The Rapid Rise of ZK (Zero-Knowledge) Assets and Protocols: How Network Enhancements and Institutional Embrace Impact Investments

- ZK protocols saw 2025 seismic growth via network upgrades and institutional adoption, reshaping investment theses for scalable, private blockchain infrastructure. - ZKsync's Atlas Upgrade achieved 43,000 TPS with $0.0001/tx costs, while Polygon and StarkNet secured $1B+ in adoption through EVM compatibility and 90% gas fee reductions. - Deutsche Bank , Walmart , and HSBC adopted ZKP for cross-chain settlements, supply chain transparency, and compliance, accelerating enterprise-grade use cases. - ZKP mark

Network Upgrades: Addressing the Scalability Challenge

The Atlas Upgrade introduced by ZKsync in 2025 demonstrates how ZK protocols are tackling the longstanding blockchain scalability dilemma. With the launch of the Atlas Sequencer and Airbender Prover,

Alongside ZKsync’s achievements, Polygon zkEVM has committed $1 billion to advancing ZKP adoption, using EVM compatibility to facilitate the smooth transition of

Institutional Adoption: Turning Compliance into Opportunity

More institutions are turning to ZK protocols as they seek solutions that offer privacy, scalability, and regulatory alignment. Deutsche Bank has adopted ZKsync for cross-chain settlements, benefiting from its EVM compatibility and lower operational expenses

Protocols focused on privacy, such as Aztec Network and Mina Protocol, are also gaining momentum. Aztec allows institutions to conduct confidential DeFi transactions, and Mina’s compact 22KB blockchain makes it accessible for devices with limited resources

Market Trends and Investment Outlook

The ZKP industry, valued at $1.28 billion in 2024, is forecasted to grow to $7.59 billion by 2033, representing a 22.1% annual growth rate

For those investing in the space, the most promising protocols are those that blend technical excellence with strong enterprise uptake. The Atlas Upgrade by ZKsync, for example, not only enhances scalability but also meets institutional needs for interoperability and cost savings. Likewise, initiatives like Quartz KYC, which uses ZKP to cut compliance times from 10 days to just 3 hours, illustrate the technology’s importance in regulated sectors

Risks and Key Considerations

Despite the positive outlook, investors should proceed carefully. Uncertainty in regulations, especially regarding tokenized assets and cross-chain transactions, could lead to market fluctuations. Furthermore, the fast pace of technological change means that protocols lacking strong technical foundations may lose relevance. Spreading investments across various ZK ecosystems—including EVM-compatible platforms (like ZKsync and Polygon) and privacy-centric networks (such as Aztec and Mina)—can help manage these risks.

Conclusion

The rapid growth in ZK protocols and assets is a response to genuine demand for infrastructure that is scalable, private, and compliant—not just market speculation. As more organizations and businesses implement ZKP-based solutions, investment opportunities will increasingly favor protocols that offer both technical breakthroughs and real-world utility. For investors, the coming 12 to 24 months are a crucial period to take advantage of this shift, provided they focus on projects with demonstrated institutional support and clear upgrade strategies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: VanEck Issues Bitcoin an Ultimatum—Adopt Quantum-Resistant Privacy or Face Withdrawal

- VanEck CEO warns firm may exit Bitcoin if quantum computing threatens its encryption and privacy model. - Privacy coins like Zcash gain traction as alternatives, using zero-knowledge proofs to address Bitcoin's transparency risks. - Quantum-resistant crypto market grows rapidly, with IBM-Cisco quantum internet project and PQC sector projected to reach $2.84B by 2030. - Regulatory shifts and institutional investments in altcoins signal evolving crypto landscape amid security and privacy challenges.

Bitcoin Updates: Stimulus Fails to Curb Crypto Fluctuations; Uncertainty Over Hedging Function

- Japan's $135B stimulus package failed to curb Bitcoin's decline below $85,500 amid heightened market volatility. - Analysts debate crypto's role as an inflation hedge, with Fundstrat's Tom Lee framing it as a leading indicator for U.S. stocks. - Brazilian firm Rental Coins' $370M BTC collapse highlights sector fragility, filing Chapter 15 bankruptcy to recover assets. - Security threats persist in DeFi, with Aerodrome Finance's front-end attack and Coinbase's routine wallet migrations underscoring risks.

