Bitcoin News Update: Whale's $28.7 Million Profit Highlights Leverage Issues in Crypto

- A crypto whale earned $28.7M via a 20x leveraged short as Bitcoin fell 29% from $126K to $90K. - Market turmoil saw $2.9B ETF outflows and $19B in liquidations during October's "black Friday" volatility. - Leveraged trading amplified Bitcoin's decline, erasing $1.2T in value through cascading margin calls. - Institutional leverage via derivatives and $74B in crypto loans deepened systemic risks during the selloff. - Analysts warn of ongoing liquidation risks as Bitcoin nears $91K with whale selling inten

A major investor recently placed a substantial short bet on

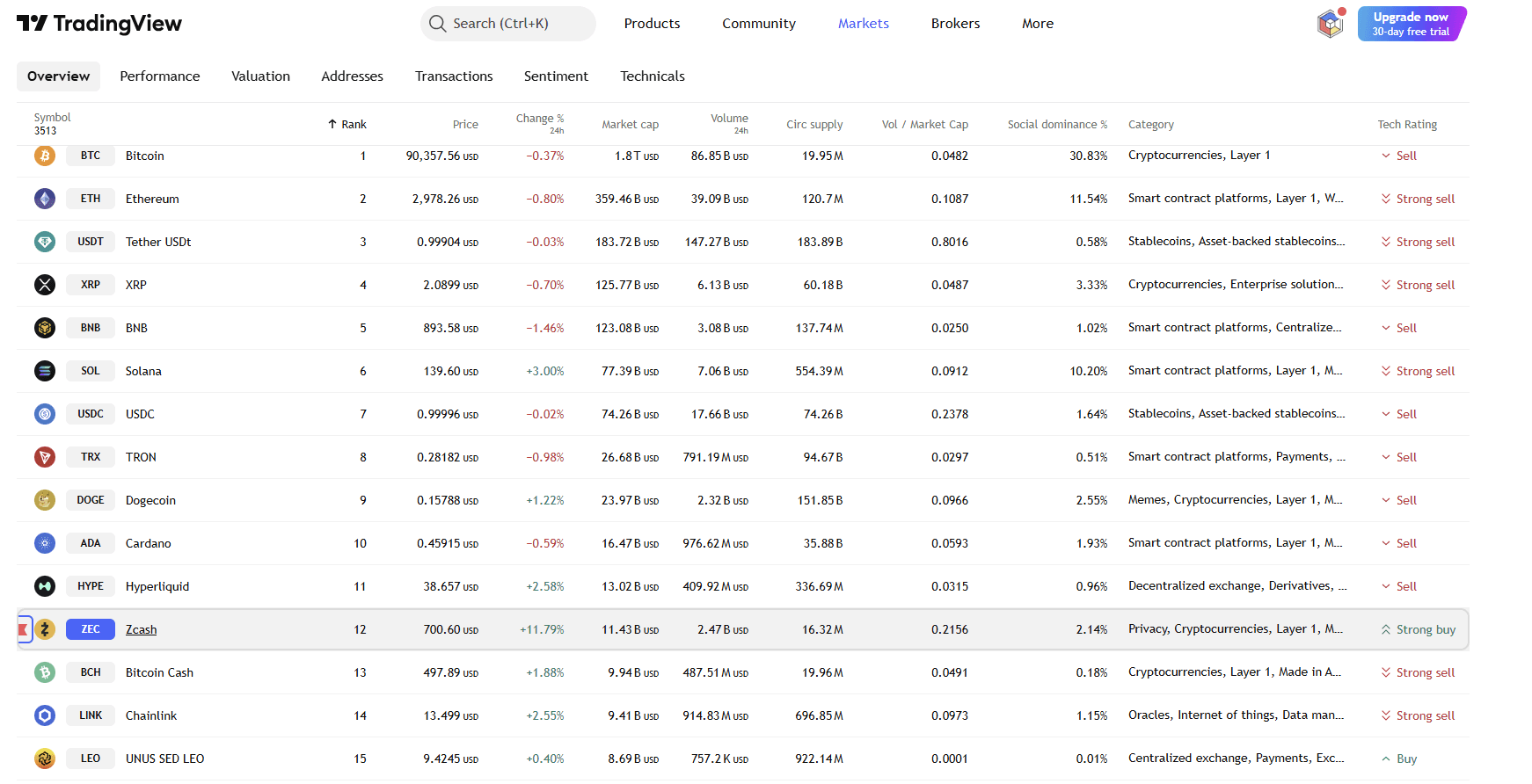

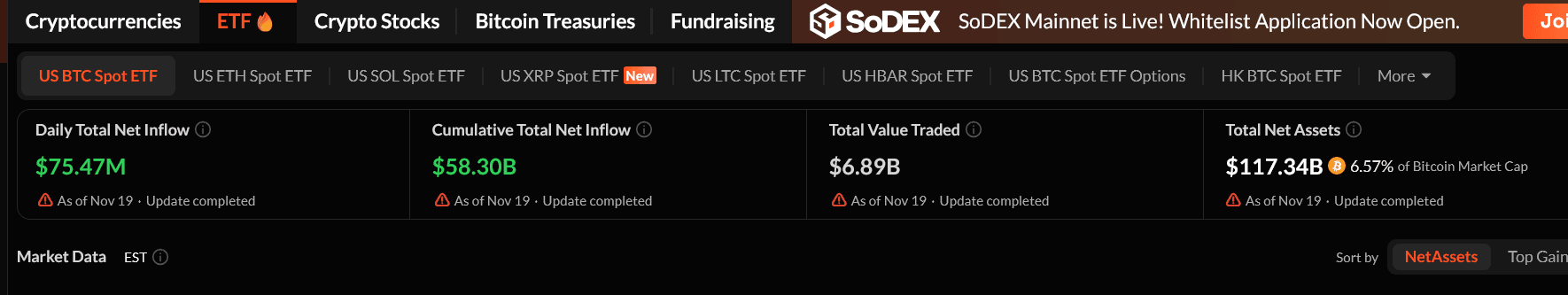

Recent volatility in Bitcoin has been fueled by a mix of global economic challenges and the effects of leveraged trading. In the past month, investors worldwide have withdrawn $2.9 billion from cryptocurrency ETFs, marking the largest recorded outflows. The leading crypto ETF, iShares Bitcoin Trust, saw $1.2 billion leave in just the first 17 days of November. This wave of withdrawals has paralleled a broader Bitcoin selloff, which

The downturn has been intensified by leveraged trades and forced liquidations. On October 10, a so-called "black Friday" for crypto markets resulted in over $19 billion being liquidated after the Federal Reserve’s unclear position on rate cuts unsettled investors. The prevalence of high-leverage trades—ranging from 20x to 100x—has made the market extremely reactive to price changes. For example, one trader

Institutional leverage has made the situation even more severe. Trading venues such as

