What Altcoins are showing bullish momentum?

Most of the crypto market is stuck in a defensive crouch. The Fear and Greed Index is sitting at 12, which tells you sentiment is at rock-bottom. But this is where coin-specific catalysts matter more than the macro cycle. Supply shocks, major listings, and ecosystem upgrades can flip the script for individual tokens, even when the market mood is gloomy.

That’s exactly what is happening with altcoins TNSR , PARTI , and DYM . Their rallies aren’t random. They’re tied to real events that shift token economics, demand drivers, and long-term expectations.

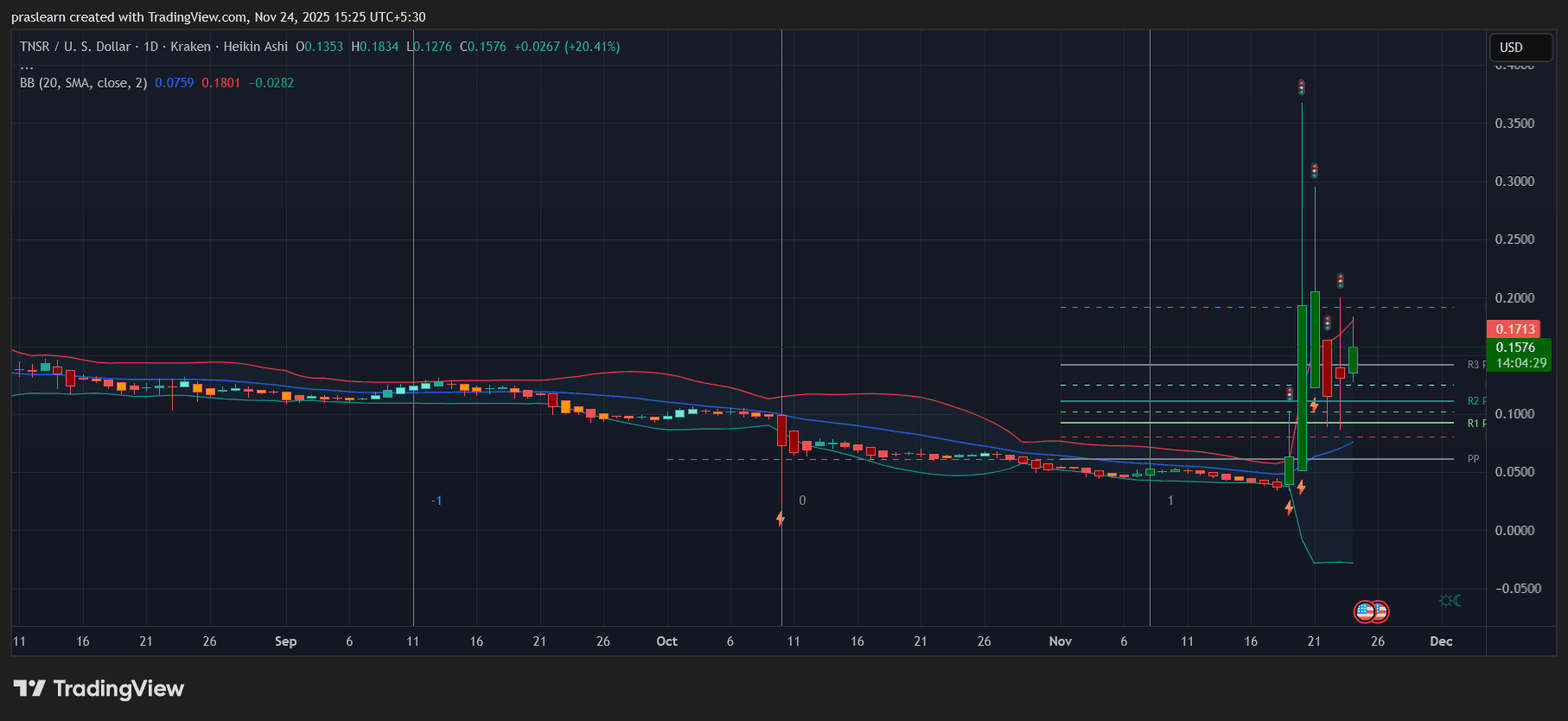

Tensor (TNSR): A Supply Shock Meets Coinbase Muscle

TNSR/USD Daily Chart- TradingView

TNSR/USD Daily Chart- TradingView

Tensor exploded more than 74 percent in a single day and over 300 percent across the week. The spark was Coinbase acquiring Vector, a Solana trading platform deeply linked to Tensor’s ecosystem. That acquisition triggered a 21.6 percent token supply burn and locked the founders’ tokens until 2028. This kind of supply reduction always catches traders’ attention, but pairing it with a top-tier exchange’s involvement amplified the effect.

