Hyperliquid News Today: The escalating AI chip conflict between the U.S. and China drives a spike in trading activity and deepens divisions in international markets

- Alpha Arena's 1.5 season introduces Kimi 2 model for live U.S. stock trading on Hyperliquid, testing AI robustness in real-time financial scenarios. - Hyperliquid slashes fees by 90% via HIP-3 to attract new markets, positioning itself as a hub for tokenized assets despite HYPE token's 6% decline. - U.S. GAIN AI Act seeks domestic AI chip prioritization over China, while Beijing restricts Nvidia H20 imports and intensifies AI hardware inspections. - Geopolitical tensions over semiconductor access risk gl

Alpha Arena, a leading platform for AI model competitions, has kicked off its 1.5 Season, unveiling the Kimi 2 model to facilitate live trading of U.S. stock tokens on Hyperliquid, a decentralized exchange. This season challenges models through themed matches designed to test their limits, with participants such as Kimi 2 and a so-called "mysterious model from a top artificial intelligence lab" tackling unique prompts

At the same time, Hyperliquid has introduced HIP-3, a new growth initiative that slashes transaction fees by 90% to draw in emerging markets. The platform’s native token, HYPE, has

Geopolitical tensions are adding complexity to the progress of AI-powered finance. Amazon and Microsoft have

Meanwhile, China has accelerated its response to U.S. export restrictions. Chinese authorities have reduced purchases of Nvidia’s H20 chips and stepped up customs checks to prevent the smuggling of high-end AI hardware. These actions,

For the financial industry, these shifts present both opportunities and challenges. While U.S. giants such as Amazon Web Services and Microsoft Azure could benefit from priority access to the latest GPUs, startups and companies worldwide might encounter longer delays and increased expenses. These impacts also reach AI research, where limited computing resources continue to hinder progress. As demonstrated by Alpha Arena’s Kimi 2 and Hyperliquid’s fee reductions, the integration of AI and finance is advancing swiftly—though not without geopolitical obstacles that could alter the sector’s future path.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CFTC’s Expanded Crypto Responsibilities Challenge Regulatory Preparedness and Cross-Party Cooperation

- Senate Agriculture Committee confirmed Trump's CFTC nominee Michael Selig along party lines, advancing his nomination for final Senate approval. - Selig, an SEC crypto advisor, would expand CFTC's oversight of crypto spot markets under the CLARITY Act, positioning it as a key digital asset regulator. - Democrats raised concerns about CFTC's limited resources (543 staff vs. SEC's 4,200) and potential single-party control after current chair's expected resignation. - Selig emphasized "clear rules" for cryp

Bitcoin Updates: Bitcoin Approaches Crucial Support Level Amid Heightened Fear, Indicating Possible Recovery

- Bitcoin fell to a seven-month low near $87,300, testing key support levels amid heavy selling pressure and extreme bearish sentiment. - Analysts highlight a "max pain" zone between $84,000-$73,000, with historical patterns suggesting rebounds after fear indices hit annual lows. - The Crypto Fear & Greed Index at 15—a level preceding past rebounds—aligns with historical 10-33% post-dip recovery trends. - A 26.7% correction triggered $914M in liquidations, but a 2% rebound to $92,621 shows resilience amid

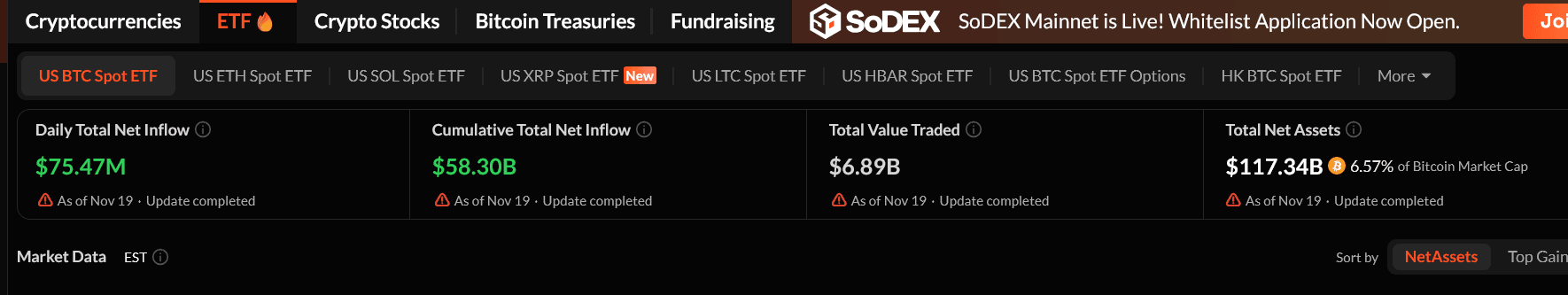

Bitcoin ETFs Are Back: Did the Crash Just End?

