Bitcoin Update: Federal Reserve's Balancing Act and Death Cross Indicate Extended Bitcoin Downturn

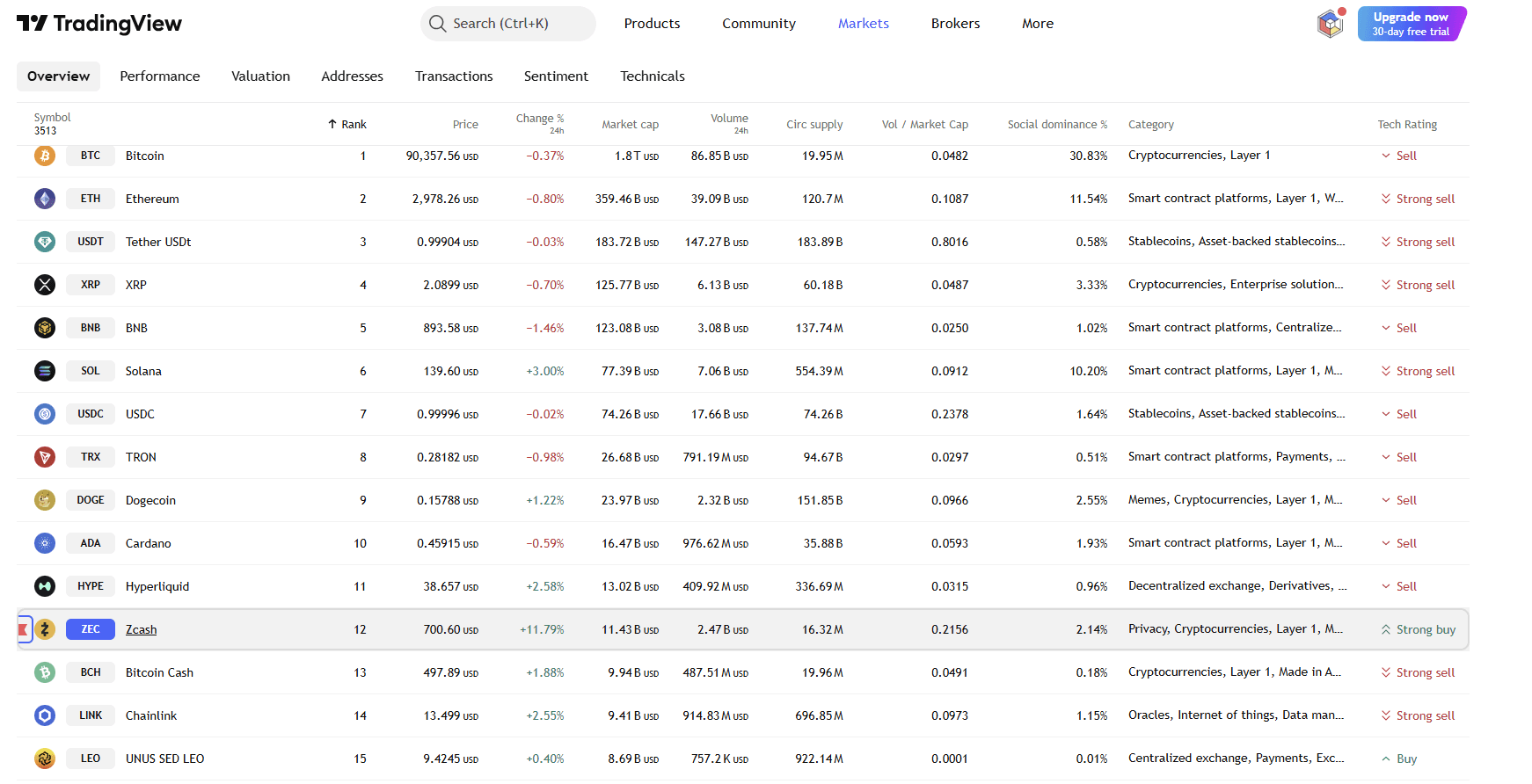

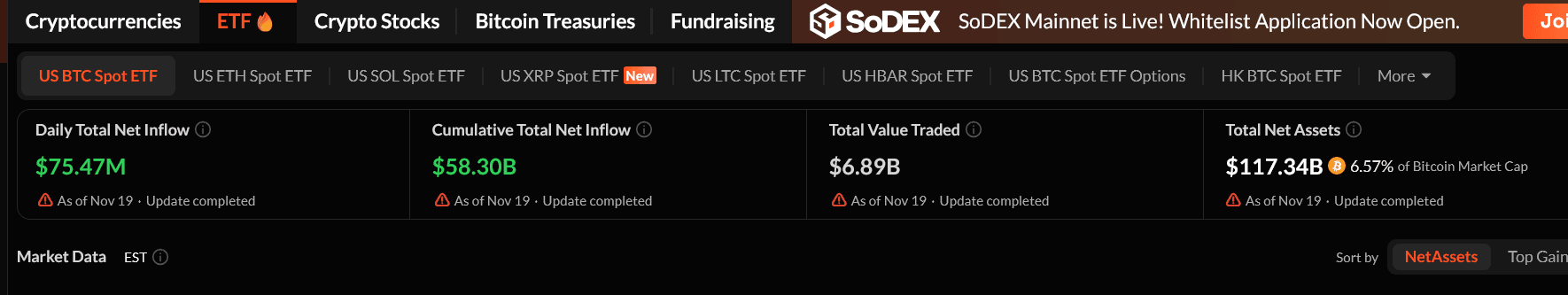

- Bitcoin fell below $91,000 amid $3B ETF outflows, technical "death cross" signals, and shifting Fed policy expectations. - BlackRock's IBIT saw record $523M outflows, while Mubadala tripled Bitcoin holdings despite market volatility. - Fed officials split on December rate cuts (46% chance now vs. 93.7% earlier), with Waller citing weak labor markets. - Stablecoin balances hit 11-month lows, Nansen traders added $5.7M short positions, and XRP derivatives stagnated. - Bitcoin and Ethereum entered technical

Bitcoin’s recent drop below $91,000 has heightened worries about a larger market downturn, fueled by a mix of ETF withdrawals, changing expectations for Federal Reserve policy, and negative technical trends. The cryptocurrency’s losses have been deepened by

The Federal Reserve’s tightening measures have become a major talking point. Fed Governor Christopher Waller, who supports a 25-basis-point rate reduction at the December 9–10 meeting,

Technical signals are also highlighting a bearish outlook. Bitcoin’s 50-day and 200-day exponential moving averages

The recent selloff has also revealed weaknesses within the crypto sector. Tom Lee from Bitmine Immersion cautioned about financial shortfalls at two leading market makers, while the XRP derivatives market remains sluggish, with

