A Sharp Shift in Crypto ETF Flows Creates New Market Momentum

The cryptocurrency market experienced significant volatility this week as flows into crypto ETFs revealed some notable sentiment shifts. Bitcoin and Ethereum experienced substantial outflows, while Solana and XRP had very strong inflows that indicated a changing modality in the market. Obviously, investors were reacting quickly to changes, which ushered in a new wave of weekly conversations around flows into crypto.

While it was widely expected that this week’s ETF activity to be dominated by Bitcoin, this expectation was met with surprise by the events that unfolded. A sharp amount of outflows for BTC and ETH raised some caution, while inflows into SOL and XRP showcased that traders were exploring larger opportunities. As markets fluctuated, these changes contributed to the ETF market movement and showcased how investors positioned their portfolios at this time of shifts to sentiment.

🇺🇸 UPDATE: Spot ETF flows last week saw $BTC outflows of $1.22B and $ETH outflows of $500.25M.

— Cointelegraph (@Cointelegraph) November 24, 2025

Meanwhile $SOL saw $128.2M in inflows and $XRP saw $179.6M in inflows. pic.twitter.com/IwTjDbsaI4

Strong Bitcoin Outflows Show a Sharp Sentiment Change

Bitcoin saw outflows of $1.22 billion last week. This large number showed a clear shift in weekly crypto flows as investors reduced BTC exposure. The move surprised some market watchers because Bitcoin usually leads most ETF market trends. However, traders adjusted to new price action and took profits after recent rallies.

Investors reacted to market volatility and looked for assets with stronger short-term momentum. Bitcoin still holds a major role in the market, but crypto ETF flows showed cooling confidence for the week. Analysts expect this situation to change again soon because Bitcoin continues to attract long-term interest.

Ethereum Outflows Continue as Investors Explore Alternatives

Ethereum recorded outflows of $500.25 million. This showed that investors moved away from ETH for the week. The data showed a similar trend to Bitcoin, which created a broader decline across top assets. These outflows shaped ETF market trends and redirected traders into other tokens.

Ethereum still maintains strong developer activity and market presence. However, the shift in weekly crypto flows pushed investors toward faster-growing assets. Traders now watch ETH closely to see if new upgrades spark stronger momentum.

XRP Sees Strong Investor Demand Despite Market Uncertainty

XRP surprised many traders with inflows of $179.6 million last week. This number showed strong interest in the asset even with ongoing market uncertainty. Weekly crypto flows showed a clear rise in confidence around XRP’s stability and long-term utility.

Investors moved into XRP because they saw growing use cases and lower volatility during hectic market days. This shift also aligned with ETF market trends that showed interest in assets with stronger risk management profiles. XRP now holds a stronger position among top inflow leaders for the week.

The inflow surge showed that traders trust XRP’s long-term potential. Many analysts believe that these inflows can support steady momentum in the coming weeks.

A Week of Clear Divergence in Investor Behavior

This week created a clear divide between outflow-heavy giants and inflow-strong alternatives. Bitcoin and Ethereum saw strong selling pressure through ETF channels, while Solana and XRP gained new support. Crypto ETF flows highlighted the evolving nature of investor strategies and confirmed a strong pivot toward assets with short-term momentum.

Investors now track upcoming economic data, market liquidity, and ecosystem growth to guide next week’s decisions. The landscape remains dynamic, and traders continue to adjust fast as weekly crypto flows reveal fresh insights.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple stablecoin gains Abu Dhabi approval as UAE tightens crypto rules

Fluence-TON Agreement Eliminates "Cost Barrier" for Blockchain Entrepreneurs

- Fluence Energy joins TON's Grant Program to offer blockchain/AI developers high-performance compute credits, slashing infrastructure costs by up to 85% via AMD Zen5 and NVIDIA GPUs. - The initiative supports three credit tiers ($2k–$10k) with 6–12 month validity, targeting early-stage projects while Fluence reports $2.3B FY2025 revenue and 50% 2026 growth forecast. - Leveraging Fluence's enterprise-grade global infrastructure, the partnership optimizes compute-intensive tasks like TON node operations and

