Zcash Halving and Its Impact on the Privacy Coin Market

- Zcash's November 2025 halving reduced block rewards by 50%, reinforcing its deflationary model and drawing Bitcoin-like scarcity comparisons. - Arthur Hayes' "shielded liquidity" strategy boosted Zcash's fee revenue 560% but risks amplifying price volatility through reduced tradable supply. - Institutional adoption via Grayscale Zcash Trust ($137M AUM) contrasts with Monero's rigid anonymity, as regulatory frameworks like EU AMLR loom. - Zcash surged 1,172% YTD to $589, outperforming Bitcoin during bear

Supply Shifts and Shielded Transactions: Evolving Market Structure

The immediate result of the halving was a 50% cut in new ZEC issuance, but its wider impact is tied to the increasing use of Zcash’s privacy capabilities. Currently, shielded pools account for 27–30% of all circulating ZEC, with a notable migration to the newer Orchard protocol

This tactic has already had an impact: Zcash’s transaction fee income

Institutional Interest and Regulatory Turning Points

Institutional participation has played a major role in Zcash’s rally after the halving. The Grayscale Zcash Trust, which now oversees $137 million in assets, highlights the increasing confidence from traditional financial players

Market Swings and Investor Outlook: Two Sides of the Coin

The halving has heightened Zcash’s price swings, with its value

Yet, volatility also brings risk. Zcash experienced a 30-day price drop of over 35% in November 2025, exposing the dangers of speculative trading

Wider Effects on the Privacy Coin Sector

The Zcash halving has also altered the broader privacy coin market. For a brief period, Zcash’s market cap surpassed Monero’s, hitting $7.2 billion compared to XMR’s $6.3 billion

Still, Zcash’s lead is not guaranteed. Monero’s Fluorine Fermi upgrade in late 2025 improved its privacy features, and Litecoin’s experiments with hybrid privacy indicate growing competition. For Zcash, the challenge will be to sustain its balance between privacy and regulatory compliance—a delicate act that could shape its future prospects.

Conclusion: High Risk, High Potential

The November 2025 halving has placed Zcash at a pivotal moment. Its deflationary supply, growing institutional backing, and privacy advancements have fueled a record-breaking rally, but these benefits come with considerable risks. Ongoing regulatory uncertainty, possible miner sell-offs, and the volatility linked to shielded transactions could unsettle the market. For investors, Zcash offers a high-risk, high-reward proposition: a privacy-focused asset that could outperform Bitcoin during downturns, yet remains susceptible to regulatory actions and liquidity shocks.

As the privacy coin market continues to develop, Zcash’s ability to handle these obstacles will be crucial. Whether it cements its status as a leading privacy asset or is overtaken by regulatory and market shifts is still uncertain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Crypto Market Faces $1.3 Trillion Downturn—Testing Industry Growth and Altcoin Stability

- Cryptocurrency markets lost $1.3 trillion since October, with Bitcoin and altcoins like Solana and Ethereum plummeting amid leveraged trading and macroeconomic shifts. - Trump family's crypto-linked wealth dropped $1 billion, highlighted by a 90% collapse in his meme coin and 30% decline in American Bitcoin shares . - Prediction token RAIN surged 100% after Enlivex Therapeutics announced a $212M RAIN treasury, positioning it as a decentralized forecasting innovation leader. - Ethereum-focused Bitmine Imm

XRP News Today: XRP ETFs Launch While SEC's Security Status Remains Unsettled

- Franklin Templeton launched XRPZ ETF on NYSE Arca, offering regulated XRP exposure via a grantor trust structure with a 0.19% fee. - SEC's August 2025 Ripple settlement cleared regulatory hurdles, enabling XRP ETF approvals from major providers like Bitwise and Grayscale. - XRP's cross-border payment utility and low energy consumption drive institutional interest, though price volatility and unresolved SEC classification persist. - XRPZ employs Coinbase/BNY Mellon custody for transparency but lacks activ

Amazon’s $50 Billion Investment in AI: Strengthening America’s Position in the Worldwide Technology Competition

