TRUMP Price Holds Above $7, Even As Epstein Files Release Approved

OFFICIAL TRUMP trades at $7.06 as political pressure and weakening indicators raise breakdown risks, with $6.89 serving as the last major support.

OFFICIAL TRUMP has shown little movement in recent days, with price action flattening as uncertainty grows. The lack of volatility reflects cautious sentiment among holders, who are watching external developments closely.

That pressure is set to intensify after the US Senate approved the release of Epstein files, a decision likely to influence TRUMP’s short-term direction.

OFFICIAL TRUMP Could Bear The Brunt

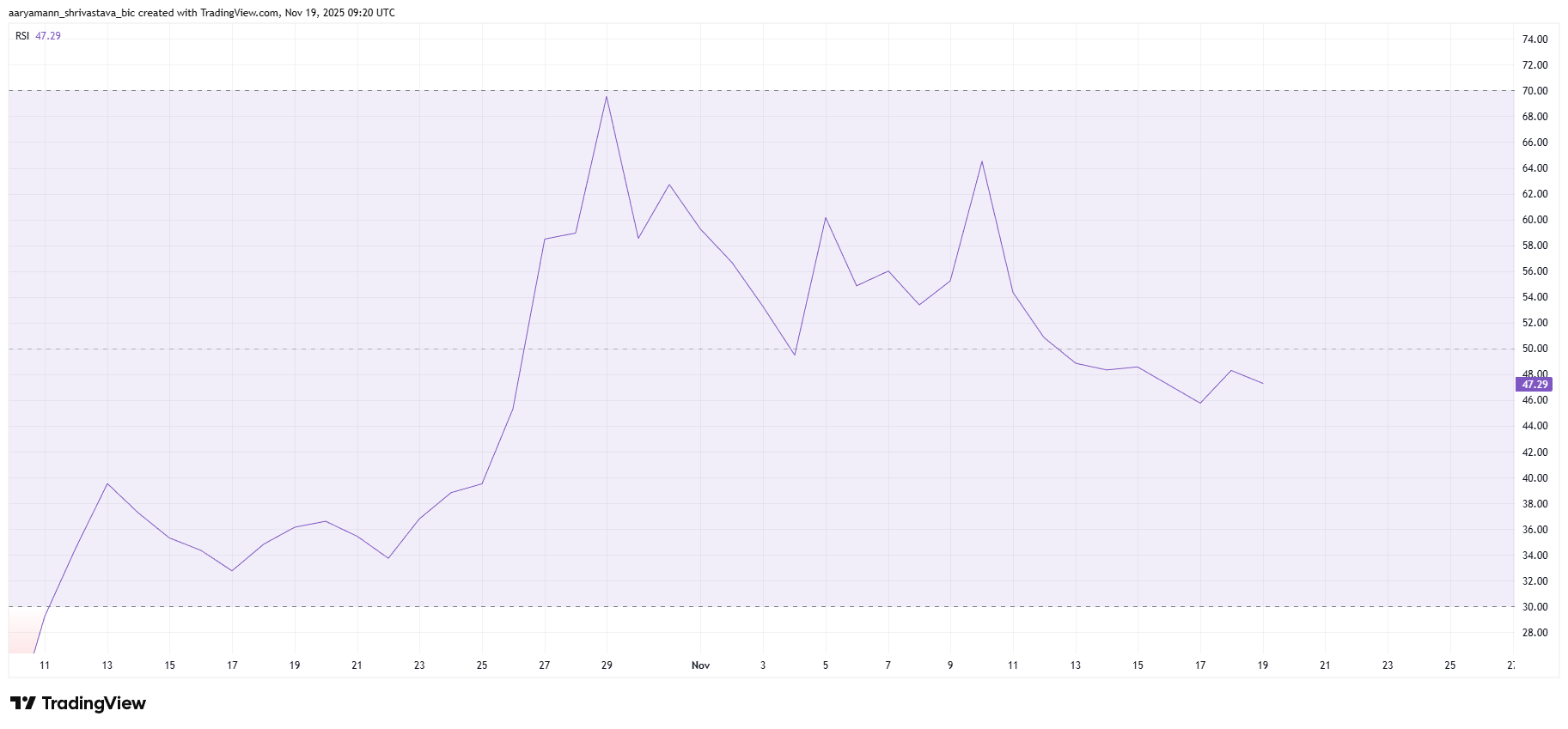

Market sentiment is weakening as the Relative Strength Index slips below the neutral 50.0 level, signaling growing bearish momentum. A continued drop into the negative zone would confirm increasing downside pressure. With Bitcoin now trading near $90,000, overall market confidence has already eroded, creating a challenging backdrop for risk-sensitive tokens like TRUMP.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

