Grayscale Investments’ LINK Holdings Hit a New High in November Despite Price Declines

Chainlink’s on-chain strength and renewed institutional interest position LINK for a potential rebound. Declining exchange supply and ETF momentum reinforce the recovery case.

Chainlink (LINK) continued to feel the impact of negative market sentiment in November. The selling pressure pushed its price down 50% from last quarter’s peak. However, Grayscale and several analysts still maintain a bullish outlook.

The three-month decline has also driven LINK back to the most important support level of the past two years. This zone is where traders may find new opportunities.

How Much LINK Is Grayscale Holding?

Grayscale – one of the largest investment firms in the digital asset sector – recently released an extremely optimistic research report on the LINK token. The report highlights Chainlink’s role as a foundational infrastructure layer for decentralized finance (DeFi) and asset tokenization.

The report, titled ‘The LINK Between Worlds,’ describes Chainlink as a middleware module. It enables on-chain applications to use off-chain data securely. It also allows them to interact across blockchains and meet enterprise-level compliance needs.

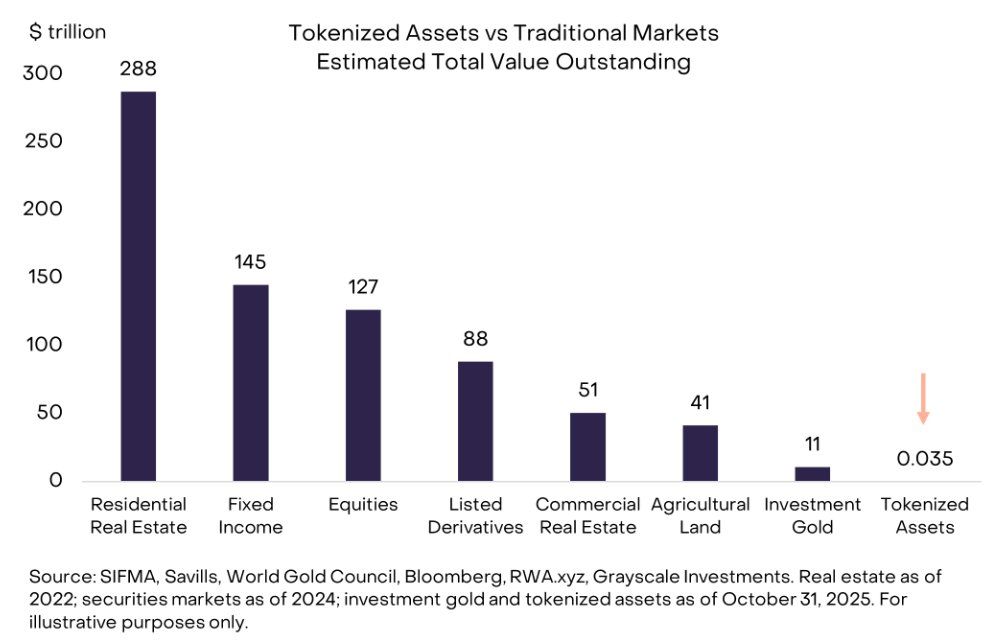

Zach Pandl, Head of Research at Grayscale, noted that tokenized assets remain very small today. They represent only about one basis point (0.01%) of the global equity and bond market capitalization. As a result, the growth potential is enormous.

Tokenized Assets vs. Traditional Markets. Source:

Grayscale.

Tokenized Assets vs. Traditional Markets. Source:

Grayscale.

“Tokenized assets are tiny today: just ~1 basis point (0.01%) of global equity and bond market cap. They will grow enormously over the next decade. In our view there is no project more central to making tokenization a reality than Chainlink,” Zach Pandl said.

The report was released shortly after Grayscale filed an application with the US Securities and Exchange Commission (SEC) for a spot LINK ETF, which would be listed under the ticker GLNK. According to Chainlink’s community liaison Zach Rynes, the application was recently amended and is expected to launch on December 2, 2025.

At the same time, Bitwise’s Chainlink ETF has been listed on the Depository Trust and Clearing Corporation (DTCC) platform under the ticker CLNK.