- Amazon invests $50B to boost AWS AI/supercomputing for U.S. government agencies, adding 1.3GW capacity by 2026. - Tech giants like Microsoft and Meta also ramp up AI spending, with global capex projected to hit $611B by 2026. - AWS dominates government cloud computing, serving 11,000+ agencies with secure, classified workloads since 2011. - Competitors like AMD and Oracle join AI expansion, while economic analysts warn of overbuilding risks and GDP concentration. - The GAIN AI Act supports domestic AI ch

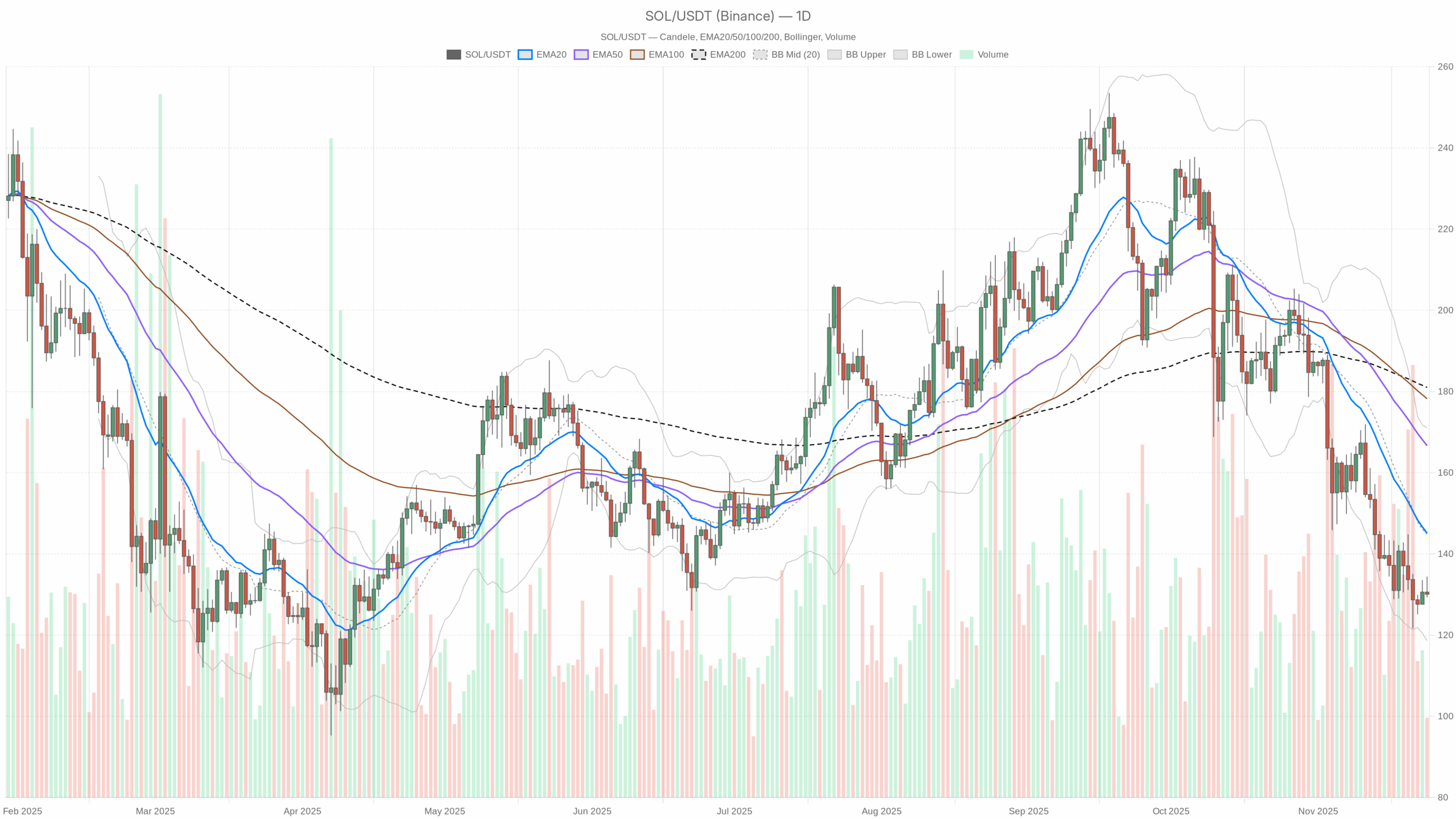

Solana crypto forecasting: is SOL nearing a tactical bottom?