Growing Popularity of Momentum (MMT) and What It Means for Individual Investors

- Momentum (MMT) surged 1,300% in 2025 due to Binance listing, futures contracts, and institutional backing like 1607 Capital's increased holdings. - MMT's utility includes governance rights via veMMT, liquidity rewards, and buyback programs, though volatility and liquidity fragmentation persist. - Q3 2025 data showed $12B DEX volume and $265M TVL, but extreme price swings and macroeconomic uncertainty highlight speculative risks for retail investors. - Institutional capital increasingly favors Bitcoin/Eth

Market Sentiment: Structural Drivers Versus Retail Speculation

In contrast to assets that typically surge due to social media buzz or influencer promotion, MMT’s dramatic 1,300% price increase in November 2025 was largely propelled by underlying structural developments. The token’s debut on Binance, along with the launch of MMT/USDT and MMT/USDC futures contracts and margin trading, greatly improved liquidity and attracted institutional players. For example,

Although retail sentiment was not the main catalyst, it was shaped by broader economic uncertainty.

Token Functionality: Governance, Incentives, and Long-Term Value

Within the Momentum ecosystem, MMT serves multiple purposes, functioning as both a governance and utility token under a vote-escrow (veMMT) framework. By locking up MMT, holders receive veMMT, which

A key aspect of MMT’s utility is its buyback initiative, which uses protocol-generated revenue to repurchase tokens and distribute them to veMMT holders. This approach

Momentum’s future plans involve expanding beyond DeFi, including launching a perpetual derivatives exchange on

On-Chain Metrics: Trading Activity, Liquidity, and Ecosystem Expansion

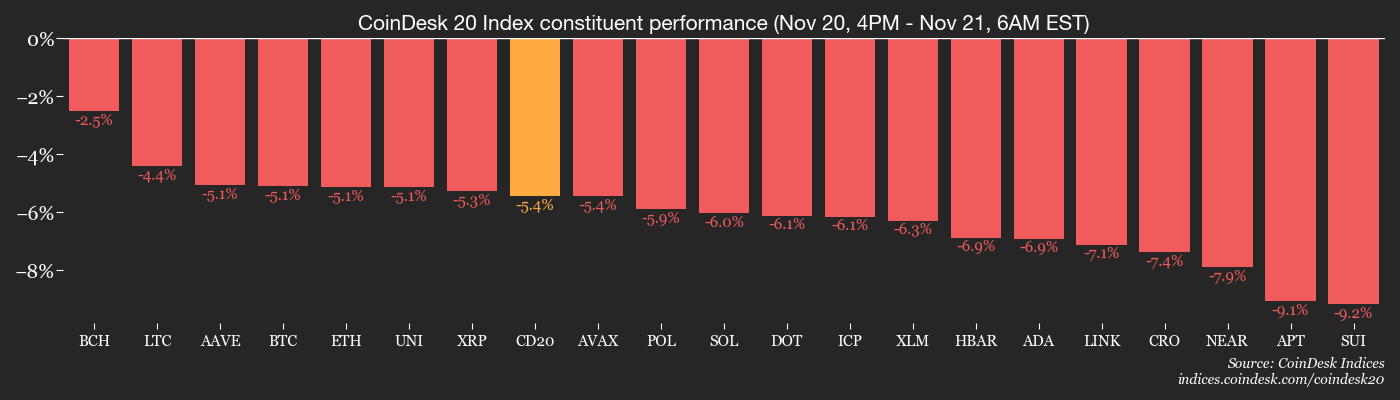

Wider market patterns also illustrate MMT’s place in a changing environment.

What Retail Investors Should Consider: Weighing Potential and Risk

For individual investors, MMT offers both promise and peril. On the positive side, structural drivers like its Binance listing and institutional support provide liquidity and growth prospects. Conversely, its price instability and dependence on clear macroeconomic signals introduce considerable risk.

Additionally, the token’s speculative tendencies are evident in its volatile price movements and

Summary

Momentum (MMT) drew significant attention in late 2025 due to a mix of structural catalysts, token features, and blockchain activity. While institutional support and governance structures offer a base for expansion, the token’s speculative swings and economic uncertainties require careful consideration. Retail investors should approach MMT with a thorough understanding of its risks, especially in a market where liquidity and macroeconomic visibility are crucial for long-term success.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Snipers Made $1.3M on Jesse Pollak’s Creator-Coin Debut on Base

Indonesia Detains Hacker Tied to Markets.com Crypto Theft After $398K Loss

CryptoQuant CEO Ki Young Ju Disputes Michael Saylor's Claims That He Will Sell Bitcoin! Here Are the Details

The Canary in the Coalmine: Crypto Daybook Americas