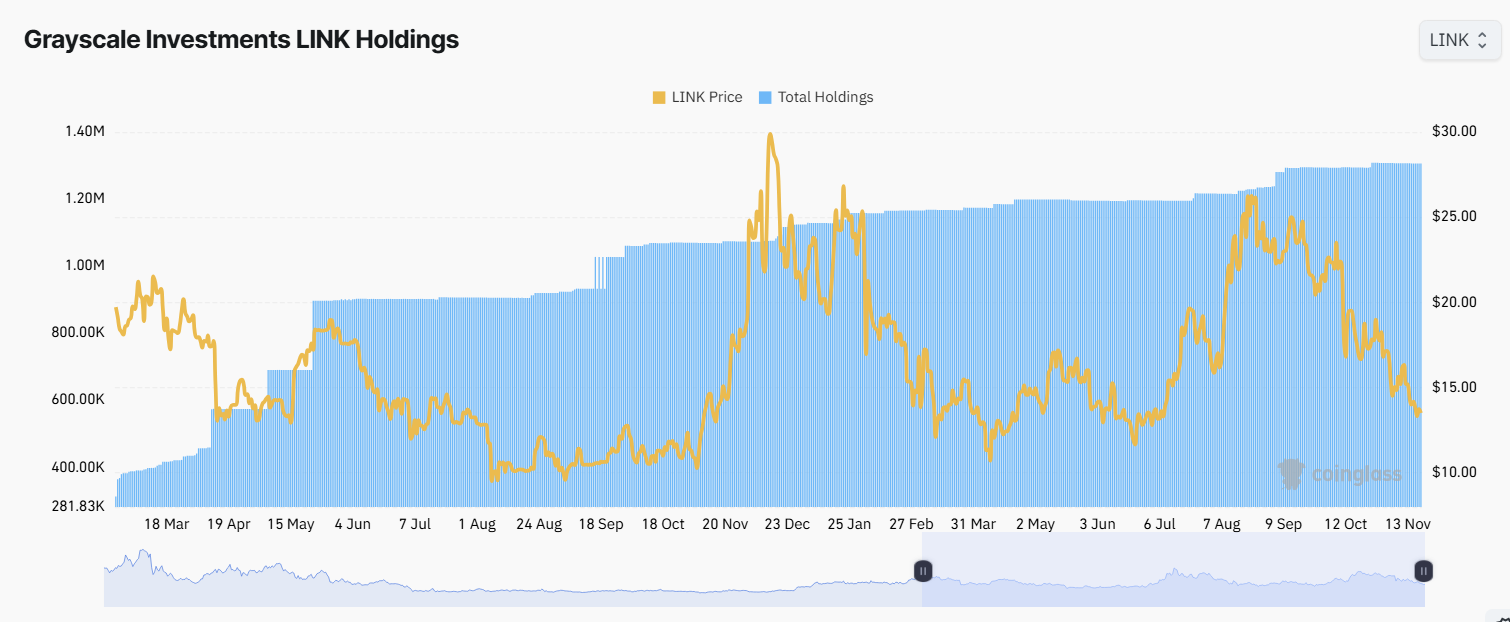

Furthermore, Grayscale Investments’ LINK holdings surpassed 1.3 million tokens in November 2025, according to CoinGlass data. Their holdings have increased more than fourfold over the past two years.

Grayscale Investments LINK Holdings. Source:

Coinglass.

Grayscale Investments LINK Holdings. Source:

Coinglass.

This trend reflects Grayscale’s growing confidence in Chainlink’s long-term potential, particularly as the firm continues to accumulate during periods of lower prices.

Chainlink (LINK) Faces a Recovery Opportunity While Entering Its Best Buying Zone in 2 Years

