Bitcoin News Update: Aave's ETHLend 2.0 Disrupts DeFi's Dependence on Wrapped Tokens by Introducing Native Bitcoin

- Aave founder Stani Kulechov announced ETHLend 2.0's 2026 relaunch using native Bitcoin as collateral, diverging from wrapped tokens. - The hybrid P2P-liquidity pool model aims to enhance DeFi efficiency while reducing synthetic asset reliance through cross-chain BTC integration. - This revival aligns with growing institutional demand for non-wrapped BTC and could restore utility for the legacy LEND token. - Despite bearish market conditions, the move signals confidence in Bitcoin's foundational role for

Stani Kulechov, the founder of Aave, has announced that ETHLend—the project’s original peer-to-peer lending platform—will be revived in 2026 with a major update:

ETHLend, which became known as

The DeFi sector has responded with both nostalgia and intrigue. Old screenshots of ETHLend’s 2018 interface have resurfaced on social media, showcasing the project’s journey from a small-scale P2P initiative to a major DeFi ecosystem.

Although the focus is on ETHLend’s return, the overall crypto market remains in a downturn.

This revival highlights Aave’s intention to move beyond just liquidity pools and broaden its product lineup. While it’s still uncertain whether ETHLend 2.0 will be a standalone platform or integrated with Aave, the renewed focus on P2P lending suggests it will complement Aave’s current offerings. This could appeal to users who prefer direct counterparty relationships, a need not fully met by automated market makers.

As DeFi continues to develop, bringing back ETHLend with native Bitcoin support puts Aave in a strong position to attract both long-time users and new institutional participants. With 2026 approaching, the industry will be watching closely to see how this hybrid approach balances fresh innovation with the efficiency that made Aave a leader in the space.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Bitcoin Declines While Altcoins Show Strength: Different Trends Suggest Market Recovery

- Bitcoin's prolonged slump below $90,000 contrasts with altcoin resilience as ETF outflows and fading Fed rate-cut hopes drive market correction. - On-chain data shows retail capitulation and subdued whale activity, historically signaling potential rebounds amid oversold technical indicators. - Institutional adoption and tokenized assets sustain long-term crypto optimism despite short-term volatility and unrealized losses in digital treasuries. - Diverging investor behavior highlights altcoin utility-driv

KITE's Price Movement After Listing and Institutional Perspectives: Managing Immediate Fluctuations and Sustained Worth in AI-Powered Real Estate

- KITE's post-IPO volatility reflects retail sector fragility and AI-driven industrial real estate opportunities amid macroeconomic headwinds. - Q3 2025 earnings missed forecasts (-$0.07 EPS, $205M revenue) as rate cuts and OBBBA fiscal impacts amplified REIT sensitivity to market shocks. - Strategic divestments of noncore retail assets and 7.4% dividend growth signal portfolio optimization, though opaque institutional ownership complicates sentiment analysis. - Industrial real estate's AI-powered logistic

The MMT Token TGE: A Fresh Driving Force in the Web3 Investment Arena

- MMT Token's 2025 TGE launched a hybrid tokenomics model combining liquidity provision and RWA integration, sparking Web3 debate. - Binance listing and airdrop drove 3,880% initial surge but 86.6% 48-hour crash, exposing volatility risks and $114M liquidations. - Tokenomics allocates 42.72% to community, 24.78% to investors, with 80% supply locked until 2026, yet early unlocks triggered $24. 3M sell-offs. - Institutional adoption grew 84.7% post-CLARITY/MiCA 2.0, but 34.6% weekly price drop highlights fra

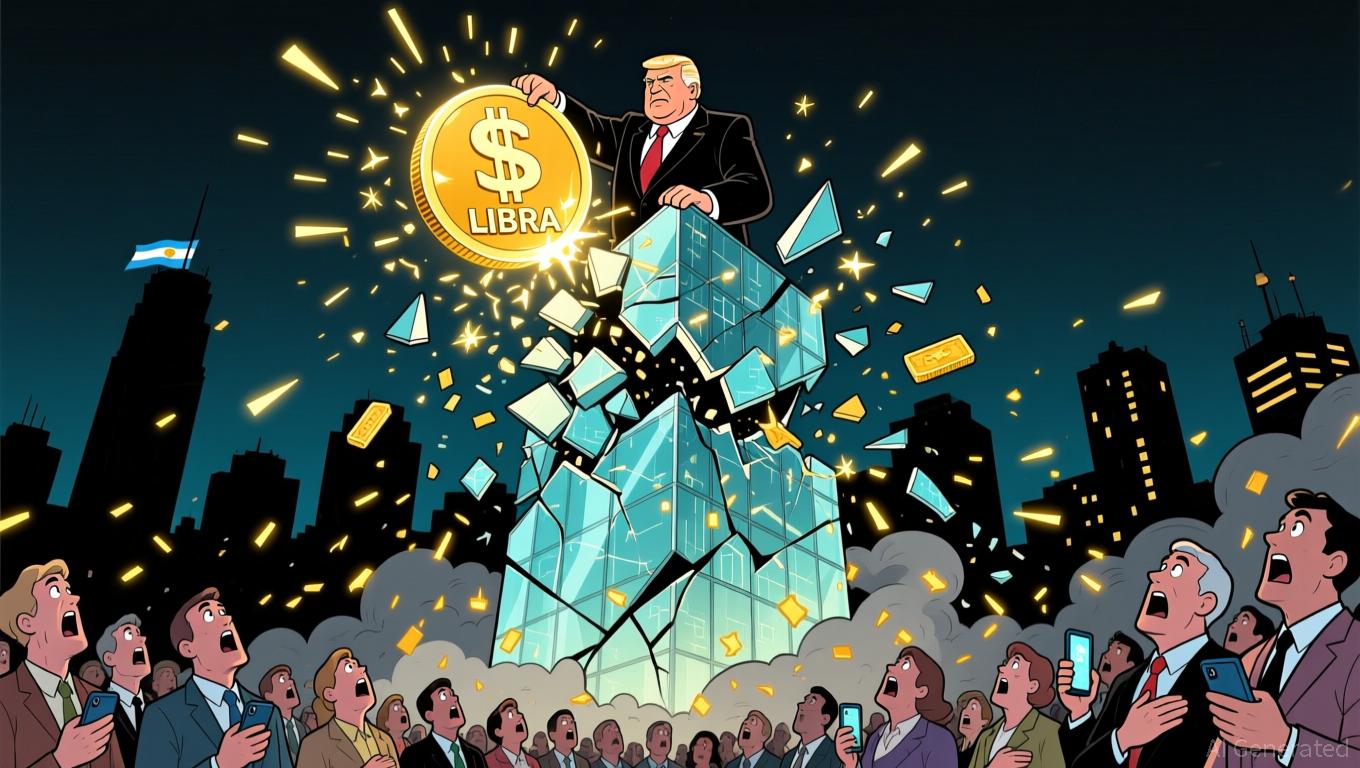

Milei's $LIBRA Endorsement Reportedly Led to $100M Cryptocurrency Crash, Investigation Suggested

- Argentine President Javier Milei faces investigation for promoting $LIBRA, a collapsed crypto linked to $100M+ investor losses. - Congressional report claims his endorsement boosted the token's visibility, enabling a "rug pull" and draining liquidity pools. - The probe also ties Milei to prior crypto projects and corruption allegations involving his sister at the National Disability Agency. - Legal actions freeze assets of $LIBRA organizers, while political challenges persist amid a new Congress dominate