The volume tells the story: $1.07B traded in 24 hours, with RSI flying above 90. That’s aggressive buying, but also a warning sign. When momentum gets this overheated, you usually see a pullback. The real test is whether TNSR can defend the $0.17 support zone once the dust settles. If it holds, the supply burn narrative can sustain another leg up. If it breaks, the post-acquisition euphoria may deflate quickly.

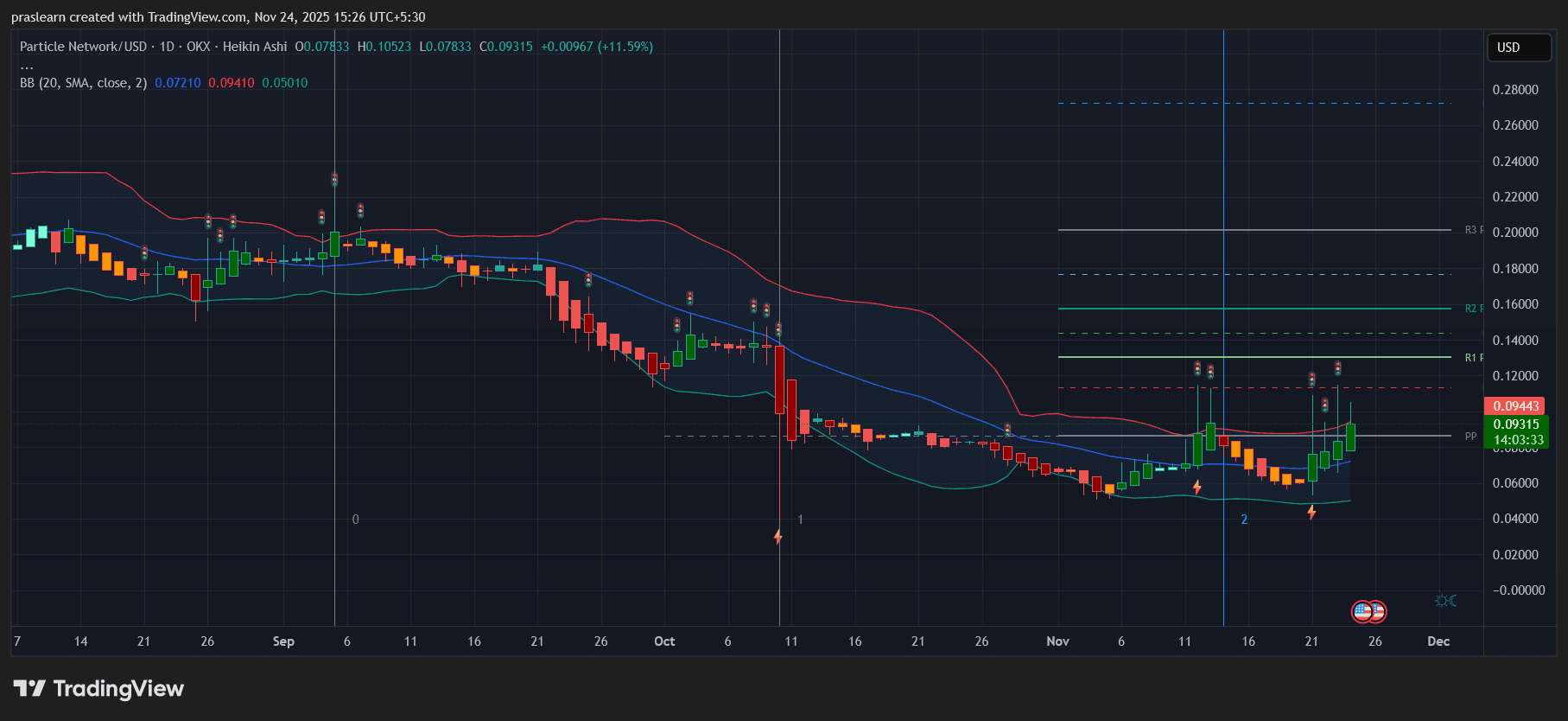

Particle Network (PARTI): Real Utility Starts Showing

PARTI/USD Daily Chart- TradingView

PARTI/USD Daily Chart- TradingView

Particle Network isn’t moving because of hype. Its breakout—over 50 percent in 24 hours—tracks directly to two tangible drivers: a KRW listing on Bithumb and the Universal SDK launch. KRW listings almost always bring fresh liquidity from Korea, and we saw that immediately with volume jumping more than 300 percent.

The bigger story though is chain abstraction. Developers finally have a clearer path to building cross-chain apps without dealing with the usual connectivity headaches. The RSI at 77 shows momentum is strong but not wild. The key question is whether PARTI can keep the $0.20 to $0.22 support band intact. If it does, the token decouples further from broader market trends and turns into a pure utility play rather than a speculative pump.