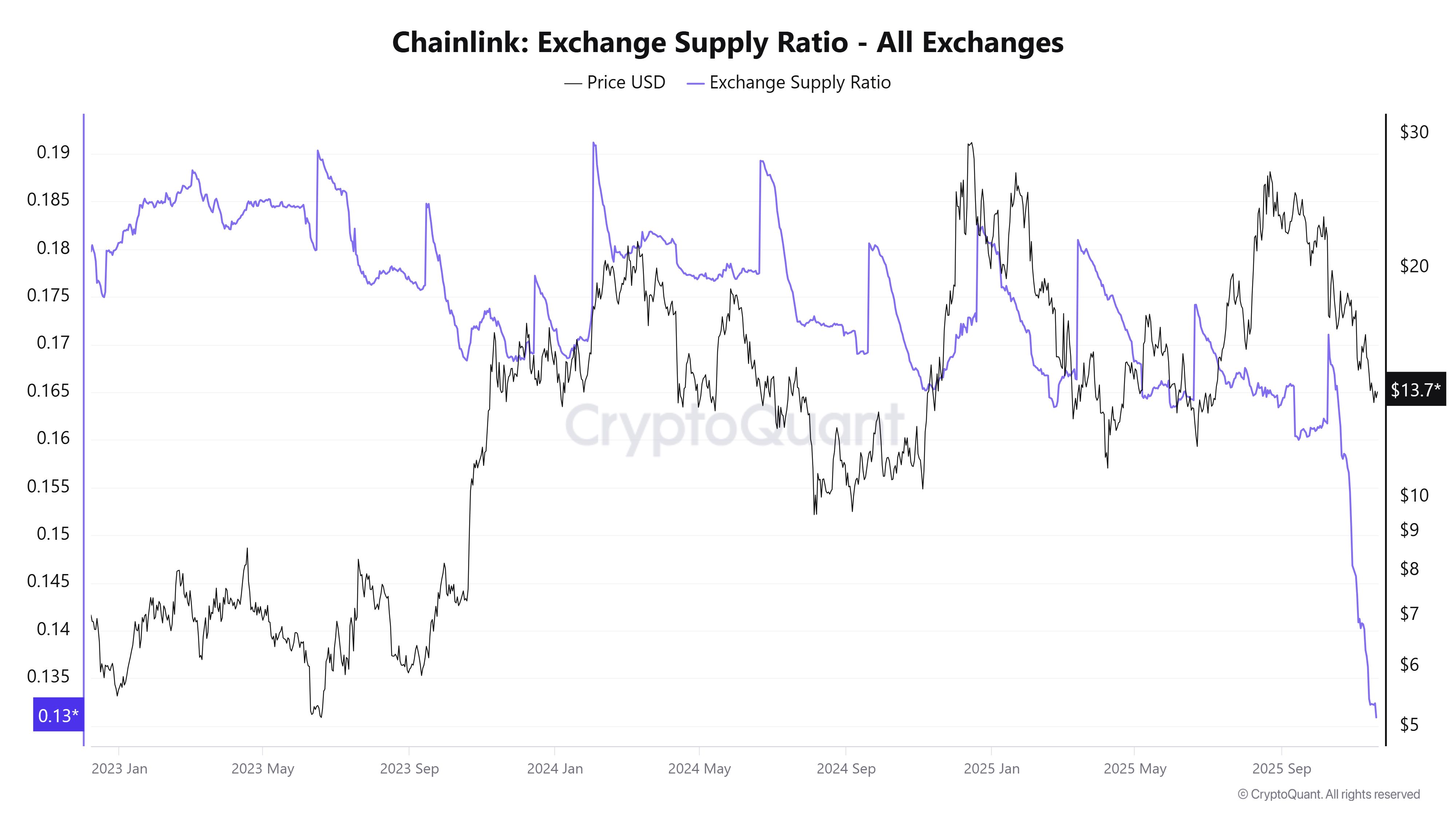

Another key indicator is LINK’s Exchange Supply Ratio, which hit a new low in November. This ratio measures exchange reserves as a percentage of the total supply.

Chainlink Exchange Supply Ratio. Source:

CryptoQuant.

Chainlink Exchange Supply Ratio. Source:

CryptoQuant.

CryptoQuant data shows the supply of LINK on exchanges dropped from 170 million tokens in October to 131 million in November. As a result, the Exchange Supply Ratio fell to its lowest level ever at 0.13.

This signals that fewer LINK tokens are available for trading. It reduces selling pressure, suggesting that investors are withdrawing tokens from exchanges for long-term holding. Such scarcity often precedes a major price rally when demand eventually exceeds supply.

On the technical side, LINK remains inside a large bullish structure and has reached its strongest support level in two years.

Chainlink Price’s Parallel Channel. Source:

CryptoPulse

Chainlink Price’s Parallel Channel. Source:

CryptoPulse

“LINK has been grinding inside a big ascending channel, and price is now right at the bottom of that structure — a spot where it has bounced multiple times before,” analyst CryptoPulse stated.

In summary, with support from Grayscale, upcoming ETFs, record-low exchange supply, and a solid technical position, Chainlink now stands on the edge of a strong recovery.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Senate Crypto Legislation Transfers Oversight to CFTC Amid Rising Partisan Debate

- U.S. Senate proposes bipartisan bill transferring crypto regulation to CFTC, limiting SEC's role and classifying most cryptocurrencies as commodities. - Trump's CFTC nominee Selig faces scrutiny over agency staffing and bipartisan governance, with Democrats warning of political bias risks under single Republican leadership. - Industry supports CFTC's expanded oversight for regulatory clarity, but critics question its capacity to enforce AML standards and manage crypto market growth. - Finalized framework

Ethereum Updates: DATs Offload Ether to Boost Stock Prices, Triggering Market Fluctuations and Investor Concerns

- FG Nexus sold 11,000 ETH to fund a stock buyback, triggering Ethereum's 2% dip and highlighting DAT sector instability. - Crypto treasury firms increasingly liquidate assets to prop up undervalued stocks, with ETHZilla's $40M token sale mirroring this trend. - Ethereum tests $2,850 support as whale accumulation rises, while BlackRock's staked ETH ETF filing offers limited short-term relief. - FG Nexus' $7.7M Q3 loss and rising debt-to-equity ratio underscore risks in its aggressive buyback strategy despi

PEPE’s Downturn: Is This a Bear Market Slide or the Start of Meme Season 2.0?

- Meme coin PEPE plunges 70% to $0.00000485, sparking debate over further decline or short-term rebound amid broken support levels and bearish technical indicators. - Analysts highlight critical resistance at $0.0000059, weak momentum (negative MACD), and liquidity risks toward $0.00000178, while on-chain data shows $193.5M futures open interest and negative spot netflows. - Optimists cite potential 12-15% bounce to $0.00000524-$0.0000066 from bullish RSI crossovers and short-squeeze risks, alongside commu

Tether’s Gold Rally Obscures the Line Between State and Private Market Influence

- Tether's gold reserves hit 116 tons, making it the largest non-sovereign bullion holder, with 12 tons backing XAUt and 104 tons supporting USDT. - The 26-ton Q3 surge accounts for 2% of global demand, tightening supply and driving gold prices to record highs amid geopolitical risks. - Tether's $300M+ investments in gold firms and hiring of HSBC traders signal deeper market integration, contrasting with mixed central bank trends. - Analysts project continued supply tightening as Tether reinvests profits,