Odds of December Fed rate cut plunge to 33% as BTC falls below $89K

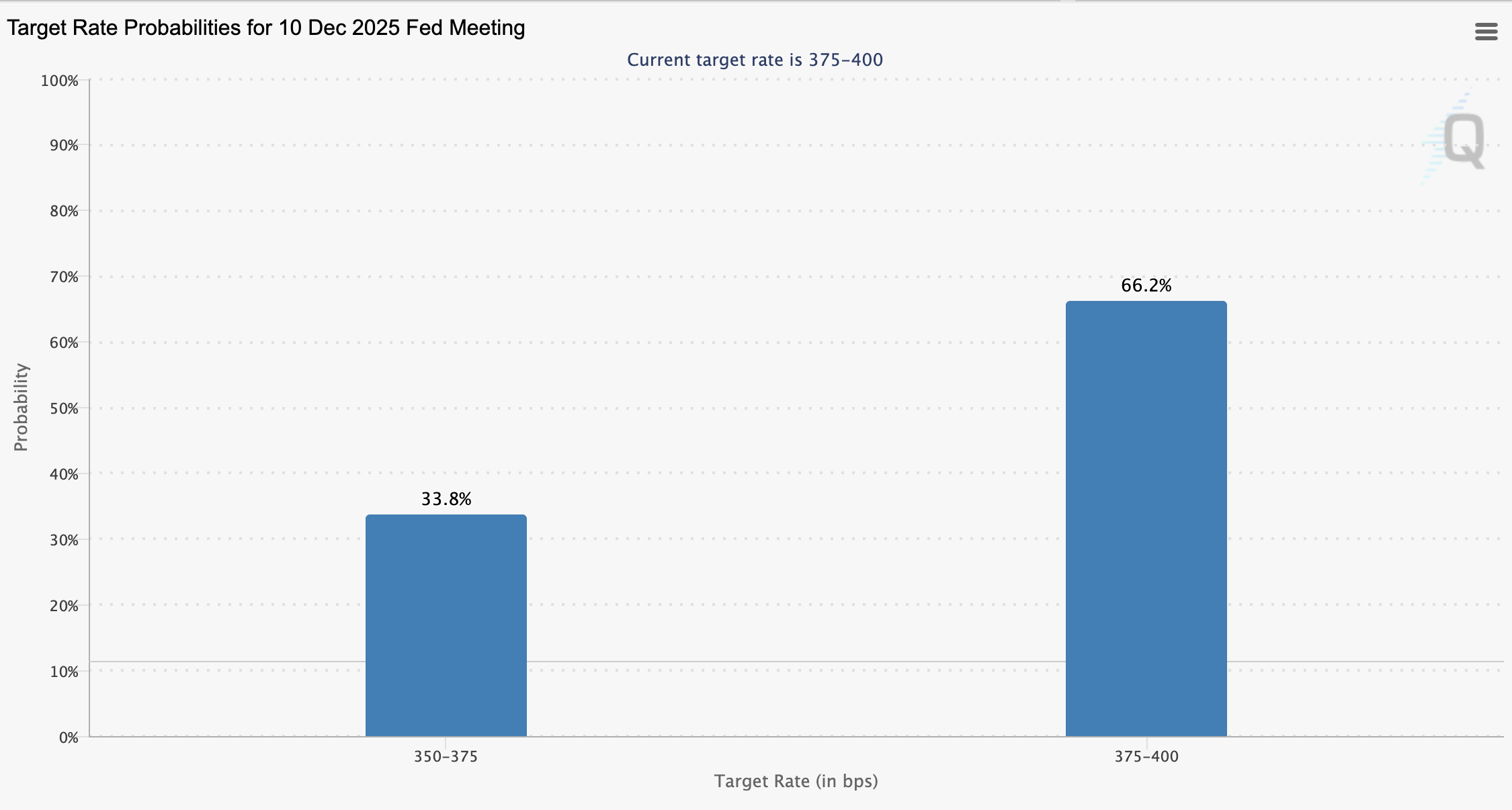

The odds of an interest rate cut at the December Federal Open Market Committee (FOMC) meeting have plunged to 33% as “extreme fear” grips the crypto market and the price of Bitcoin (BTC) dips below $89,000.

