Ripple, XRP eyes staking as Canary Capital ETF sparks new investor interest

Ripple’s XRP Ledger is reportedly undergoing a strategic shift amid calls from the community for native staking capabilities.

- Zcash almost tripled in value in less than a month

- According to Ran Neuner, there has been a coordinated push by key influencers

- Tyler and Cameron Winklevoss, and Arthur Hayes recently spoke about Zcash

The development follows the recent launch of the Canary Capital ETF , which recorded significant trading volume on its first day, according to market data.

The two events indicate XRP is expanding beyond its traditional payments-focused operations toward broader investment applications, industry observers noted.

The XRP Ledger community has been discussing implementing native staking features, which would align the platform more closely with decentralized finance (DeFi) protocols currently operating on other blockchain networks.

Ripple has not issued an official statement regarding the timeline or technical specifications for potential staking implementation on the XRP Ledger.

Singing Canary’s praises

The Canary Capital ETF is one of the first exchange-traded funds focused on XRP, providing traditional investors with regulated exposure to the digital asset.

It generated $58 million in first-day trading, slightly surpassing Bitwise’s BSOL ETF , which launched last month with $57 million. The activity places XRPC among the top-performing ETFs of 2025, far ahead of most of the roughly 900 funds launched this year.

The fund’s debut came amid a shaky crypto market, with Bitcoin dipping below $99,000 and total market capitalization falling about 3.5% to $3.43 trillion. Yet trading in XRPC was robust, with $26 million exchanged in the first 30 minutes and over $36 million by mid-morning, including rapid transactions on Robinhood.

XRPC is a physical spot ETF holding only XRP, tracking the token’s price via the CME CF XRP-USD Reference Rate. The fund carries a 0.50% annual fee and uses Gemini Trust and BitGo Trust for custody.

Canary Capital, a Tennessee-based digital asset firm with prior Bitcoin, Ethereum, and HBAR ETFs, positions XRPC as a convenient way for institutions to access XRP’s utility in cross-border payments without managing wallets or custody. Analysts note that demand for payment-linked tokens is rising, as reflected in Canary’s HBAR ETF raising $70 million in its first week.

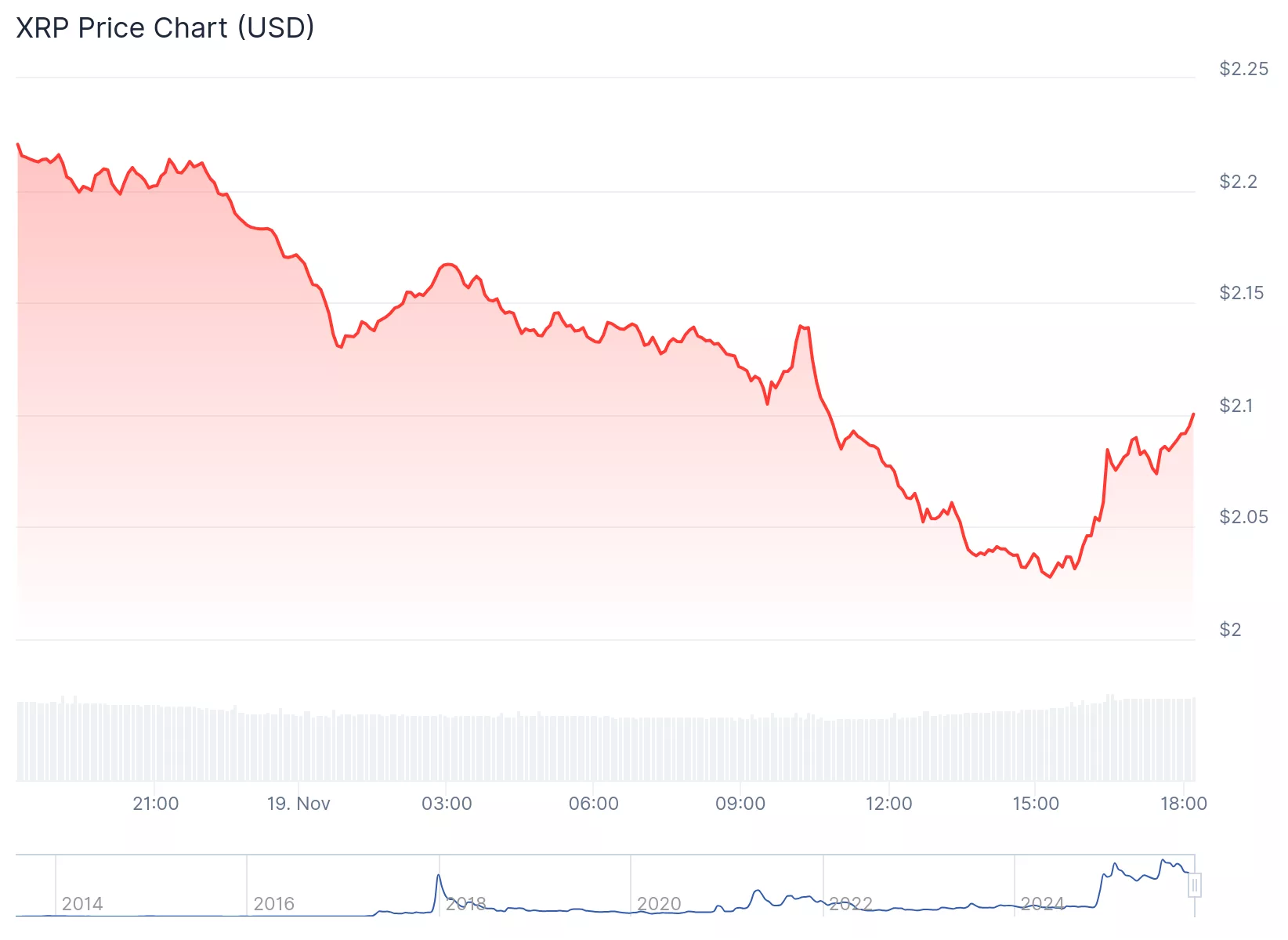

At last check, XRP was trading at around $2.10, down 5.4% for the day.

Source: CoinGecko

Source: CoinGecko

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Ethereum Challenges $2,800 Support Level—Is This a Liquidity Rebalance or the Start of a Longer Decline?

- Ethereum stabilizes near $2,800 support, with analysts suggesting potential bottoming after recent volatility. - Market turbulence sees ETH under $2,900, but record staking activity and institutional buying highlight resilience. - On-chain liquidity patterns mirror past reversals, though delayed recovery risks prolonged stagnation. - Extreme fear index (15/100) and $1B+ liquidations signal bearish control, yet key support holds for potential rebound.

Ethereum News Update: Ethereum Challenges $3K Support Level as Bears Target $2.5K and Bulls Strive for a Comeback

- Ethereum fell below $3,000 for first time since July 2024, with spot ETFs recording $74.22M outflow over six days. - Technical indicators show oversold RSI (33.8), 12/0 sell/buy signals, and broken Fibonacci levels triggering automated selling. - Bitcoin's 58.1% dominance siphons capital from altcoins while Ethereum's 0.89 MVRV ratio signals loss-making holder capitulation. - Price tests $2,770 support with $2,500 next target if broken, amid extreme Fear & Greed Index (11) and 18.18% weekly Altcoin Seaso

Ripple News: XRP Price Breaks Below $2 Amid ETF Race, Bitwise Trails Canary

Dogecoin Price Prediction: Will DOGE Recover in December or Fall Further First?