Ethereum Updates Today: BlackRock’s $1 Billion Move Into Crypto Raises Concerns of Sell-Off and Heightens Market Volatility

- BlackRock transferred $1B in Bitcoin and Ethereum to Coinbase Prime, sparking sell-off fears amid crypto volatility. - The move coincided with price declines below $100,000 for Bitcoin and $2,900 for Ethereum, with analysts viewing it as a bearish signal amid BlackRock’s recent inactivity in crypto purchases. - Regulatory shifts, like banks now holding Ethereum for gas fees, add uncertainty over institutional management of large crypto movements. - Rising alternative crypto ETFs, such as Solana and XRP f

BlackRock Inc. has transferred more than $1 billion worth of

The transfers took place as both Bitcoin and Ethereum experienced notable price drops, with Bitcoin

Recent regulatory changes have added to market uncertainty. The Office of the Comptroller of the Currency (OCC) has recently

Attention on BlackRock’s crypto moves comes as alternative crypto ETFs are gaining momentum, potentially drawing investment away from Bitcoin and Ethereum. VanEck’s

The XRP ETF’s launch was especially significant, as it became the first spot fund for the asset listed in the U.S. Despite a price drop to $2.27 after its debut,

The reasoning behind BlackRock’s recent crypto transactions remains unclear, as the company has not offered any public explanation for these large-scale transfers. However, given BlackRock’s reputation as a market trendsetter, its actions are being closely monitored. “Should BlackRock be scaling back its crypto positions, it could add further downward pressure on prices,” one analyst remarked.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blockchain Enables Investors to Acquire Stakes in Trump’s Maldives Resort

- Trump Organization partners with Saudi's Dar Global to tokenize a $4T-aiming Maldives resort via blockchain, enabling early-stage digital share purchases. - Project features 80 luxury villas near Malé, blending real estate innovation with Saudi Vision 2030's digital transformation goals and blockchain-driven financial systems. - Saudi's blockchain expansion includes CBDC frameworks, Islamic finance experiments, and 4,000+ registered blockchain firms, positioning it as a regional tech leader. - Initiative

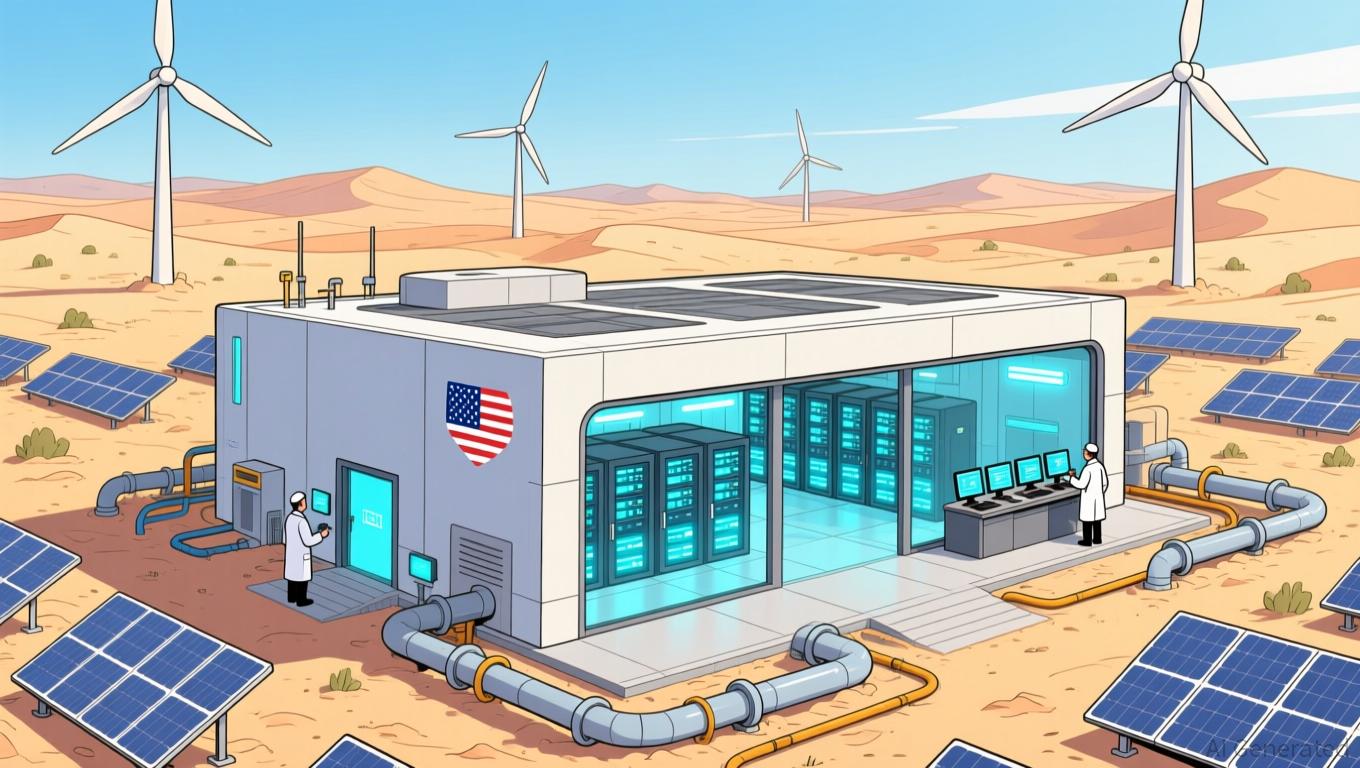

U.S. Technology Leaders Pursue Saudi AI Partnerships as Policy Discussions Continue at Home

- Nvidia's Nov. 19 earnings report, projected to show 56.4% revenue growth to $54.9B, will gauge the AI sector's health amid valuation concerns and market volatility. - Nasdaq-100 futures rose 0.6% as investors anticipate results that could either boost AI-driven stocks or trigger a sell-off, compounded by delayed data and Fed policy uncertainty. - Repeated mentions of Saudi Arabia's Humain AI partnership highlight Nvidia's strategic alignment with sovereign AI initiatives, reflecting global competition fo

Bitcoin Updates: Bitcoin ETFs See $2.6B Outflow While Harvard and Saylor Increase Investments

- Bitcoin ETFs lost $2.6B in November as institutional outflows accelerated amid macroeconomic uncertainty and price declines below $100,000. - Harvard and MicroStrategy bucked the trend by increasing Bitcoin holdings, while derivatives liquidations and risk limits worsened the selloff. - Regulatory frameworks like the GENIUS Act and crypto-collateralized loans emerged to stabilize markets during the 25% drawdown from October highs. - Analysts compare the pullback to historical volatility patterns, noting

PENGU Price Forecast Soars Following Enigmatic Smart Contract Update

- PENGU's 12.8% price surge in late November 2025 defies broader bearish trends despite Bitcoin's 4.3% rally and altcoin rebound. - Smart contract upgrades and opaque governance raise risks, while $2B token movements from team wallets signal potential dumping concerns. - Regulatory pressures (GENIUS Act, MiCA) and DeFi vulnerabilities (e.g., $128M Balancer exploit) amplify volatility amid fragmented on-chain activity. - Technical indicators (OBV, MACD) and whale-driven speculation highlight short-term mome