Fed's Discussion on Lowering Rates: Balancing Job Market Concerns and Inflation Risks Amid Limited Data

- Fed's December rate cut odds dropped to 52% as data gaps and labor market slowdown fuel investor uncertainty. - Governor Waller advocates 25-basis-point cut citing weak job growth and AI-driven hiring challenges, contrasting inflation-focused officials. - Key metrics like delayed September payrolls and October meeting minutes will shape final decision amid policy debate. - Global central banks and Trump's Fed chair selection add political risks to monetary policy neutrality. - Gold prices fell 3.4% as re

Uncertainty has increased regarding whether the Federal Reserve will lower rates in December, as the market

Waller

The Fed’s decision is further complicated by limited data.

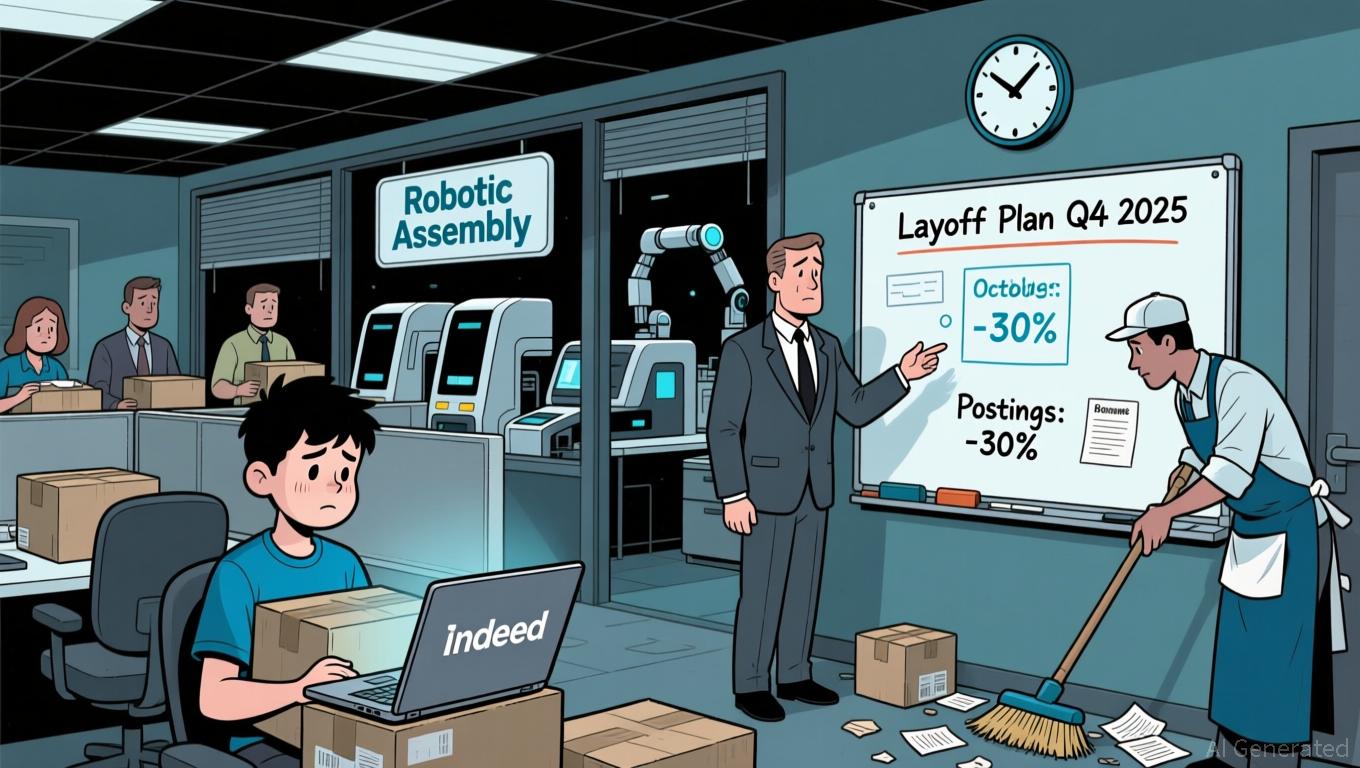

The Fed’s dual mandate is facing new obstacles.

Investors are also wary of the Fed’s political environment.

The outcome of the Fed’s December meeting will likely

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Japan's Bond Turmoil Triggers Worldwide Crypto Sell-Off Amid Yen Carry Trade Reversal

- Japan's $135.4B stimulus package triggered a 3.41% surge in 30-year bond yields, destabilizing the $20T yen carry trade and sparking global crypto/stock selloffs. - Rising yields threaten Japan's 230% GDP debt load with higher servicing costs, creating a "debt death spiral" risk as BOJ hesitates to tighten policy. - Forced deleveraging by financial institutions intensified Bitcoin's 26% drop, with Ethereum/XRP/Solana also falling 3-5.6% amid margin calls and capital repatriation. - Upcoming 40-year bond

Bitcoin News Today: Bitcoin ETFs See $523M Outflow as Investors Weigh Fear Against Long-Term Strategies

- BlackRock's IBIT ETF recorded a $1.26B net outflow in Nov 2025, its largest redemption since 2024 launch. - Bitcoin price fell 16% to $52, triggering $2.59B outflows across 11 spot ETFs as bearish options demand surged. - Put-call skew hit 3.1% (7-month high), reflecting heightened pessimism and capitulation pressures in Bitcoin's price action. - Gold ETFs gained $289M as investors sought safe havens, contrasting with $1B inflows to tech/healthcare sector funds. - Year-to-date Bitcoin ETF inflows ($27.4B

YFI Drops 1.7% After Subpar Weekly Results as Edgewater Showcases AI-Powered Wi-Fi at Canada’s Leading Semiconductor Conference

- Edgewater Wireless will showcase AI-powered Wi-Fi 8 solutions at Canada’s premier semiconductor symposium in November 2025. - The company’s CEO will highlight ultra-reliable wireless roadmaps and a $2.4M commercialization initiative supported by $921K in government grants. - Its patented Spectrum Slicing technology claims 10x performance gains and 50% latency reduction, aligning with Canada’s semiconductor self-sufficiency goals. - Despite a 11.85% monthly stock decline, Edgewater positions itself at the

Ethereum Updates Today: Ethereum Transforms into Digital Bonds, Soaring Above $3,000 Driven by Institutional Interest

- Ethereum surged past $3,000 in late 2025 driven by institutional demand, ETF approvals, and technical upgrades like the Fusaka upgrade. - BlackRock's staked Ethereum ETF attracted $13.1B inflows since 2024, reclassifying staked ETH as "digital bonds" for institutional investors. - Over 69 corporations now hold 4.1M ETH in treasuries, but ETF outflows highlight ongoing market differentiation from Bitcoin . - Fusaka's focus on layer-1 scalability aims to redirect economic activity to Ethereum's base layer