Pi Coin Price Triangle Breakout Is Backed by Multi-Sided Momentum

Pi Coin is demonstrating a notable shift in momentum after remaining constrained within a key technical pattern for several days. The altcoin is showing early signs of strength, but its ability to break out will depend heavily on market conditions and sustained investor support. With volatility building, Pi Coin is approaching a decisive moment. Pi

Pi Coin is demonstrating a notable shift in momentum after remaining constrained within a key technical pattern for several days.

The altcoin is showing early signs of strength, but its ability to break out will depend heavily on market conditions and sustained investor support. With volatility building, Pi Coin is approaching a decisive moment.

Pi Coin Has Support

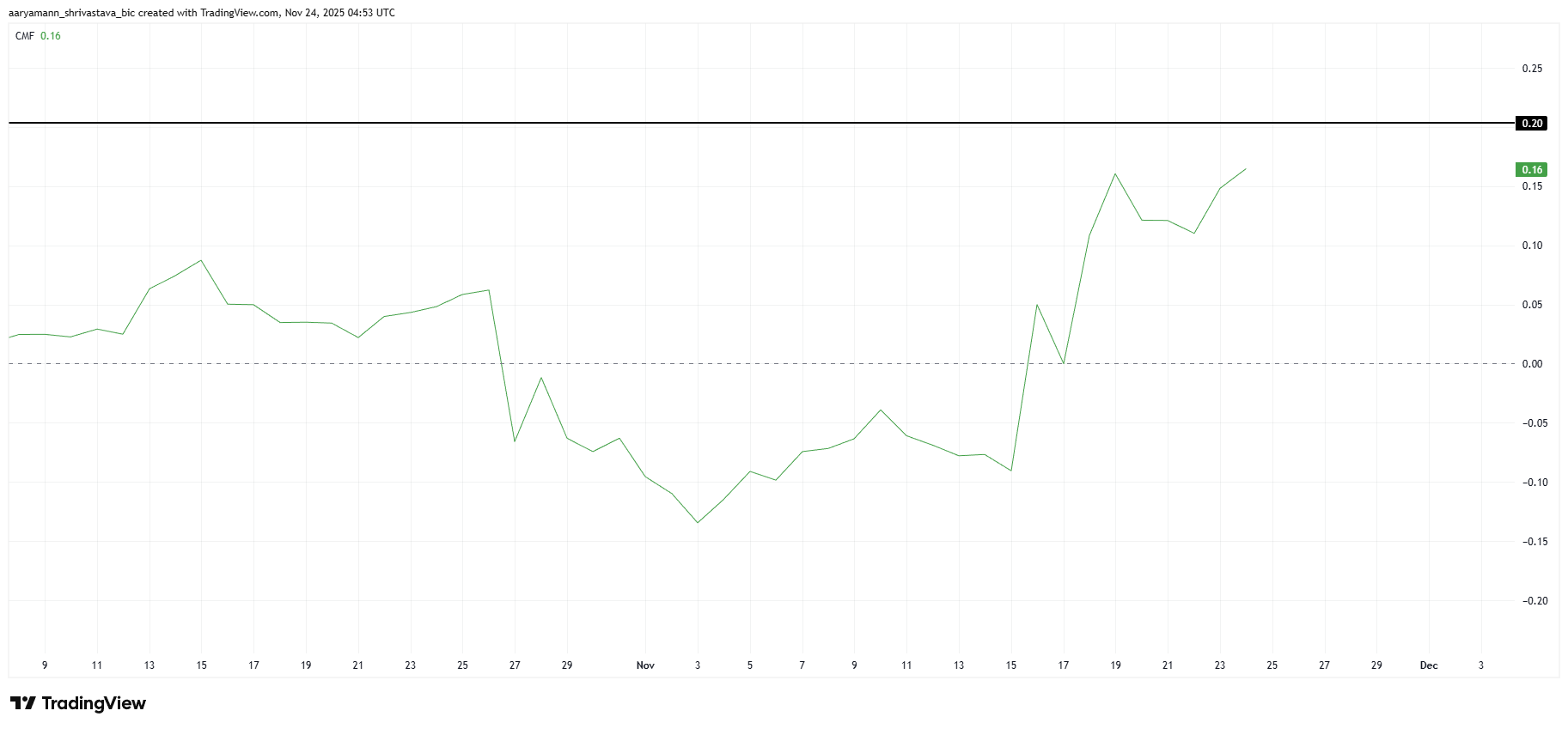

The Chaikin Money Flow offers an encouraging signal for Pi Coin. CMF has climbed to 0.16, indicating consistent inflows as investors continue to fund the altcoin’s rise. This indicator measures capital movement, and a rising trend reflects growing confidence among traders expecting a near-term price increase.

