Brazil Suggests Taxing Stablecoins to Address $30 Billion Shortfall and Meet International Norms

- Brazil plans to tax stablecoin transactions via expanded IOF to align with global standards and recover $30B in lost revenue. - Stablecoin transfers (e.g., USDT) will be reclassified as forex operations under 2025 central bank rules, subjecting them to IOF tax. - The move aligns with OECD's CARF framework, enabling international crypto data sharing and joining global efforts to combat tax evasion. - Political debates persist over crypto tax exemptions, while regulators aim to curb money laundering and in

Brazil Weighs Tax on Overseas Crypto Transactions to Meet Global Standards and Address Fiscal Shortfalls

Brazil is moving forward with plans to impose taxes on international cryptocurrency payments, aiming to bring its regulations in line with global practices and recover substantial tax revenue lost to unchecked digital asset transfers. Authorities are reportedly considering broadening the scope of the Imposto sobre Operações Financeiras (IOF)—a tax on financial transactions—to cover stablecoin remittances and other crypto-related cross-border payments. If approved, these changes would be implemented under new central bank guidelines beginning in February 2025,

The planned tax would categorize stablecoin operations—including those using Tether’s USDT—as foreign exchange transactions, subjecting them to the same regulatory scrutiny as conventional currency exchanges. This adjustment

This initiative brings Brazil in line with the Organisation for Economic Co-operation and Development’s (OECD) Crypto-Asset Reporting Framework (CARF), a worldwide protocol for exchanging tax data on digital assets. On November 14, Brazil’s Federal Revenue Service introduced updated reporting requirements to comply with CARF, granting authorities access to citizens’ offshore crypto assets through an international information-sharing system. This mirrors steps taken by the U.S., European Union, and United Arab Emirates,

Regulatory bodies have raised alarms about stablecoins being exploited for unofficial currency trading and illicit financial activities.

Political friction has surfaced as legislators discuss the measure. A bill put forward by Eros Biondini proposes exempting long-term crypto holders from capital gains taxes, arguing that the current tax burden is too heavy. However,

The central bank’s broader regulatory reforms—which include mandatory licensing for crypto exchanges and enhanced consumer protections—complement the proposed tax. These actions demonstrate Brazil’s intent to strengthen oversight of its digital asset market,

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CFTC’s Expanded Crypto Responsibilities Challenge Regulatory Preparedness and Cross-Party Cooperation

- Senate Agriculture Committee confirmed Trump's CFTC nominee Michael Selig along party lines, advancing his nomination for final Senate approval. - Selig, an SEC crypto advisor, would expand CFTC's oversight of crypto spot markets under the CLARITY Act, positioning it as a key digital asset regulator. - Democrats raised concerns about CFTC's limited resources (543 staff vs. SEC's 4,200) and potential single-party control after current chair's expected resignation. - Selig emphasized "clear rules" for cryp

Bitcoin Updates: Bitcoin Approaches Crucial Support Level Amid Heightened Fear, Indicating Possible Recovery

- Bitcoin fell to a seven-month low near $87,300, testing key support levels amid heavy selling pressure and extreme bearish sentiment. - Analysts highlight a "max pain" zone between $84,000-$73,000, with historical patterns suggesting rebounds after fear indices hit annual lows. - The Crypto Fear & Greed Index at 15—a level preceding past rebounds—aligns with historical 10-33% post-dip recovery trends. - A 26.7% correction triggered $914M in liquidations, but a 2% rebound to $92,621 shows resilience amid

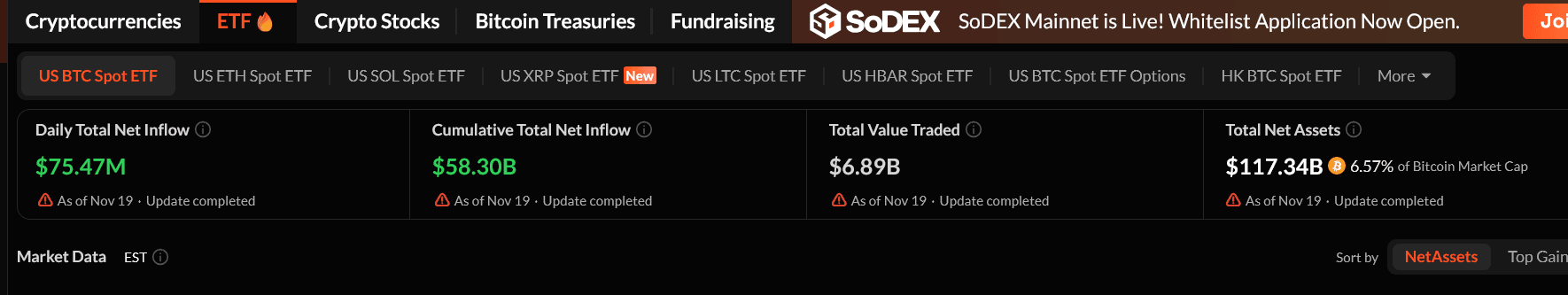

Bitcoin ETFs Are Back: Did the Crash Just End?

