Bitcoin Faces Deepest Pullback of the Bull Cycle as Analysts Remain Split on the Future

Bitcoin’s sharp retreat and record-long Extreme Fear streak have split analysts on whether the market has entered a new bear phase or is close to bottoming. While some see structural breakdowns, others say the conditions match past local bottoms.

Bitcoin’s (BTC) current retreat now stands as the deepest correction of this market cycle, based on observations from an on-chain analyst.

At the same time, sentiment has tanked. Analysts disagree on whether the market is entering a prolonged downturn or if a bottom will form soon.

Bitcoin Faces Deepest Correction of the Cycle as Fear Dominates Market

Bitcoin has continued to shed its gains in the past months. Yesterday, the coin dropped below $90,000, marking a 7-month low. However, a modest recovery followed.

BeInCrypto Markets data showed that it was trading at $91,460 at the time of writing. This represented a 0.109% increase over the past 24 hours.

Bitcoin Price Performance. Source:

Bitcoin Price Performance. Source:

On-chain analyst Maartunn highlighted the magnitude of the pullback in a recent X (formerly Twitter) post. He pointed out that the depth of the correction is now the largest seen so far in the current cycle.

The current pullback is the largest of this bull market cycle 📉

— Maartunn (@JA_Maartun)

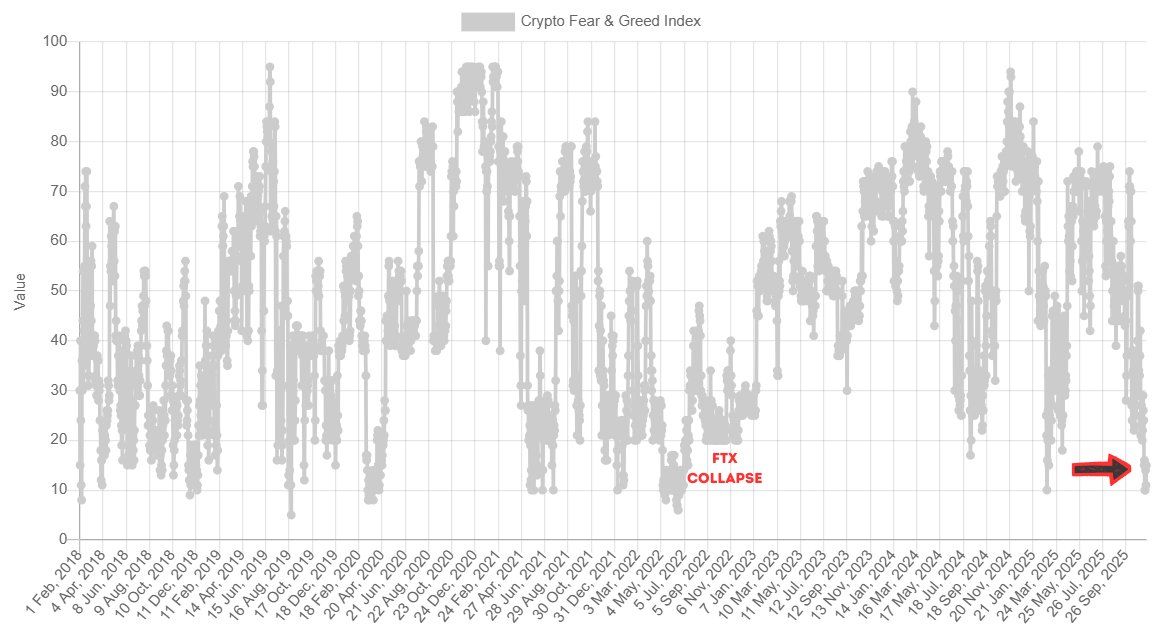

The decline has also shaken market sentiment. The Crypto Fear & Greed Index has remained locked in Extreme Fear for eight consecutive days as of November 19.

Such a long streak signals that traders remain deeply cautious, with risk appetite at one of its lowest levels of the year.

“This is now the longest Extreme Fear streak since the FTX collapse,” Coin Bureau wrote.

The Crypto Fear & Greed Index. Source:

The Crypto Fear & Greed Index. Source:

Analysts Divided on Bitcoin: Bear Market or Local Bottom?