TRUMP RSI. Source:

TRUMP RSI. Source:

TRUMP faces additional headwinds owing to the Epstein files discourse. The Senate approved a House-passed bill requiring the Justice Department to release documents related to Jeffrey Epstein. Donald Trump has opposed the release previously, and past images of him with Epstein may spark renewed speculation. This combination heightens uncertainty and could weigh heavily on the TRUMP price as investors reassess risk.

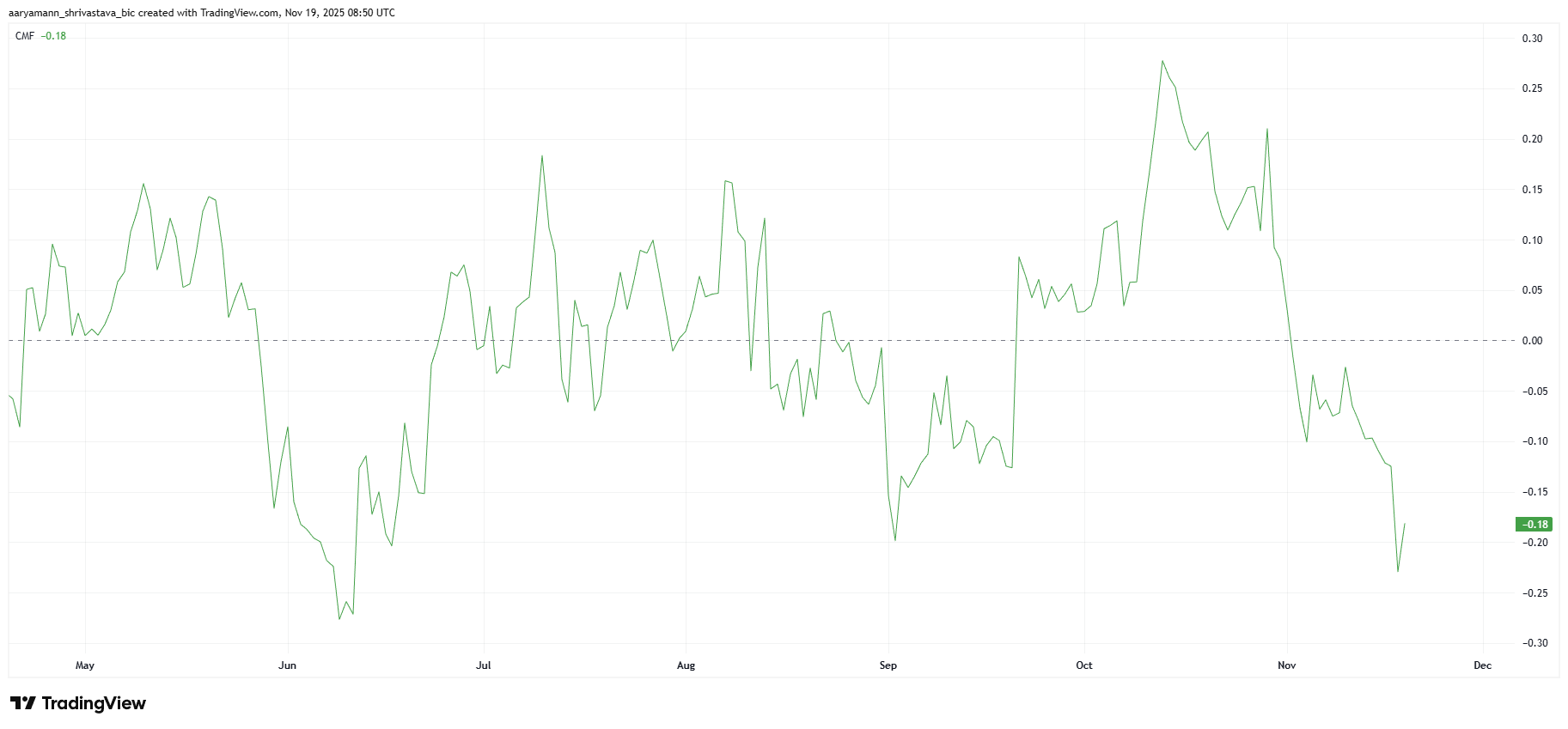

Macro momentum indicators confirm a deteriorating outlook. The Chaikin Money Flow has dropped to a five-month low, signaling aggressive capital outflows from TRUMP. The indicator weakened sharply over the past several days, revealing that investors are pulling liquidity and reducing exposure as concerns grow.

Heavy withdrawals indicate fading conviction among holders who fear further controversy and market instability. Sustained negative CMF readings typically point toward prolonged weakness, especially when paired with falling momentum indicators.

TRUMP CMF. Source:

TRUMP CMF. Source:

