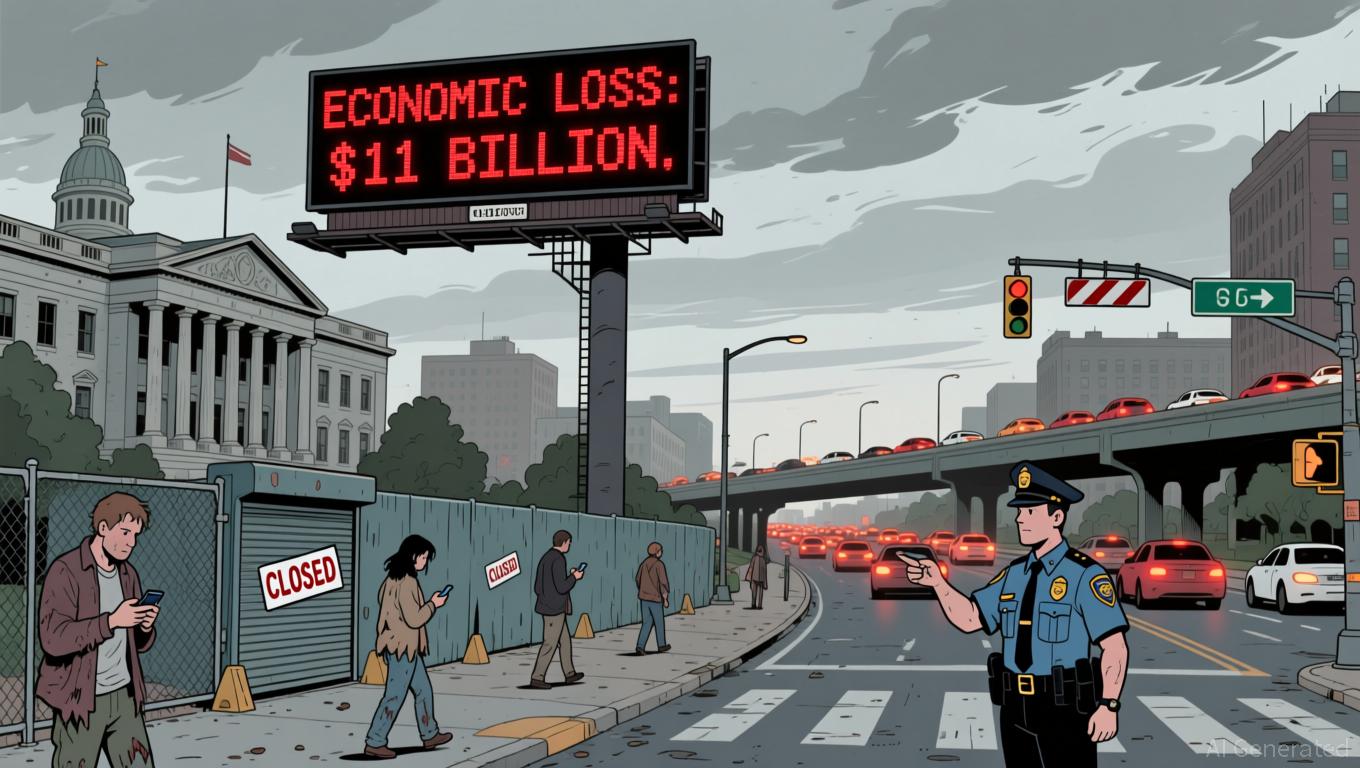

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

The United States experienced a government shutdown spanning 43 days at the end of 2025

The BLS

Despite these obstacles, the administration remains optimistic about the nation’s economic direction.

The economic consequences of the shutdown have strengthened demands for legislative change.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi's Automation Shortfall Addressed: Orbs Introduces dSLTP to Achieve CeFi-Grade Risk Control

- Orbs launches dSLTP, a decentralized stop-loss/take-profit protocol for DEXs, bridging CeFi automation with DeFi. - The protocol automates risk management via on-chain orders, reducing real-time monitoring needs during volatility. - Built on Orbs' Layer-3 infrastructure, it enhances DEX functionality with CeFi-grade tools while maintaining decentralization. - This innovation addresses DeFi's automation gap, potentially driving DEX adoption and institutional-grade on-chain trading.

XRP Latest Updates: XRP ETFs Enhance Market Liquidity, Large Holder Sell-Offs Postpone Price Increases to 2026

- XRP ETFs launched in late 2025 (e.g., Grayscale's GXRP) expanded institutional access, but whale sales delayed price gains until 2026. - XRP traded near $2.12 as 41.5% of its supply remains in loss, with whale-driven volatility and structural supply imbalances persisting. - Ripple secured $500M institutional backing for XRP Ledger infrastructure, while projects like XRP Tundra accelerated tokenization plans. - XRP trails Ethereum in market cap ($129B vs. $373B) due to lack of smart-contract capabilities,

Dogecoin News Today: Grayscale's Alternative Coin ETFs Indicate Change: Bitcoin Withdrawals Differ from Rising Interest in Altcoins

- Grayscale launches GDOG and GXRP ETFs on NYSE, offering direct exposure to Dogecoin and XRP via spot ETPs. - ETFs convert private trusts to public offerings, aligning with industry trends to boost liquidity and attract institutional capital. - GXRP competes with existing XRP products ($422M inflows), while GDOG follows DOGE's rise to 9th-largest crypto by market cap. - SEC's "Project Crypto" framework and FalconX partnership strengthen Grayscale's position in regulated altcoin investment vehicles. - Altc

Bitcoin Update: Federal Reserve Postponements and $1.2 Billion ETF Withdrawals Trigger 26% Drop in Bitcoin Value

- Bitcoin falls 26% to $83,000 amid Fed's delayed rate-cut timeline and $1.2B ETF outflows, marking its longest losing streak since 2024. - Analysts warn of structural risks, with Bloomberg's Mike McGlone projecting a potential $10,000 drop and Cathie Wood revising bullish 2030 forecasts. - Market volatility intensifies as JPMorgan's index exclusion proposal sparks crypto sector backlash and S&P 500 defensive sector shifts highlight interconnected risks. - Fed's December rate-cut speculation and upcoming i