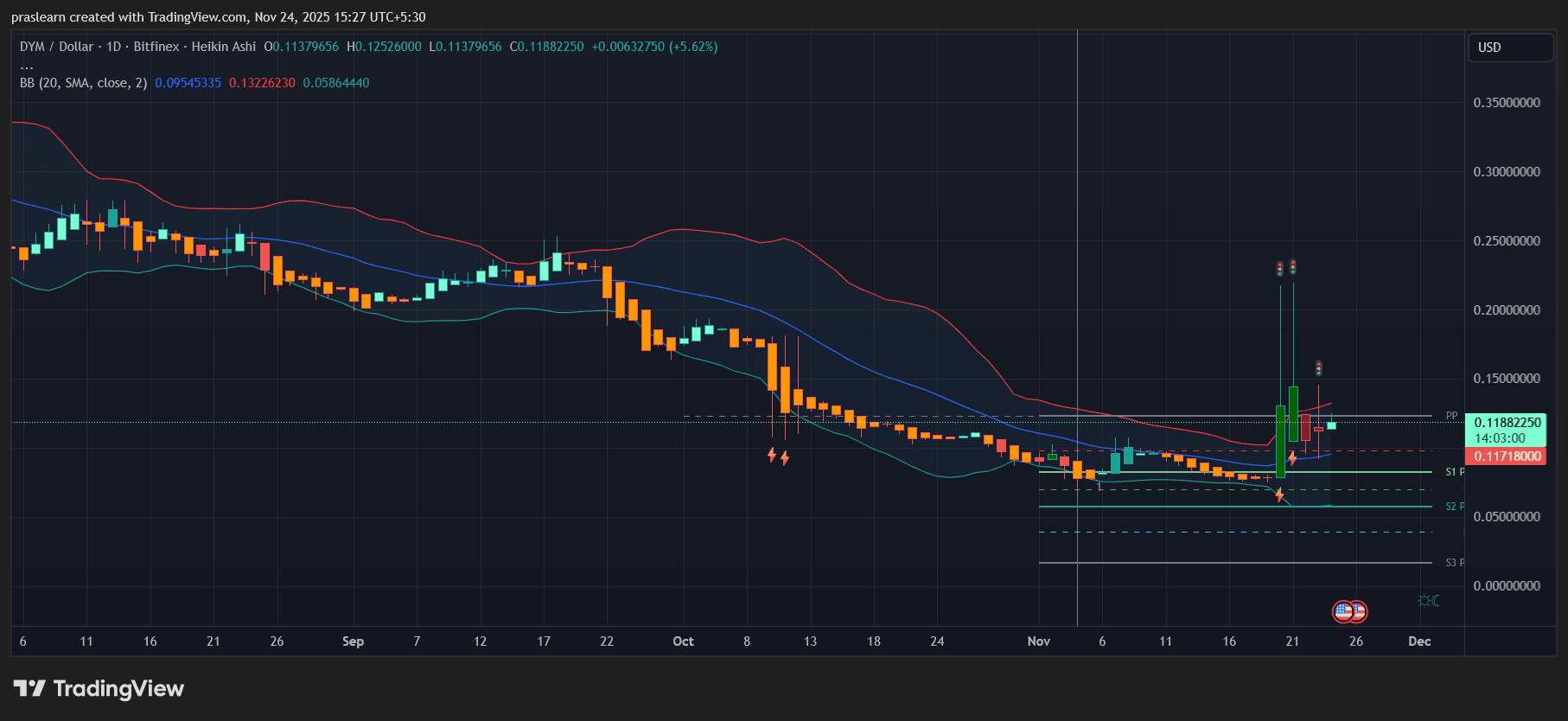

Dymension (DYM): Tech Upgrades That Actually Matter

DYM/USD Daily Chart- TradingView

DYM/USD Daily Chart- TradingView

Dymension’s move is tied to fundamentals rather than hype cycles. The Beyond upgrade is a genuine architecture shift, cutting block times to a single second. Pair that with a steady weekly burn of 115,000 tokens and you get a mix of speed, scarcity, and growing use cases.

The market rewarded that. DYM is up more than 34 percent in 24 hours and nearly 54 percent across the week. The bullish MACD crossover reinforces the momentum, but the bigger picture sits in the RollApps ecosystem and the eye-catching 50 percent APY staking rewards. Traders will want to watch how fast new RollApps come online and how quickly the upgrade drives real adoption. That will decide whether DYM breaks into a sustained growth cycle.

So What Happens Next?

When the crypto market is fearful, altcoins usually fall into two categories: hype-driven spikes that fade quickly or structurally strong moves backed by catalysts. TNSR, PARTI, and DYM land in the second group. Each has a driver that isn’t tied to general market sentiment: a supply shock, a major listing with real utility, and a core protocol upgrade.

The predictive angle comes down to two checkpoints:

- Do they sustain their volumes above key moving averages? If volume collapses, momentum breaks.

- Do roadmap events deliver what traders are pricing in? Token burns, SDK launches, and L1 upgrades only matter if adoption follows.

Right now, $TNSR is the most vulnerable to a sharp correction because RSI overheating rarely ends gently. $PARTI looks the most stable if it protects its new support zone. $DYM sits in the middle but has the strongest long-term story tied to its ecosystem expansion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Investing in eco-friendly urban infrastructure as an approach to reduce climate impacts

