Bitcoin News Today: Bitcoin Approaches $80K Threshold: $2B in Long Positions at Risk of Liquidity Chain Reaction

- Bitcoin nears $80,000 support level with $2B in leveraged longs at risk of liquidation amid 30% price drop since October highs. - ETF outflows accelerate as BlackRock's IBIT records $523M single-day redemption, with total crypto ETF assets falling 28% to $122.29B. - Technical indicators show bearish "death cross" and oversold RSI, while 396,000 traders lost positions in 24 hours as leverage amplifies volatility. - Fed rate-cut odds drop to 46% and geopolitical tensions worsen sentiment, though institutio

The risk of forced liquidations in Bitcoin has sharply increased, with almost $2 billion in leveraged long bets at risk of being wiped out if the cryptocurrency dips below $80,000,

The recent downturn has been intensified by significant withdrawals from

Technical signals are painting a bleak outlook. Bitcoin has struggled to maintain levels above $91,000, and a “death cross” has emerged as the 50-day exponential moving average (EMA) dropped below the 200-day EMA—a pattern often seen as bearish. The Relative Strength Index (RSI) has slipped into oversold territory, indicating growing downward pressure. Experts caution that falling below $80,000 could set off a wave of forced liquidations,

Broader economic factors are also dampening market sentiment. The probability of a Federal Reserve rate cut in December has plunged to 46%, down from 93.7% at the start of October, dashing hopes for a market rebound. Institutional players, often called “smart money,” have increased their short positions by $5.7 million in the last 24 hours, signaling expectations of further declines. Heightened geopolitical tensions, such as the escalating conflict in Eastern Europe, have also contributed to risk aversion, with

Despite the current volatility, some market observers maintain that Bitcoin’s long-term outlook remains positive. The scheduled Ethereum Dencun upgrade in early 2026 and ongoing institutional involvement—demonstrated by tokenized funds from UBS and

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

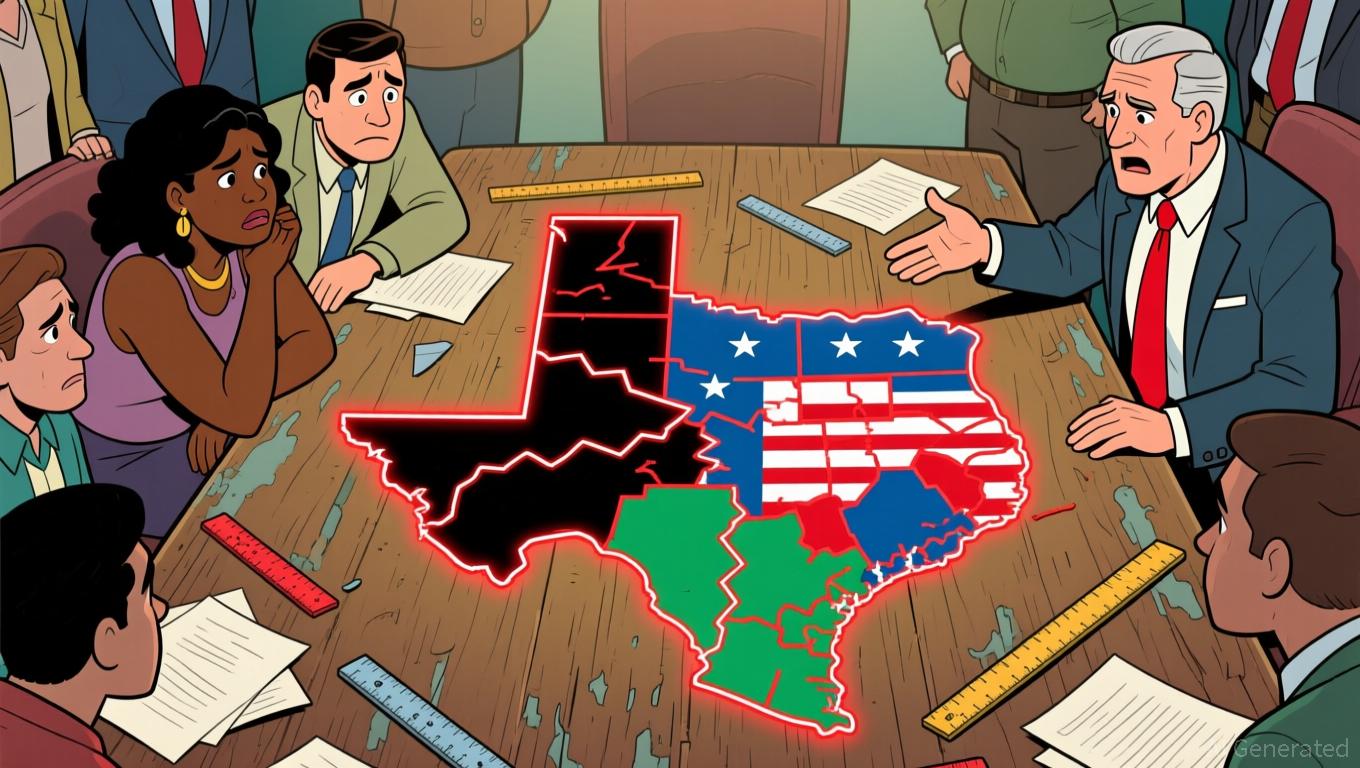

Supreme Court Decision Challenges Party Tactics in Racial Gerrymandering Cases

- Supreme Court Justice Alito blocked a lower court ruling that found Texas' 2026 redistricting plan racially discriminatory, preserving its implementation for the 2026 midterms. - Texas argued the lower court erred by conflating political and racial motivations, citing logistical challenges of changing the map 91 days before the primary. - The case tests boundaries between partisan strategy and racial gerrymandering, with LULAC criticizing the Supreme Court's pause as undermining fair representation for m

XRP News Today: Death Cross Emerges: XRP's Sharp Decline Highlights Broader Crypto Market Fragility

- XRP's price fell below $2.20 on Nov 19, 2025, signaling a "death cross" technical pattern linked to prolonged declines. - The bearish crossover of 50-day and 200-day EMAs suggests intensified selling pressure and potential 55% drop to $1.25. - The decline mirrors weakness in Bitcoin and Ethereum , reflecting systemic crypto market fragility amid macroeconomic and regulatory risks. - Analysts warn of erratic crypto behavior near key levels, emphasizing unpredictable volatility during this bearish phase.

XRP News Today: The Growth of Crypto: Institutional Funding Compared to Market Fluctuations and Risks of Delisting

- Bitwise launches XRP ETF (XRP) to offer institutional exposure to Ripple's blockchain, navigating risks like token depreciation and market volatility. - ARK Invest defies crypto pessimism by injecting $39M into crypto-linked stocks, adjusting its 2030 Bitcoin price target to $1.2M from $1.5M. - Coinbase acquires Solana-based DEX Vector (ninth 2025 deal), aiming to become an "everything exchange" amid surging DEX volume exceeding $1T. - GSR upgrades institutional platform with treasury workflows and marke

Solana News Today: Solana's Emission Reform: Charting a Course for Long-Term Blockchain Economic Stability

- Solana proposes SIMD-0411 to cut $2.9B token emissions over six years, accelerating inflation reduction to 1.5% by 2029. - The "leaky bucket" plan aims to curb supply growth by 3.2% annually, stabilizing market dynamics through scarcity-driven value. - Staking yields may drop from 6.41% to 2.42% by Year 3, risking 47 validators' profitability and forcing industry consolidation. - Institutional adoption surges with $421M in Solana ETF inflows and Coinbase's acquisition of Solana-based DEX Vector. - The ov