While the 0.20 level is historically viewed as a critical reversal threshold, Pi Coin has not reached that point yet. Until it does, the asset maintains strong backing from investors, giving it room to extend its upward momentum. Sustained inflows will be essential for any successful breakout.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Pi Coin CMF. Source:

Pi Coin CMF. Source:

Pi Coin CMF. Source:

Pi Coin CMF. Source:

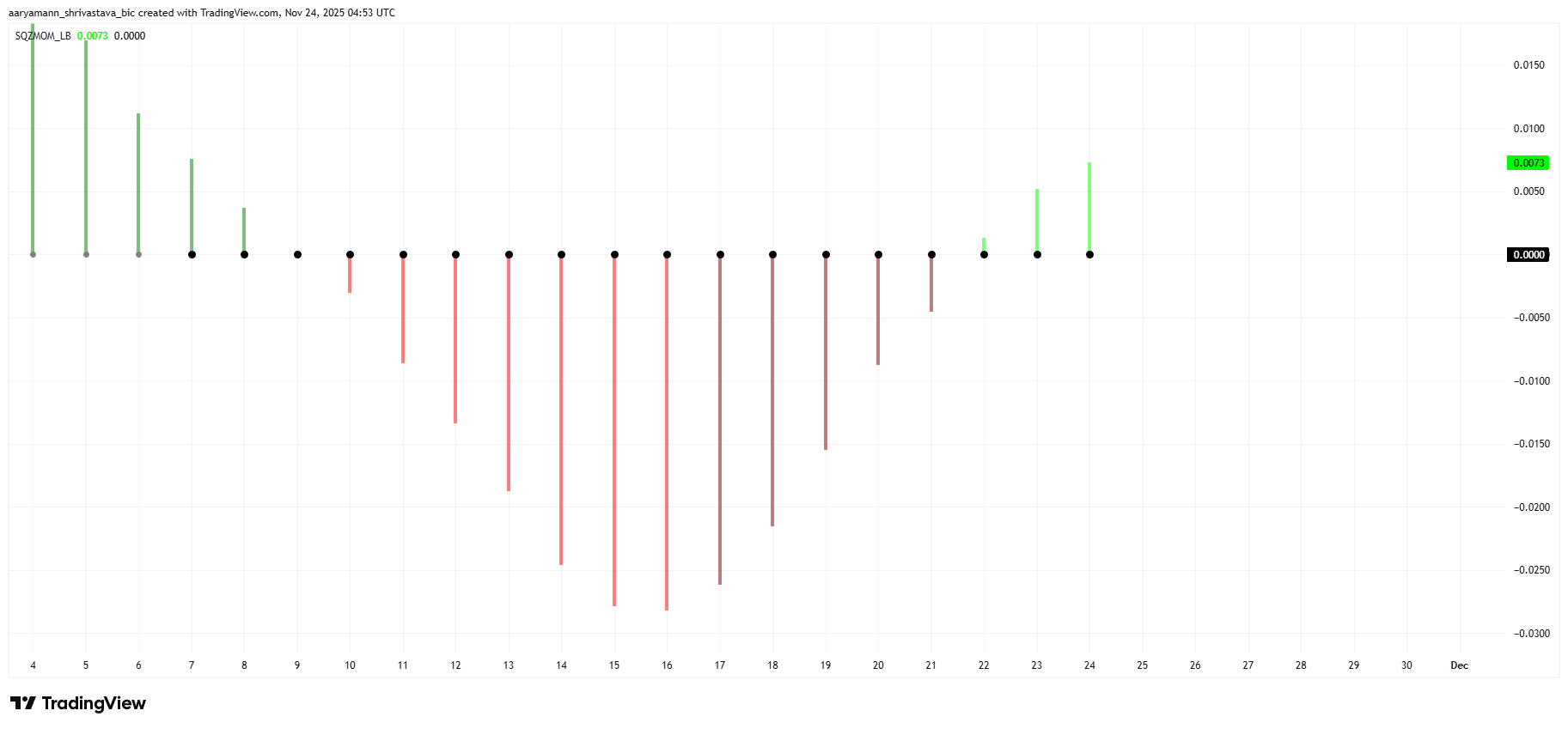

Macro momentum indicators reinforce Pi Coin’s strengthening position. The squeeze momentum indicator is currently showing a tightening squeeze as green bars rise, signaling growing bullish momentum. This pattern often precedes a sharp price move once the squeeze is released.

If the bullish momentum remains intact during the release, Pi Coin may experience a volatility surge that supports a substantial price rise. This setup indicates that broader market forces are aligning in favor of PI, strengthening the case for an imminent breakout.

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

PI Price Can Break Out

Pi Coin trades at $0.241 while moving within a symmetrical triangle pattern, a formation known for producing sharp breakouts. The technical structure suggests that PI is approaching the end of its consolidation phase and is likely to break through the pattern soon.

Given the strong inflows and building momentum, a successful breakout could push Pi Coin above the $0.250 level. From there, the price may extend toward $0.260 or even $0.272 if bullish conditions persist. These targets align with the current upward pressure reflected in momentum indicators.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

However, investors should remain cautious. If either inflows weaken or bullish momentum softens, Pi Coin may shift into sideways movement. A breakdown from the symmetrical triangle could send the price falling to $0.224 or even $0.217. Such a move would invalidate the bullish thesis and signal a reversal in sentiment.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: "Institutions Show Confidence While Whales Stir Uncertainty: Will XRP Reach $2.60 or Falter?"