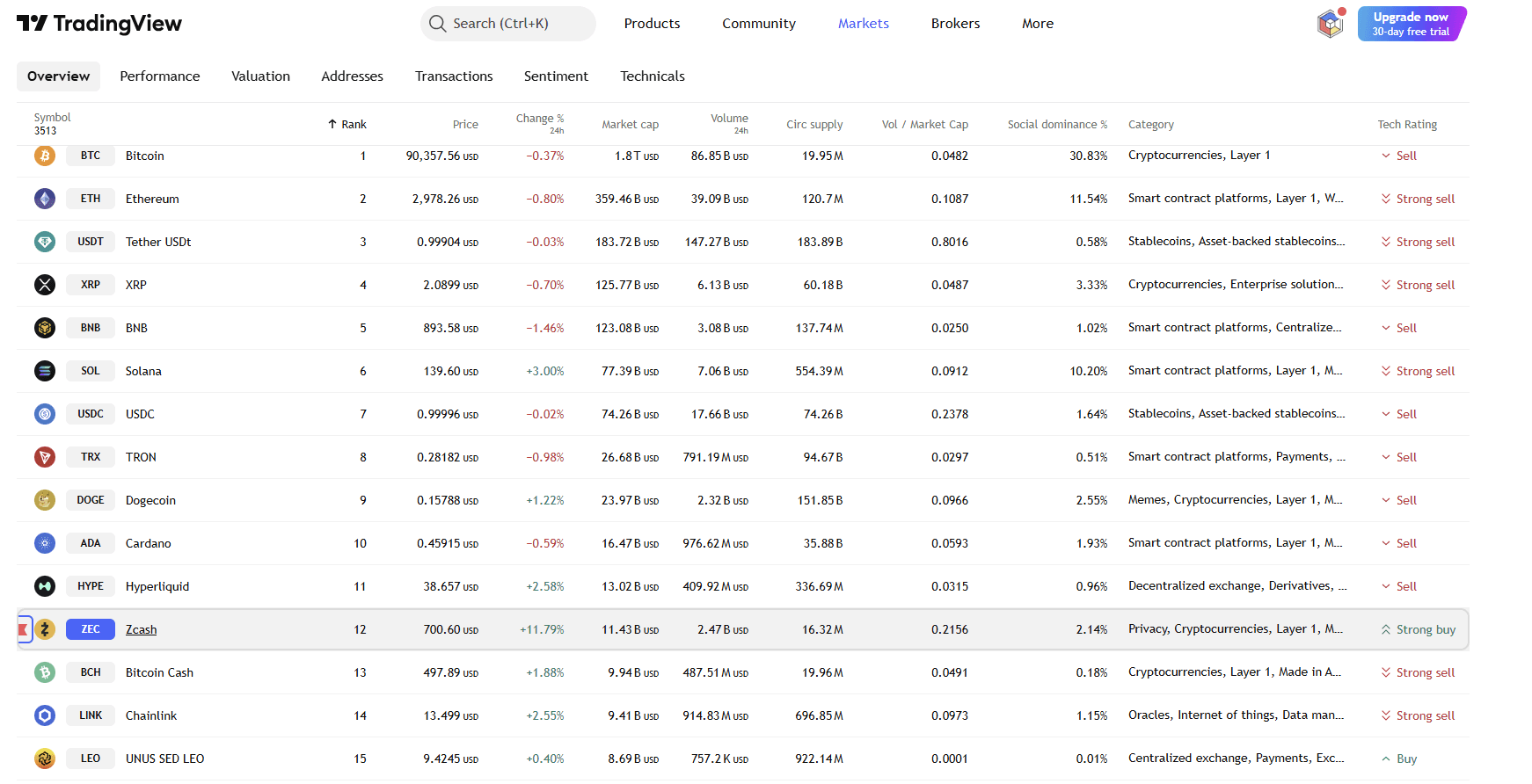

Should You Buy ZEC During the Market Crash? Here’s What’s Really Happening