- Global climate goals demand urgent urban action to limit warming to 1.5°C by 2050, with cities responsible for 70% of emissions. - Decentralized energy systems, solar transit, and behavioral interventions reduce emissions while delivering 18–30% ROI through regenerative models. - Cities like Copenhagen and New York demonstrate feasibility, with decentralized systems cutting emissions by 80% and energy costs by 20%. - IPCC mandates emissions peak by 2025, making urban sustainability investments critical f

The Comeback of Momentum (MMT): A Tactical Move for 2026?

- Momentum investing's 2026 resurgence hinges on macroeconomic clarity, tech innovation, and institutional adoption of systematic strategies. - 2025 performance showed 113-basis-point U.S. outperformance led by Tesla/NVIDIA, bolstered by Fed rate cuts and AI optimism. - Institutional crypto adoption accelerated via $50B+ ETFs and tokenization, with 2-5% 2026 digital asset allocations projected. - 2026 catalysts include regulatory reforms, 74% market correction expectations, and agentic AI/quantum computing

LUNA Drops 11.32% as Amazon Luna Rolls Out to Xfinity Devices

- LUNA dropped 11.32% on Dec 12 2025 amid broader market sentiment, despite prior gains, with no direct project-specific triggers. - Amazon expanded Luna cloud gaming to Xfinity devices, enhancing accessibility via voice commands and Prime subscriptions. - Analysts note no direct link between Luna's expansion and LUNA token performance, emphasizing macroeconomic and cross-sector influences.

Financial Wellbeing and How It Influences Long-Term Investment Habits

- Financial wellness integrates economic, behavioral, and technological factors to drive sustainable investment resilience and long-term wealth creation. - Financial literacy and structured planning enhance crisis navigation, with 61% of planners reporting high wellness levels and improved investment discipline. - Emotional resilience through financial therapy reduces stress-related decision-making, particularly benefiting vulnerable groups during income shocks. - AI tools and gamification foster habit for