Top 5 Altcoins to Buy in December 2025

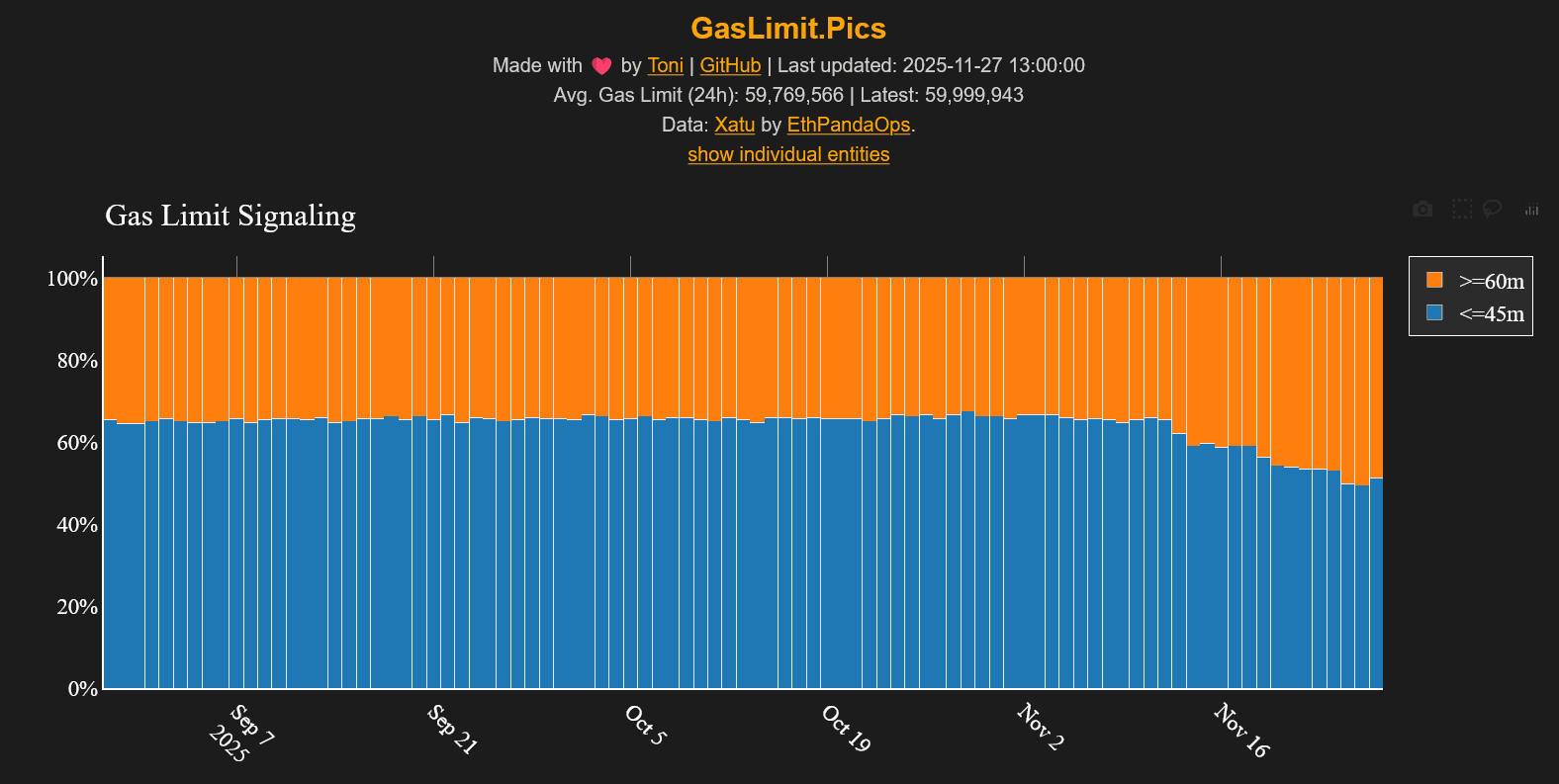

ETH Gas Limit Jumps to 60M and the Timing Is Wild