- XRP rebounded from $2 support, with analysts targeting $2.60 as a key resistance level within a descending channel. - Institutional adoption grew via new XRP ETFs and Standard Chartered's custodial role, though ETFs hold just 0.5% of XRP's market cap. - Whale selling pressure (200M XRP in 48 hours) and bearish technical indicators below $2.20–$2.52 challenge bullish momentum. - Regulatory uncertainty and unresolved Ripple litigation keep XRP's trajectory dependent on technical execution and macro develop

Unpacking the Rise of MMT Token TGE: Is This a Fresh Driver for Digital Asset Adoption?

- Momentum (MMT) Token's 2025 TGE triggered extreme volatility, surging to $4.47 before an 86.6% drop, exposing speculative market fragility and centralized ownership risks. - Institutional backing (Coinbase, Circle , OKX) and $600M TVL support MMT's DeFi role through RWA tokenization and CLMM liquidity models, despite structural volatility challenges. - 2025 macroeconomic tailwinds (rate cuts, inflation hedging) and regulatory clarity (CLARITY Act, MiCA 2.0) enhance institutional trust, aligning with cryp

Bitcoin Updates: Federal Reserve's Softer Stance and ETF Investments Drive Bitcoin's Recovery to $91,000

- Bitcoin surged above $91,000 in December 2025 as Fed rate-cut odds hit 70%, driven by dovish signals and ETF inflows reversing outflows. - Technical indicators showed oversold RSI levels and seller exhaustion, while altcoins like XRP/ZEC jumped 7.7%-17% amid $2.95T market cap growth. - Institutional flows favored Solana ETFs and altcoin products, but MSCI's crypto exclusion policy sparked backlash from advocates like Michael Saylor. - Retail fear metrics and $605M liquidations highlighted fragility, yet

Ethereum Updates Today: Institutional Investments Rise While Prices Remain Flat: The Challenge of Ethereum's Potential Breakout

- Ethereum's MVRV Z-Score (0.29) signals potential buying opportunities amid prolonged accumulation and institutional ETF inflows. - Retail investors reduced exposure while whales (10K+ ETH) accumulated, contrasting with $92M ETH ETF inflows on Nov 24. - BlackRock's staked ETH ETF filing threatens DATs' opaque fee models as ETH price struggles to reclaim $2,800 despite technical buildup. - Divergent ETF flows ($88M ETHA inflow vs. $53M outflow) highlight market volatility, with analysts eyeing $9K breakout