Adherence to regulations and rapid transaction speeds are driving the widespread adoption of cryptocurrency in mainstream business.

- OwlTing Group's "Invisible Rails" strategy enables rapid deployment of compliant crypto gateways via global licensing across Asia and Latin America. - Opera's MiniPay expands Latin American reach by integrating USD₮ stablecoins with local payment systems like PIX and Mercado Pago. - Grayscale rebrands XRP Trust as GXRP ETF, reflecting growing institutional demand for regulated crypto exposure in global markets. - Industry analysis highlights blockchain's convergence with AI data infrastructure, emphasizi

OxaPay White-Label: Launch Your Own Crypto Gateway in Under 24 Hours

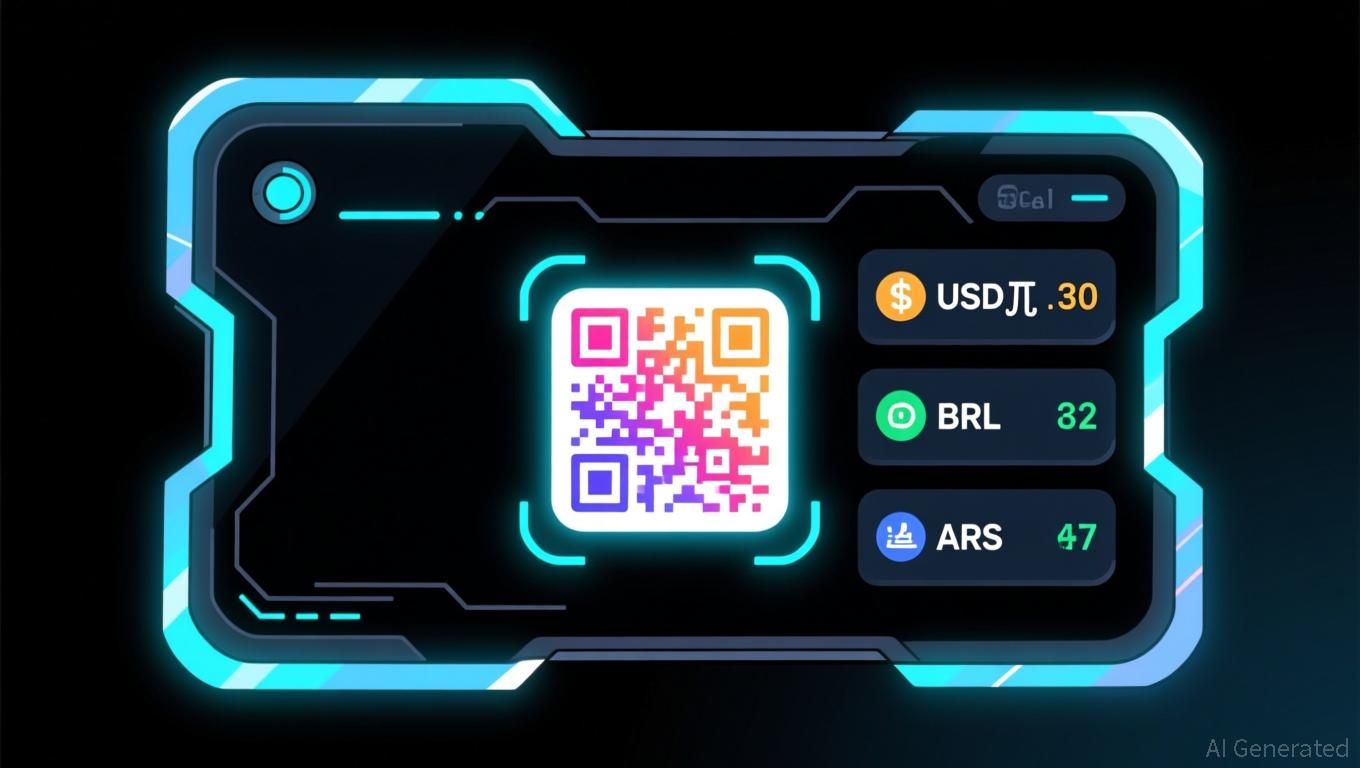

The adoption of custom-branded cryptocurrency gateways is gaining momentum as businesses implement compliant and scalable platforms to connect digital currencies with everyday transactions. A standout example is OwlTing Group's (NASDAQ: OWLS) "Invisible Rails" initiative, which

This surge mirrors larger trends in the $209 billion web data infrastructure sector, where companies including Bright Data and Oxylabs are

Darren Wang of OwlTing remarked that "success in this industry will belong to those who excel at navigating regulations, not those who ignore them," a view shared by MiniPay’s Murray Spark, who

As the industry progresses, the relationship between AI-driven data demands, stablecoin integration, and regulatory oversight will shape how crypto becomes part of the global economic landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Institutions Boost ETH Holdings Amid Market Downturn

- Major Ethereum whales and institutions continue accumulating ETH during market dips, with a single whale buying $7.2M worth of ETH amid broader price declines. - BlackRock injects $199.73M ETH into Coinbase , while Bitmine adds $72.52M ETH, signaling institutional confidence in crypto markets. - On-chain data reveals diversified whale strategies, including leveraged ETH longs, HYPE token staking, and AAVE token accumulation with $3M liquidity. - Binance's $215M ETH transfer to an unknown wallet and Ether

Brazil’s Crypto Clampdown: Battling Tax Dodging or Driving a Decentralized Migration?

- Brazil's tax agency mandates foreign crypto exchanges and DeFi platforms to disclose user transactions under 2026 rules aligned with OECD's CARF framework. - New requirements target R$35,000+ monthly crypto activities, including stablecoin transfers, to combat $30B annual tax losses from unregulated digital asset flows. - Critics warn rules may drive users to untraceable decentralized platforms while political debates emerge over crypto tax exemptions for long-term holders. - Brazil will share crypto tra

SHIB's Indifference Compared to MUTM's Rise: Is This DeFi's Upcoming Major Opportunity?

- Shiba Inu (SHIB) faces bearish technical signals with price near critical support at $0.00000837, risking a drop to $0.00000678 if broken. - Mutuum Finance (MUTM) surges 250% in presale, raising $18.7M with a dual P2C/P2P DeFi model and utility-driven tokenomics. - MUTM's $0.035-to-$0.04 price jump and Sepolia Testnet launch aim to create immediate liquidity, contrasting SHIB's stagnant volume and "apathy phase." - Analysts highlight MUTM's stablecoin minting, buy-back mechanisms, and 12K+ engaged follow

Bitcoin Latest Updates: ETF Arbitrage Tactics Heighten the Danger of Bitcoin Price Drops

- U.S. crypto markets face crash risks as major Bitcoin ETFs like IBIT and FBTC record $3.79B in November outflows, driven by profit-taking after October's rally. - Experts warn of 50%+ price corrections to flush out inexperienced investors buying ETFs/DATs, with leveraged positions and arbitrage trades amplifying downward pressure. - Bitcoin fell below $83,400 as ETF holders' average cost basis exceeds current prices, while arbitrage strategies involving futures shorting risk mechanically lowering prices.