DOGE Is Gone: Trump and Musk’s Federal Overhaul Quietly Collapses 8 Months Early

The Department of Government Efficiency (DOGE) has been dissolved, according to the Office of Personnel Management (OPM), despite its mandate being scheduled to continue through July 2026. Despite the news, the meme coin associated with the Elon Musk and Vivek Ramaswamy-led initiative is up by double digits. Trump’s DOGE Project Is Over DOGE began by

The Department of Government Efficiency (DOGE) has been dissolved, according to the Office of Personnel Management (OPM), despite its mandate being scheduled to continue through July 2026.

Despite the news, the meme coin associated with the Elon Musk and Vivek Ramaswamy-led initiative is up by double digits.

Trump’s DOGE Project Is Over

DOGE began by executive order on Trump’s first day following reelection. Its mission was to dramatically streamline bureaucracy and cut $6.5 trillion in federal spending.

The launch sparked immediate attention, driving Dogecoin prices up over 10% on the announcement and leading to expectations of more crypto use in government.

OPM director Scott Kupor confirmed the dissolution, noting that DOGE doesn’t exist as a centralized entity. The department’s roles have shifted into OPM, while Trump now refers to DOGE in the past tense at public events.

Good editing by – spliced my full comments across paragraphs 2/3 to create a grabbing headline 🙂 The truth is: DOGE may not have centralized leadership under . But, the principles of DOGE remain alive and well: de-regulation; eliminating fraud, waste and abuse;…

— Scott Kupor (@skupor) November 23, 2025

The shutdown came eight months before its expected end. Musk left Washington in May. In June, turmoil appeared as staff packed personal items and searched for new homes, while tensions reportedly rose between Trump and Musk.

Despite its aggressive cost-cutting, the department quietly closed its doors.

Vivek Ramaswamy withdrew from the Ohio Senate race to focus on DOGE, but the department faced criticism for a lack of transparency and public accountability throughout its brief existence.

DOGE agents reportedly moved aggressively through agencies, making large personnel cuts and trimming budgets with minimal stakeholder input.

DOGE’s leadership claimed billions in savings, but no concrete, verifiable evidence has shown true cost reductions from these actions. This lack of transparent accounting has left many questioning whether DOGE improved spending efficiency at all.

Until shortly before its closure, DOGE’s official account posted regular updates on contract reductions, highlighting cost-cutting milestones in multiple agencies.

Contracts Update! Over the last 9 days, agencies terminated and descoped 78 wasteful contracts with a ceiling value of $1.9B and savings of $335M, including an $616k HHS IT services contract for “social media monitoring platform subscription”, an $191k USAGM broadcasting…

— Department of Government Efficiency (@DOGE) November 23, 2025

Some former DOGE employees are concerned about possible legal consequences related to their involvement in the department’s aggressive measures.

These concerns reveal persistent questions regarding whether DOGE’s practices crossed legal or ethical lines in its short tenure.

This transition marks a shift from DOGE’s drastic cost-cutting to broader government modernization. Critics have noted that only Congress can officially disband agencies, and DOGE’s scope was always limited to what executive actions could deliver.