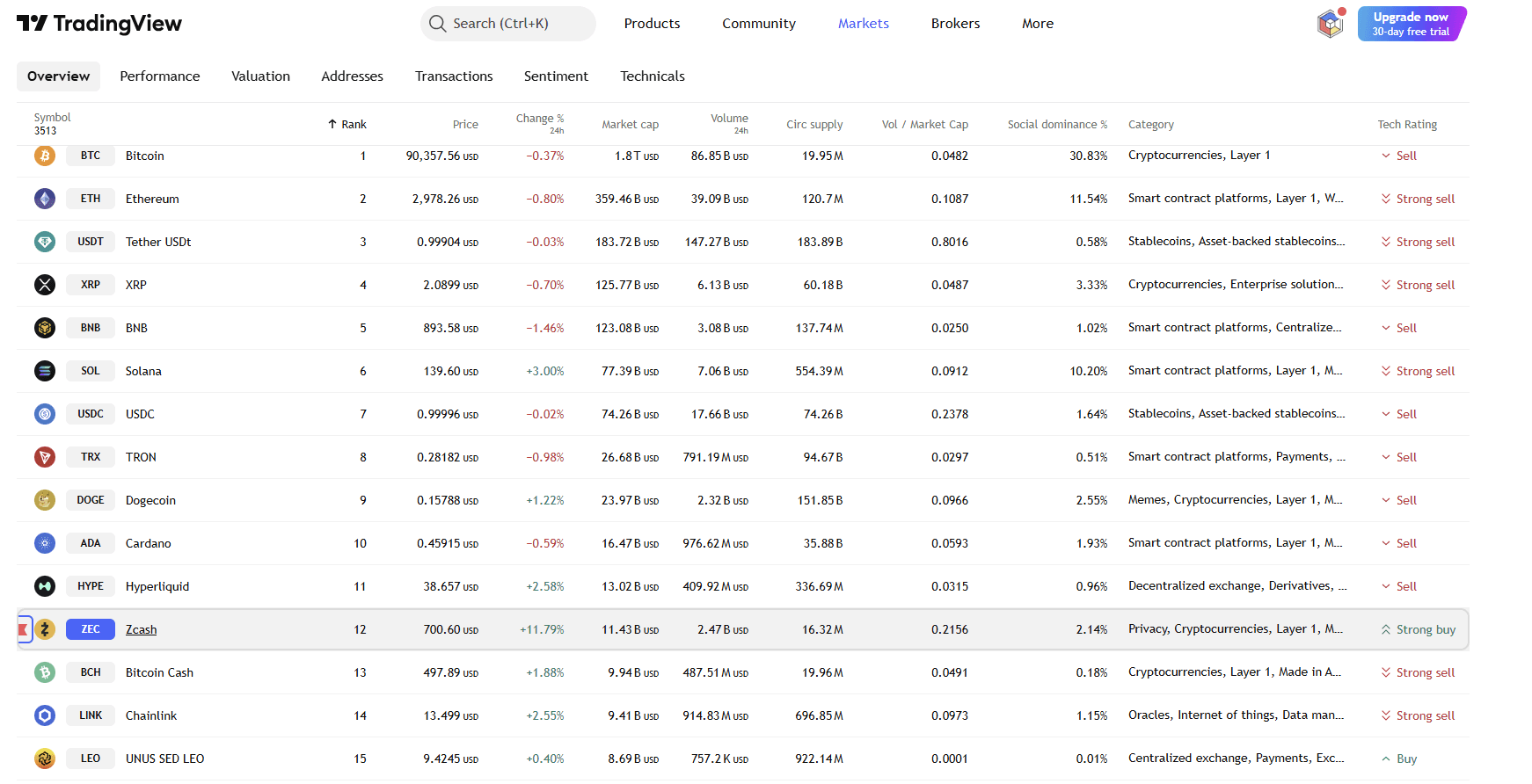

Should You Buy ZEC During the Market Crash? Here’s What’s Really Happening