TRUMP Price Is Holding Above Crucial Support

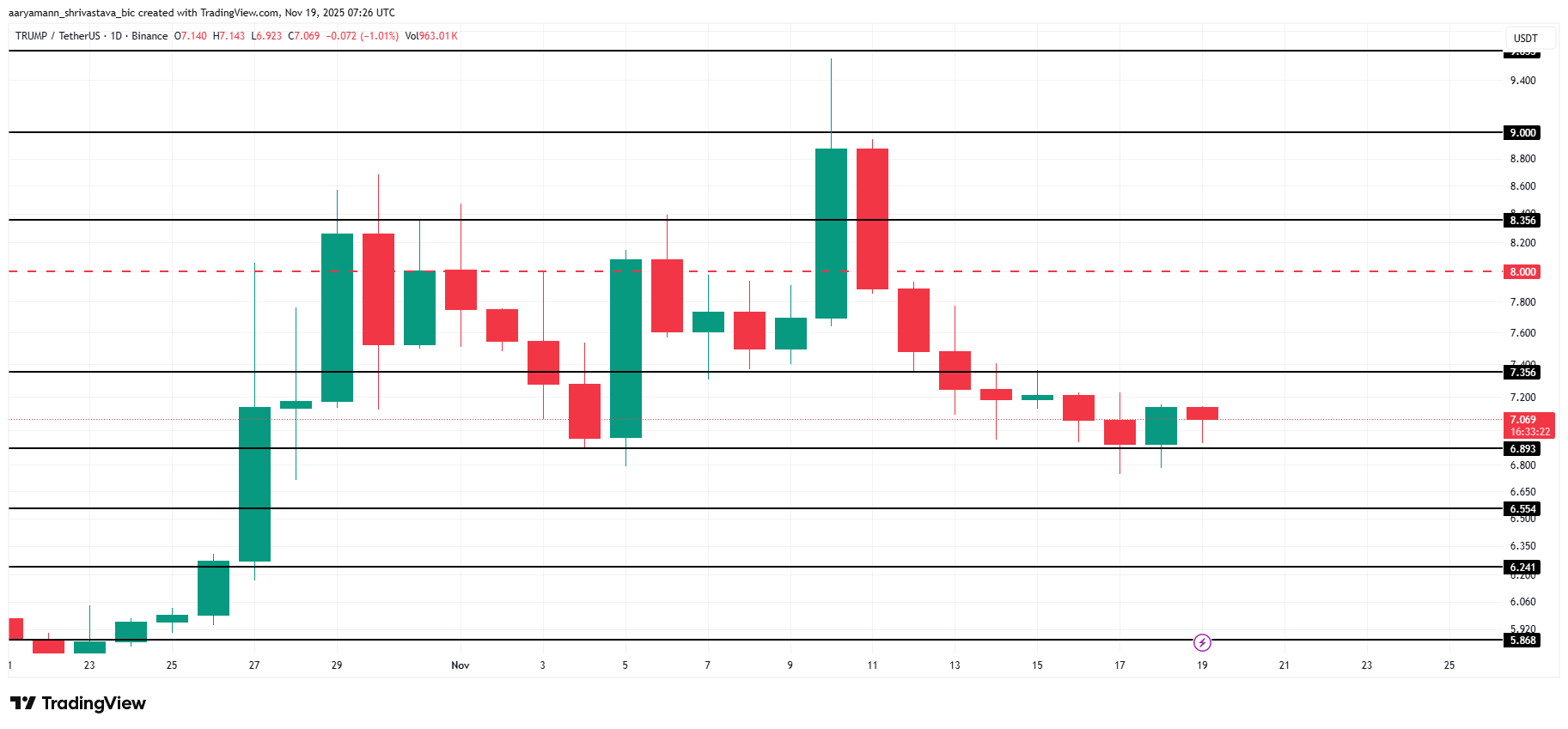

TRUMP trades at $7.06, holding just above the $6.89 support level that has stabilized the price for three weeks. The coin’s inability to generate upward traction increases the likelihood of a breakdown. Continued pressure could push TRUMP below this zone as sentiment worsens.

A drop under $6.89 would expose the price to deeper losses, potentially sending it toward $6.55 or $6.24. If fear surrounding the Epstein files intensifies, TRUMP could break below $6.00 for the first time in months and reach $5.86. Bearish sentiment and political uncertainty may accelerate this move.

TRUMP Price Analysis. Source:

TRUMP Price Analysis. Source:

However, if Donald Trump avoids controversy after the approval of the files’ release, OFFICIAL TRUMP may find room to recover. A bounce from $6.89 could lift the price to $7.35. A break above that level would open the path toward $8.00. This would invalidate the bearish thesis and restore short-term confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Japan's Bond Turmoil Triggers Worldwide Crypto Sell-Off Amid Yen Carry Trade Reversal

- Japan's $135.4B stimulus package triggered a 3.41% surge in 30-year bond yields, destabilizing the $20T yen carry trade and sparking global crypto/stock selloffs. - Rising yields threaten Japan's 230% GDP debt load with higher servicing costs, creating a "debt death spiral" risk as BOJ hesitates to tighten policy. - Forced deleveraging by financial institutions intensified Bitcoin's 26% drop, with Ethereum/XRP/Solana also falling 3-5.6% amid margin calls and capital repatriation. - Upcoming 40-year bond

Bitcoin News Today: Bitcoin ETFs See $523M Outflow as Investors Weigh Fear Against Long-Term Strategies

