Solo Bitcoin Miner Nets $266K in Rare Bitcoin Block Victory

A rare win captured attention in Bitcoin mining on Friday space when a solo miner managed to solve block 924,569 using only a small fraction of the computing power usually required. In a space dominated by massive operations, this achievement stands out as an interesting feat.

In Brief

- A solo miner earned 3.146 BTC, worth around $266,000, by successfully mining a Bitcoin block, a rare achievement for an individual miner.

- The payout included 3.125 BTC from the block reward and 0.021 BTC from transaction fees collected in the block.

Solo Miner Defies the Odds

Blockchain data provider Mempool Space reports that the miner received a total of 3.146 BTC, valued at around $266,000. The payout comprised 3.125 BTC from the block subsidy and 0.021 BTC in transaction fees.

What makes this win particularly interesting is the individual’s equipment. Solosatoshi reported that the setup is a hobby-level Bitaxe Gamma, running at around 1.2 terahashes per second. While that is a large number in isolation, it is minuscule compared to large-scale mining operations that work in the exahash range, capable of performing a quintillion hashes per second.

CKpool creator Con Kolivas notes that, based on this hash rate, the odds of such a win are roughly one in 1.2 million on any given day, highlighting the rarity of the event.

Independent Miners Making Their Mark

Despite the dominance of large mining companies, solo miners have scored several significant wins this year. Data from blockchain tracker Mempool Space shows CKpool users have successfully mined 13 solo blocks in 2025 , averaging just over one per month.

- A miner with 2.3 petahashes of computing power claimed a full block reward in July, adding to similar solo wins earlier in the year ;

- Later in October, another solo operator secured block 920,440, taking home $347,455, which included the standard 3.125 BTC reward plus transaction fees.

These occasional successes highlight that individual operators continue to play an important role in the Bitcoin network. By contributing independent computing power, they strengthen decentralization and broaden participation, reducing the concentration of control by large mining operations and supporting a more balanced and secure blockchain system.

Large Mining Firms Diversifying

While small miners continue to achieve occasional wins, large companies are seeking ways to maintain profitability amid changing conditions. The recent halving of block rewards has reduced income from traditional mining, pushing firms to explore alternative revenue streams.

Riot, a major mining company, is evaluating the use of 600 megawatts of power at its Corsicana, Texas, facility for artificial intelligence and other high-performance computing applications.

Similarly, CleanSpark is shifting its operations toward AI-focused data centers. This transition has already been well received by investors, boosting CleanSpark’s stock by 13 % following the announcement last month. These initiatives illustrate a growing trend of mining companies leveraging their computing capacity for purposes beyond Bitcoin mining .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: VanEck Issues Bitcoin an Ultimatum—Adopt Quantum-Resistant Privacy or Face Withdrawal

- VanEck CEO warns firm may exit Bitcoin if quantum computing threatens its encryption and privacy model. - Privacy coins like Zcash gain traction as alternatives, using zero-knowledge proofs to address Bitcoin's transparency risks. - Quantum-resistant crypto market grows rapidly, with IBM-Cisco quantum internet project and PQC sector projected to reach $2.84B by 2030. - Regulatory shifts and institutional investments in altcoins signal evolving crypto landscape amid security and privacy challenges.

Bitcoin Updates: Stimulus Fails to Curb Crypto Fluctuations; Uncertainty Over Hedging Function

- Japan's $135B stimulus package failed to curb Bitcoin's decline below $85,500 amid heightened market volatility. - Analysts debate crypto's role as an inflation hedge, with Fundstrat's Tom Lee framing it as a leading indicator for U.S. stocks. - Brazilian firm Rental Coins' $370M BTC collapse highlights sector fragility, filing Chapter 15 bankruptcy to recover assets. - Security threats persist in DeFi, with Aerodrome Finance's front-end attack and Coinbase's routine wallet migrations underscoring risks.