The relationship between leveraged trading and systemic risk is also apparent in crypto-related stocks. Firms like Strategy (previously MicroStrategy) and BitMine Immersion Technologies have fared worse than Bitcoin’s 13% monthly drop, reflecting their exposure to leverage through treasury assets.

Analysts warn that leveraged positions are especially vulnerable in markets with limited liquidity. With Bitcoin trading near $91,000, the threat of additional liquidations remains unless there is a broader improvement in economic conditions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CFTC’s Expanded Crypto Responsibilities Challenge Regulatory Preparedness and Cross-Party Cooperation

- Senate Agriculture Committee confirmed Trump's CFTC nominee Michael Selig along party lines, advancing his nomination for final Senate approval. - Selig, an SEC crypto advisor, would expand CFTC's oversight of crypto spot markets under the CLARITY Act, positioning it as a key digital asset regulator. - Democrats raised concerns about CFTC's limited resources (543 staff vs. SEC's 4,200) and potential single-party control after current chair's expected resignation. - Selig emphasized "clear rules" for cryp

Bitcoin Updates: Bitcoin Approaches Crucial Support Level Amid Heightened Fear, Indicating Possible Recovery

- Bitcoin fell to a seven-month low near $87,300, testing key support levels amid heavy selling pressure and extreme bearish sentiment. - Analysts highlight a "max pain" zone between $84,000-$73,000, with historical patterns suggesting rebounds after fear indices hit annual lows. - The Crypto Fear & Greed Index at 15—a level preceding past rebounds—aligns with historical 10-33% post-dip recovery trends. - A 26.7% correction triggered $914M in liquidations, but a 2% rebound to $92,621 shows resilience amid

Bitcoin ETFs Are Back: Did the Crash Just End?

Should You Buy ZEC During the Market Crash? Here’s What’s Really Happening