, Exceeding Mt. Gox Repayment Amounts

- Bitcoin ETFs sold $2.96B in November, exceeding Mt. Gox's $953M debt repayment transfers, signaling extreme bearish sentiment. - BlackRock's IBIT led outflows with $2.1B, including a $523M single-day withdrawal, as BTC prices fell 28% below $90,000. - Market analysts warn ETF redemptions could accelerate Bitcoin's decline, citing technical indicators like the "death cross" and weak institutional sentiment. - The sell-off contrasts Bitcoin's historical November rallies, driven by macroeconomic fears and A