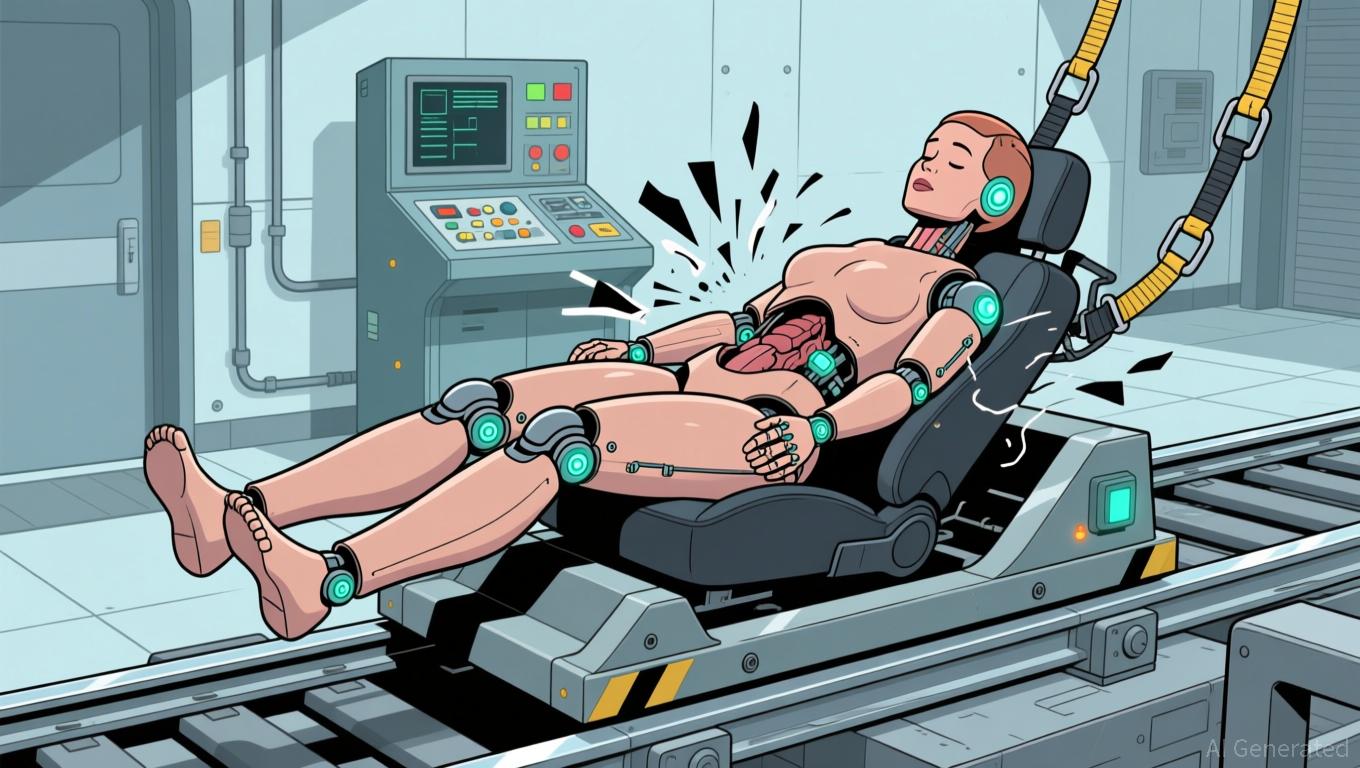

Polkadot News Today: "U.S. Requires Female Crash-Test Dummies to Tackle Longstanding Gender Inequality in Safety Engineering"

- U.S. DOT mandates female crash-test dummies in federal safety testing by 2027-2028 to address gender bias in vehicle design. - THOR-05F, representing average adult women, replaces outdated 1970s models that left women 73% more likely to suffer serious injuries in crashes. - NHTSA emphasizes scientific validation for the 150-sensor dummy, while automakers and IIHS express skepticism about current safety standards. - Advocacy groups praise the move as critical for closing safety gaps, but activists warn de

Assessing the Factors Behind COAI's Significant Price Drop in Late November 2025 and Its Long-Term Impact on Investment

- COAI's 88% year-to-date plunge in late 2025 exposed systemic risks in AI/crypto markets, driven by governance failures, regulatory ambiguity, and overvaluation. - C3.ai's $116.8M loss, leadership turmoil, and lawsuits triggered panic, while the CLARITY Act's vague oversight deepened institutional investor caution. - The selloff highlighted a stark divide between foundational AI tech and speculative crypto assets, with analysts warning against conflating sector-wide risks with isolated failures. - Long-te