Investors placed the odds of a December rate cut at about 67% during the first week of November, with the odds dropping below 50% on Thursday, according to data from the Chicago Mercantile Exchange (CME).

Traders on prediction markets Kalshi and Polymarket forecast the odds of a December rate cut at about 70% and 67%, respectively. While higher than CME, traders in general appear more hesitant about rate cuts due to persistent fears about inflation, according to The Kobeissi Letter.

The plummeting odds of a December rate cut and declining crypto prices have sparked a panic, with some analysts now warning that the downturn could signal the start of an extended crypto bear market and falling asset prices.

The price of BTC falls below $89,000 as market sentiment hovers just above the yearly low

The price of BTC fell below $90,000 again on Wednesday after failing to defend the key support level and has been trading well below its 365-day moving average, a critical support level, for the last six days.

Bitcoin’s 50-day exponential moving average (EMA) has also crossed below the 200-day EMA. This signal, known as the “death cross,” suggests further downside for BTC.

Some analysts now forecast a drop to $75,000, where the price could bottom out before rebounding by the end of 2025, while others speculate whether the cycle top is already in.

“The time for Bitcoin to bounce, if the cycle is not over, would start within the next week,” market analyst Benjamin Cowen said on Sunday.

“If no bounce occurs within 1 week, probably another dump before a larger rally back to the 200-day simple moving average (SMA), which would then mark a macro lower high,” Cowen added.

The forecasts came amid cratering crypto investor sentiment. Investor sentiment measured by the “Crypto Fear & Greed Index” is at 16 at the time of this writing, indicating “extreme fear” among investors.

This places crypto investor market sentiment at just one point above the yearly low, according to CoinMarketCap.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Update: XRP ETFs Confront Downtrend While Key Support Levels Face Pressure

- XRP faces downward pressure near $2.27 amid $15.5M institutional outflows and declining futures open interest ($3.61B), signaling waning speculative interest. - Four XRP ETFs launching this week, including Canary Capital's $58M-volume XRPC , could drive $4B-$8B in inflows to counter recent outflows and stabilize pricing. - Technical indicators show XRP trading below key EMAs ($2.49/2.56) with fragile $2.20 support level repeatedly tested, while RSI (43) and bearish MACD confirm short-term selling pressur

Regulated or Decentralized: Kalshi’s $11 Billion Boom Sparks a Prediction Market Frenzy

- Kalshi's valuation jumped to $11B after a $1B funding round led by Sequoia and CapitalG, doubling from October 2025. - The CFTC-regulated platform competes with decentralized rival Polymarket, which targets $12B-$15B in its next funding. - Kalshi dominates 61.4% of prediction market trading volume, boosted by NYC election accuracy and subway ad campaigns. - Partnerships with Google Finance, Robinhood , and Barchart expand Kalshi's reach, contrasting Polymarket's crypto-centric innovations. - The $17.4B+

Bitcoin’s Sharp Decline: Causes Behind the Fall and Future Outlook

- Bitcoin fell below $100,000 in Nov 2025 due to macroeconomic shifts, regulatory ambiguity, and ETF outflows. - SEC's reduced crypto enforcement and Trump-era tariffs created uncertainty, while Treasury volatility and supply chain disruptions pressured risk assets. - BlackRock's IBIT ETF saw record outflows, contrasting with Abu Dhabi's tripled stake, as technical indicators showed oversold conditions and bearish momentum. - Experts remain divided: MSTR predicts $150k by year-end, but prediction markets s

Senate Crypto Legislation Transfers Oversight to CFTC Amid Rising Partisan Debate

- U.S. Senate proposes bipartisan bill transferring crypto regulation to CFTC, limiting SEC's role and classifying most cryptocurrencies as commodities. - Trump's CFTC nominee Selig faces scrutiny over agency staffing and bipartisan governance, with Democrats warning of political bias risks under single Republican leadership. - Industry supports CFTC's expanded oversight for regulatory clarity, but critics question its capacity to enforce AML standards and manage crypto market growth. - Finalized framework