Alphractal stated that extremely negative sentiment can mean two things. It can signal an upcoming local bottom during a bull market. However, in a bear market, such sentiment typically indicates continued downside. Notably, this is where analysts remain split.

Some argue that a bear market has started according to the 4-year cycle. In a detailed thread, Mister Crypto also outlined several arguments for why the bull market is over. He highlighted technical signals and cycle timing models that align with previous cycle peaks.

On-chain and behavioral signals support his view. He noted that old Bitcoin whales are selling, a Wyckoff distribution pattern has completed, and Bitcoin is beginning to lose strength versus the S&P 500, just as it did at the start of the last bear market.

Investor and trader Philakone even forecasted that BTC could drop as low as $35,000 by the end of next year. This stands in sharp contrast to the numerous bullish BTC forecasts analysts have been issuing all year.

“It’s wild that people think this is impossible. That bitcoin can’t hit $35K to $40K before Dec 2026. All bear markets have lasted roughly 365 days exactly from the top to the very bottom in 2014, 2018, and 2022. All bear markets dropped 78% to 86%. So how’s this not possible?,” he posted.

However, other analysts argue the opposite. They contend that this is not how bull markets typically end and believe Bitcoin may instead be carving out a bottom.

Altcoins are sitting at a 4-year bottom.I’ve been in the crypto since 2016, and this is not how the bull market ends.

— Ash Crypto (@AshCrypto)

Institutional figures Tom Lee and Matt Hougan also suggest that Bitcoin may be forming a bottom, potentially as early as this week.

“Not saying we’ll shoot straight to new highs from here, but if history repeats, the local bottom should be in, and a recovery pump might be just around the corner,” Hougan said.

With opinions sharply divided, it remains unclear whether Bitcoin’s pullback marks the start of a deeper downturn or simply a short-term bottom. Only the coming time will reveal which side is right.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Saylor’s Bitcoin Bet—Genius Move or Risky Venture?

- MicroStrategy's $835M Bitcoin purchase (8,178 BTC) raises questions about its strategy amid a 56% stock price drop and $61B BTC holdings. - Critics like Peter Schiff call the model unsustainable, while Arca's Jeff Dorman disputes forced sale risks as Bitcoin ETFs see outflows. - Bitcoin's $94K price and MicroStrategy's $8.1B debt amplify risks, with shares trading at a 19% premium to NAV amid bearish altcoin trends. - Regulatory support for Bitcoin tax payments contrasts with market volatility, as Saylor

Polkadot News Update: Dalio: Federal Reserve's Support Sustains AI Market Surge, Withdrawal Remains Too Soon

- Ray Dalio warns AI-driven stock market nears bubble territory but advises against premature exits, citing Fed's accommodative policy as a key deflationary delay. - His proprietary bubble indicator at 80% capacity highlights AI speculation risks, yet rate cuts until 2025 could prolong the rally before any correction. - Nvidia's $57B Q3 revenue and S&P 500 record highs underscore AI's market dominance, while energy/software sectors show AI's expanding systemic impact. - Dalio urges investors to monitor Fed

Solana News Update: Abu Dhabi Commits $54 Billion—Blockchain Innovation and Strategic Alliances Drive Global Hub Aspirations

- Abu Dhabi secures Solmate-Solana blockchain partnership during Finance Week, aligning with $54B infrastructure and global innovation goals. - Five-year infrastructure plan combines government funding and public-private partnerships to boost connectivity across key regions. - Indian firms show 38.4% CAGR growth in Abu Dhabi (2019-2024), driven by business-friendly policies and strategic market access advantages. - Bitcoin Munari integrates Solana blockchain for token operations, highlighting UAE's role in

Bitcoin News Update: S&P’s $2 Trillion Crash Rattles the Crypto Market’s Foundation

- S&P 500's $2 trillion late-2025 drop triggered crypto volatility, with Bitcoin/Ethereum swings causing $1B+ daily liquidations. - High-leverage trading (20x-100x) and institutional outflows exacerbated crypto's fragility, exemplified by a $168M trader loss. - Tech stock declines (2%+ on Nov 17) and thinning liquidity amplified crypto's instability, erasing $1.2T in sector value since October. - Major crypto firms like BitMine Immersion (3.6M ETH) face scrutiny as MSCI considers excluding Bitcoin-focused