With the Fed’s December meeting approaching, investors are divided. While Waller’s dovish approach and Abu Dhabi’s aggressive investments provide some optimism, the broader economic environment—including political influences on the Fed and unresolved macroeconomic risks—suggests caution. For now, the market seems to be bracing for an extended downturn, with major support levels and institutional moves likely to determine the next trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CFTC’s Expanded Crypto Responsibilities Challenge Regulatory Preparedness and Cross-Party Cooperation

- Senate Agriculture Committee confirmed Trump's CFTC nominee Michael Selig along party lines, advancing his nomination for final Senate approval. - Selig, an SEC crypto advisor, would expand CFTC's oversight of crypto spot markets under the CLARITY Act, positioning it as a key digital asset regulator. - Democrats raised concerns about CFTC's limited resources (543 staff vs. SEC's 4,200) and potential single-party control after current chair's expected resignation. - Selig emphasized "clear rules" for cryp

Bitcoin Updates: Bitcoin Approaches Crucial Support Level Amid Heightened Fear, Indicating Possible Recovery

- Bitcoin fell to a seven-month low near $87,300, testing key support levels amid heavy selling pressure and extreme bearish sentiment. - Analysts highlight a "max pain" zone between $84,000-$73,000, with historical patterns suggesting rebounds after fear indices hit annual lows. - The Crypto Fear & Greed Index at 15—a level preceding past rebounds—aligns with historical 10-33% post-dip recovery trends. - A 26.7% correction triggered $914M in liquidations, but a 2% rebound to $92,621 shows resilience amid

Bitcoin ETFs Are Back: Did the Crash Just End?

Should You Buy ZEC During the Market Crash? Here’s What’s Really Happening