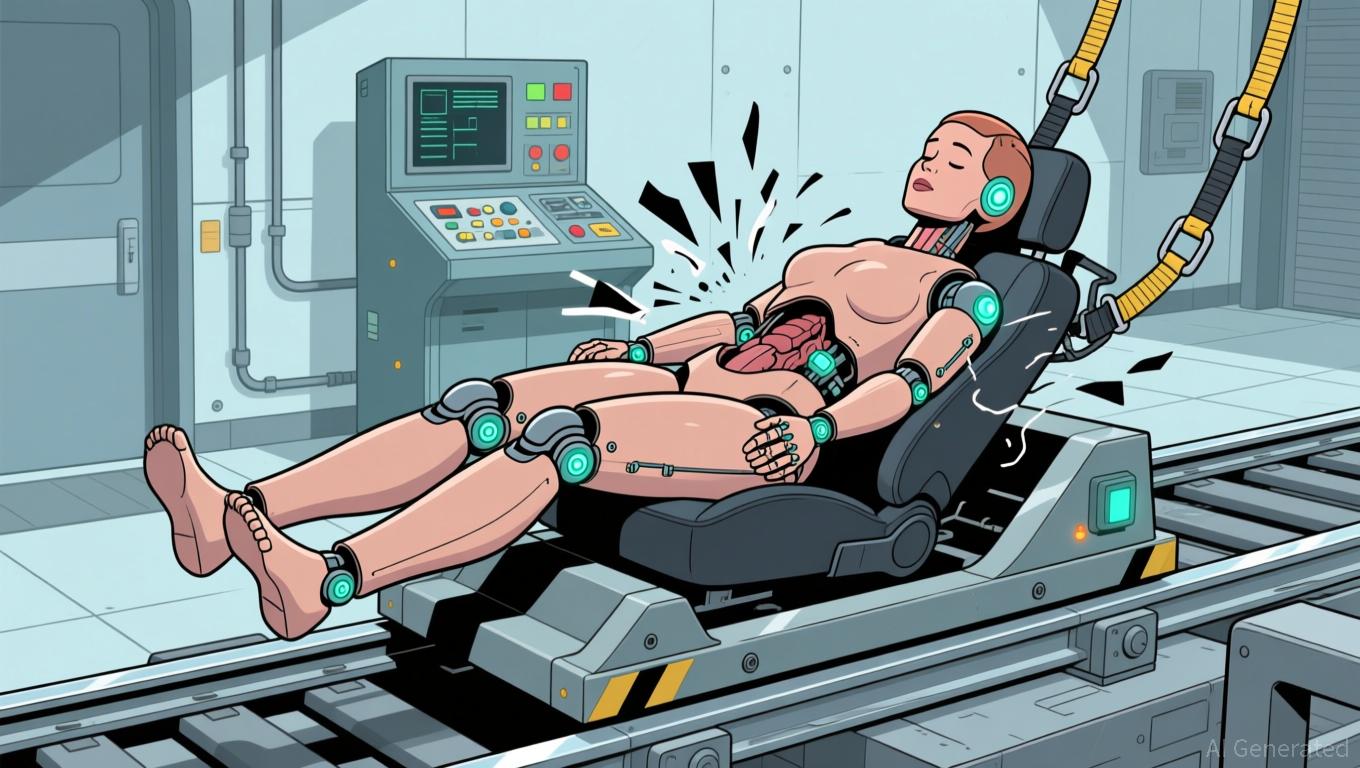

Polkadot News Today: "U.S. Requires Female Crash-Test Dummies to Tackle Longstanding Gender Inequality in Safety Engineering"

- U.S. DOT mandates female crash-test dummies in federal safety testing by 2027-2028 to address gender bias in vehicle design. - THOR-05F, representing average adult women, replaces outdated 1970s models that left women 73% more likely to suffer serious injuries in crashes. - NHTSA emphasizes scientific validation for the 150-sensor dummy, while automakers and IIHS express skepticism about current safety standards. - Advocacy groups praise the move as critical for closing safety gaps, but activists warn de

Assessing the Factors Behind COAI's Significant Price Drop in Late November 2025 and Its Long-Term Impact on Investment

- COAI's 88% year-to-date plunge in late 2025 exposed systemic risks in AI/crypto markets, driven by governance failures, regulatory ambiguity, and overvaluation. - C3.ai's $116.8M loss, leadership turmoil, and lawsuits triggered panic, while the CLARITY Act's vague oversight deepened institutional investor caution. - The selloff highlighted a stark divide between foundational AI tech and speculative crypto assets, with analysts warning against conflating sector-wide risks with isolated failures. - Long-te