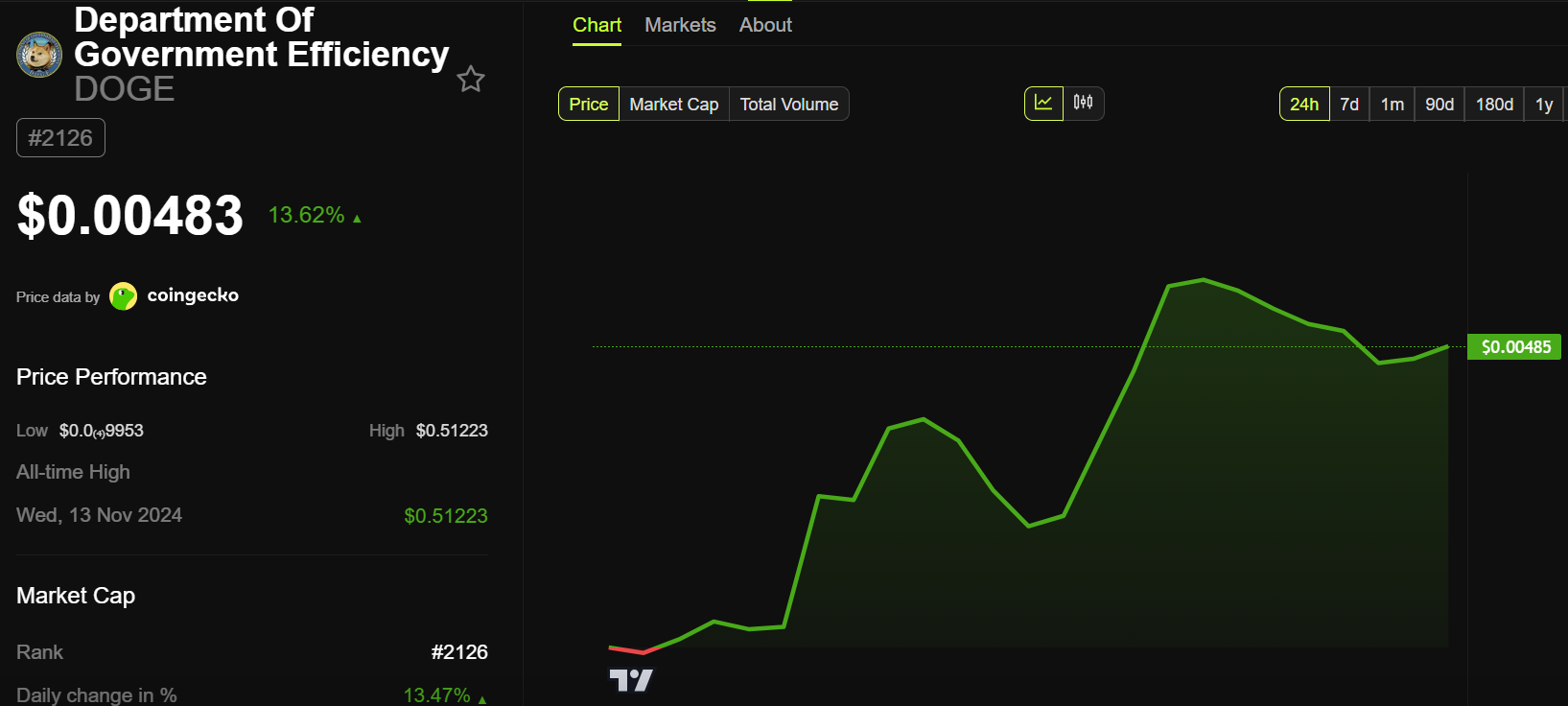

Department of Government Efficiency (DOGE) Price Performance. Source:

Department of Government Efficiency (DOGE) Price Performance. Source:

Meanwhile, the Department Of Government Efficiency cryptocurrency token continues trading. Data on BeInCrypto shows the token’s price sits at $0.00483, up 13.62% in 24 hours.

The dissolution of DOGE raises questions about how sustainable rapid government restructurings can be, and what role executive actions play in structural reform.

As federal operations absorb former DOGE staff and the administration moves on, the real impact of DOGE’s brief experiment remains uncertain and open to further assessment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How CFTC-Recognized Platforms Such as CleanTrade Are Transforming the Landscape of Clean Energy Investments

- CFTC-approved CleanTrade introduces a regulated SEF for clean energy derivatives, addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of vPPAs/RECs, achieving $16B notional volume in two months by aggregating demand/supply. - Integrated risk analytics (e.g., CleanSight) enhance transparency, allowing investors to hedge project-specific risks like grid congestion and curtailment. - Dual investment pathways attract hedge funds/pension funds through direct

The Rise of CFTC-Regulated Clean Energy Markets: Opening a New Chapter for Institutional Investors

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a landmark shift in clean energy markets by introducing standardized, transparent trading for VPPAs and RECs. - The platform attracted $16B in notional value within two months, enabling rapid institutional-grade transactions that previously took months to negotiate. - By addressing liquidity gaps and enabling precise risk modeling, CleanTrade is accelerating capital flows into decarbonization while bridging ESG investment gaps for institutional

The Increasing Overlap Between Health and Financial Wellbeing in Managing Personal Finances

- Global wellness economy to hit $9 trillion by 2028, driven by holistic well-being trends. - Millennials/Gen Z prioritize wellness as lifestyle, with 55% spending over $100/month on health. - Employers integrate financial wellness into health programs to reduce burnout and boost productivity. - Investors target wellness-driven SaaS, healthcare tech , and financial literacy platforms for holistic solutions.

Revealing the Value of Green Gold: The Transformative Impact of Institutional-Grade Platforms on Clean Energy Markets

- Clean energy markets hit $35.42B in 2025 but face VPPA/PPA liquidity gaps as U.S. policy rollbacks raise costs by 11.8% YoY. - REsurety's CleanTrade platform digitizes PPA trading, unlocking $16B in liquidity via CFTC-approved SEF infrastructure within two months. - Strategic S&P Global partnership standardizes PPA/REC valuations, addressing institutional investors' risk management gaps in green energy markets. - While global PPA markets grow at 14.6% CAGR to $9.5B by 2035, U.S. policy uncertainty remain