Bitcoin News Today: "Crypto ETFs See $3 Billion Outflow While Energy Storage Surges in Contrasting Markets"

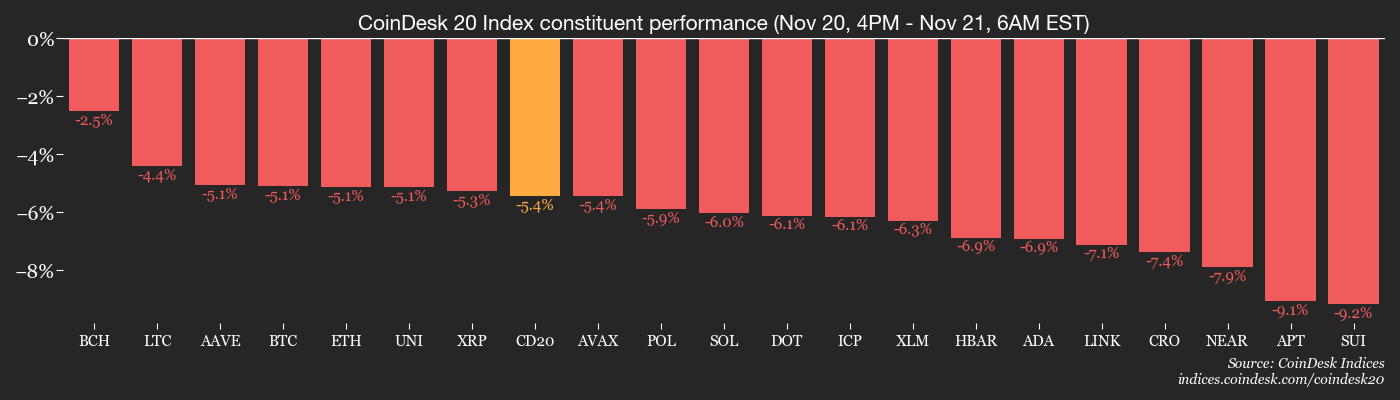

- U.S. Bitcoin ETFs lost $903M in net outflows on Nov 20, with IBIT and GBTC leading the exodus. - Ethereum ETFs faced $262M in eight-day outflows as institutional investors locked in year-end profits. - Bitcoin dropped 9% to $83,884 amid technical breakdowns and miner economics, despite major holders continuing accumulation. - Smaller crypto ETFs like Solana and XRP saw inflows, contrasting with Canadian Solar's $1.858G storage contract and 167.7% stock surge. - Divergent market trends highlight crypto vo

U.S.

This wave of selling mirrors broader market instability, with U.S. bitcoin ETFs shedding close to $3 billion in net outflows so far this month. Experts point to institutional investors cashing in profits before the year ends, a strategy described by Luno’s research team as “risk-off positioning.” “Major market participants are securing gains,” stated Przemysław Kral, CEO of European crypto exchange zondacrypto,

Bitcoin’s value dropped by more than 9% within a day, trading at $83,884 at the time of writing, influenced by institutional withdrawals, miner profitability, and technical setbacks. Kral

On the other hand, smaller crypto ETFs attracted new investments.

Elsewhere, Canadian Solar Inc. (CSIQ) revealed a major expansion in its energy storage business, securing a 1,858 MWh contract in Canada. This development is part of the company’s larger project pipeline, which includes 5,600 megawatt-peak solar initiatives and 24,332 MWh of battery storage across North America. Rivals such as SolarEdge Technologies and Enphase Energy are also ramping up their storage capabilities, with SolarEdge

Canadian Solar’s share price has soared 167.7% in the last six months, far outpacing the industry’s 33.9% rise. The company holds a Zacks Rank 2 (Buy) and is forecasted to achieve 25.4% revenue growth in 2025.

The contrasting patterns in ETF fund flows and energy storage investments underscore the market’s complexity. While cryptocurrency investors contend with volatility and profit-taking, the renewable energy sector continues to draw investment as global decarbonization efforts accelerate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Snipers Made $1.3M on Jesse Pollak’s Creator-Coin Debut on Base

Indonesia Detains Hacker Tied to Markets.com Crypto Theft After $398K Loss

CryptoQuant CEO Ki Young Ju Disputes Michael Saylor's Claims That He Will Sell Bitcoin! Here Are the Details

The Canary in the Coalmine: Crypto Daybook Americas