- BlackRock's IBIT ETF recorded a $1.26B net outflow in Nov 2025, its largest redemption since 2024 launch. - Bitcoin price fell 16% to $52, triggering $2.59B outflows across 11 spot ETFs as bearish options demand surged. - Put-call skew hit 3.1% (7-month high), reflecting heightened pessimism and capitulation pressures in Bitcoin's price action. - Gold ETFs gained $289M as investors sought safe havens, contrasting with $1B inflows to tech/healthcare sector funds. - Year-to-date Bitcoin ETF inflows ($27.4B

YFI Drops 1.7% After Subpar Weekly Results as Edgewater Showcases AI-Powered Wi-Fi at Canada’s Leading Semiconductor Conference

- Edgewater Wireless will showcase AI-powered Wi-Fi 8 solutions at Canada’s premier semiconductor symposium in November 2025. - The company’s CEO will highlight ultra-reliable wireless roadmaps and a $2.4M commercialization initiative supported by $921K in government grants. - Its patented Spectrum Slicing technology claims 10x performance gains and 50% latency reduction, aligning with Canada’s semiconductor self-sufficiency goals. - Despite a 11.85% monthly stock decline, Edgewater positions itself at the

Ethereum Updates Today: Ethereum Transforms into Digital Bonds, Soaring Above $3,000 Driven by Institutional Interest

- Ethereum surged past $3,000 in late 2025 driven by institutional demand, ETF approvals, and technical upgrades like the Fusaka upgrade. - BlackRock's staked Ethereum ETF attracted $13.1B inflows since 2024, reclassifying staked ETH as "digital bonds" for institutional investors. - Over 69 corporations now hold 4.1M ETH in treasuries, but ETF outflows highlight ongoing market differentiation from Bitcoin . - Fusaka's focus on layer-1 scalability aims to redirect economic activity to Ethereum's base layer