Bitcoin News Update: Institutional Ban Proposal Triggers Crypto Community Outrage: JPMorgan Faces Scrutiny

- Bitcoin advocates and MicroStrategy supporters launch JPMorgan boycott after MSCI plans to exclude crypto-focused firms from global indices. - Influencers like Grant Cardone withdraw $20M from JPMorgan, while Max Keiser urges "crash JP Morgan" to defend crypto sector stability. - JPMorgan analysts warn MSCI's policy could trigger $8.8B outflows for MicroStrategy, worsening its liquidity crisis amid Bitcoin's 30% decline. - MSCI's January 15 decision risks triggering index fund sell-offs, potentially crea

Bitcoin Community Calls for

The

The potential removal has triggered swift opposition. Cardone, a well-known Bitcoin supporter,

JPMorgan’s involvement in spreading the MSCI update has provoked strong criticism.

The consequences could reach beyond MicroStrategy.

Since joining the Nasdaq 100 in December 2024, MicroStrategy has benefited significantly,

This dispute highlights the ongoing friction between innovation and established norms in the crypto world. As the January 15 deadline nears,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Falls 1.74% as 1-Month Results Remain Subdued

- Algorand (ALGO) dropped 1.74% on Nov 24, 2025, extending its 1-month decline to 20.35% amid sustained bearish sentiment. - The token’s annual price has fallen 57.76% from its peak, driven by macroeconomic volatility and uncertainty over potential interest rate cuts. - No ALGO-specific news or on-chain developments were reported, with price movements linked to broader economic factors and risk appetite shifts. - Analysts warn the bearish trend may persist unless major upgrades emerge, urging investors to

DOGE drops 53.85% over the past year after early dissolution of federal agency

- Trump's DOGE department, aimed at cutting federal spending, was disbanded early, with functions absorbed by OPM. - DOGE's aggressive cost-cutting, including $1.9B in canceled contracts, faced scrutiny over lack of transparency and legal concerns. - The DOGE cryptocurrency token fell 53.85% in a year, while Grayscale launched spot ETFs as the department dissolved. - Former DOGE staff now hold federal roles, but its legacy raises ongoing questions about executive authority in reform efforts.

YFI Value Increases by 1.18% During Market Fluctuations

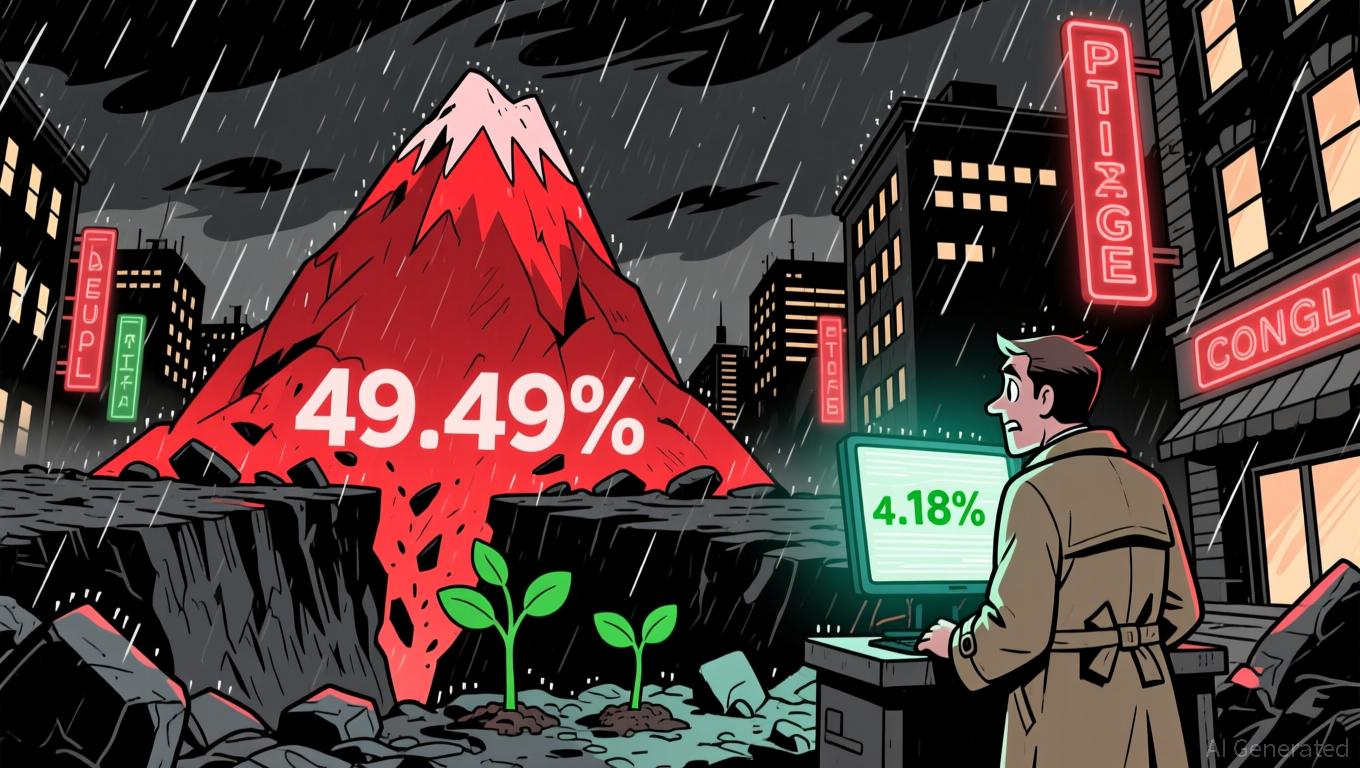

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

Aave News Today: The Two Sides of DeFi: Aave's Expansion Increases Volatility Concerns

- Aave's AAVE token faces volatility risks near 0.57 support level, with whale accumulation and leveraged positions amplifying short-term instability. - A major Aave whale added 24,000 AAVE tokens (total 276,000) at $165 average cost, but remains vulnerable to repeat October 11 liquidation risks. - A $80M WBTC long position on Aave approaches $65,436 liquidation threshold, threatening forced selling and downward price pressure. - Tangem's Aave-integrated stablecoin yield feature highlights protocol's DeFi