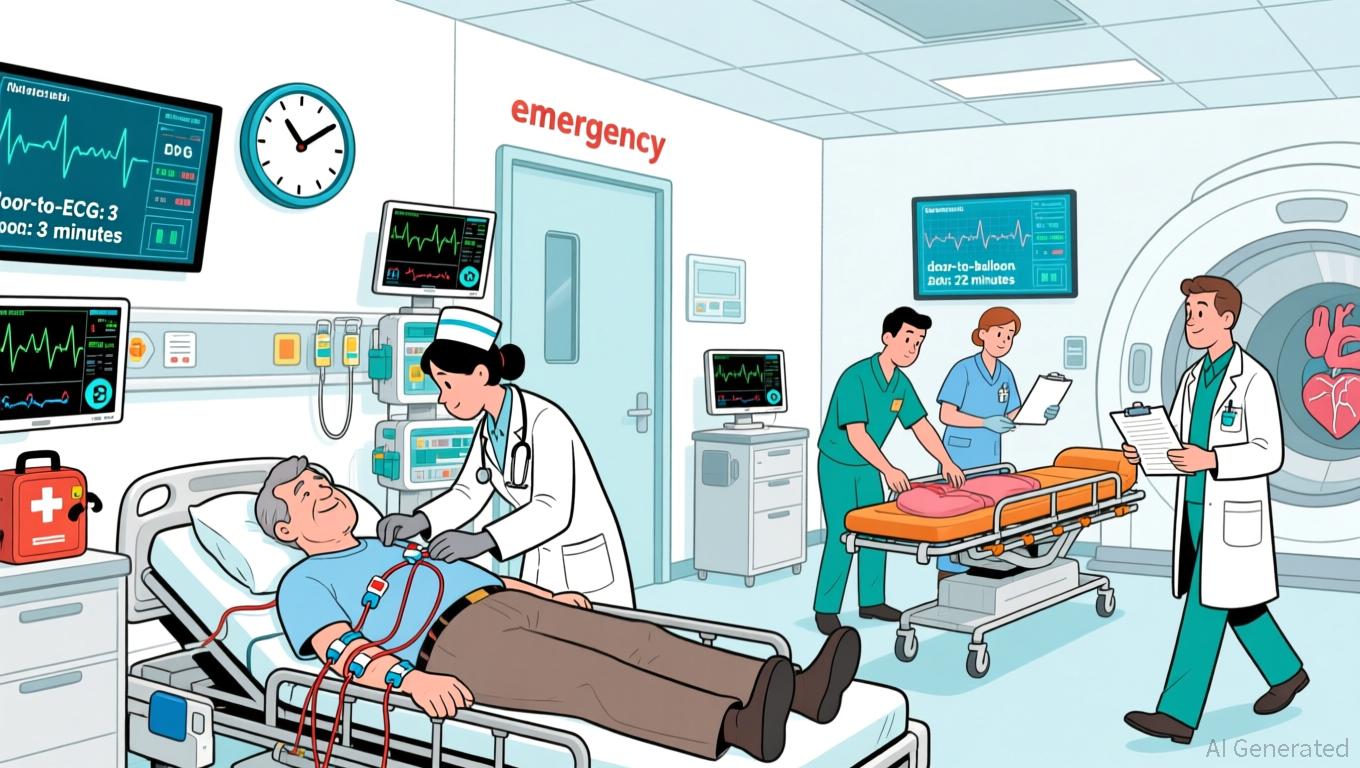

Accelerated Pathways Help Close the Gap Between ACS Guidelines and Actual Clinical Practice

- A Hunan hospital study found fast-track pathways for ACS patients reduced treatment delays and MACE without increased bleeding risk. - The protocol cut median door-to-ECG time by 50% and door-to-balloon time for STEMI patients to 68 minutes, improving guideline adherence. - In-hospital MACE rates dropped from 11.6% to 6.6%, with 30-day composite outcomes improving from 13.9% to 8.7% under fast-track care. - Researchers emphasized the pathway's applicability across all ACS subtypes and potential system ef

A recent prospective cohort investigation has found that implementing emergency fast-track protocols for acute coronary syndrome (ACS) patients leads to notably better clinical results, including shorter treatment times and fewer major adverse cardiovascular events (MACE), all without raising the risk of bleeding. The research, carried out at The Second People's Hospital of Hunan Province, assessed 870 individuals with ACS between January 2022 and December 2023. Of these, 438 were treated using a dedicated fast-track system, while 432 received standard care. The main outcomes showed that the fast-track model

The research,

The authors emphasized the study’s strong methodology, which used propensity score–based inverse probability of treatment weighting to address confounding factors. They also noted the protocol’s broad scope, as it covers all ACS types—including STEMI, NSTEMI, and unstable angina—rather than focusing solely on STEMI. This inclusive design enhances its relevance for emergency departments treating varied patient groups. Furthermore, the median length of hospital stay was

Although the findings strongly support the use of fast-track pathways, the study’s limitations include its single-center nature and insufficient sample size to detect small differences in mortality. The researchers recommend larger, multicenter studies to confirm these results and longer-term monitoring to evaluate sustained benefits. Still, the evidence offers practical guidance for healthcare leaders and providers, especially in Asia where cardiovascular disease rates are climbing. The authors suggest that structured fast-track protocols should become part of emergency care systems to help close the gap between clinical recommendations and everyday practice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Supporters Rally Ahead of 2026 Midterm Elections to Influence a Congress Favoring Innovation

- Stand With Crypto, backed by Coinbase , launched a 2026 midterm campaign to evaluate candidates' digital asset policies, focusing on innovation, de-banking, and regulation. - The group aims to influence Congress to prioritize pro-crypto policies, leveraging prior success in mobilizing voters and tracking 274 "pro-crypto" elected officials in 2024. - SEC's 2026 regulatory shift to information security and delayed digital asset legislation create uncertainty, while Trump's political strategies intersect wi

Ethereum News Update: While Ethereum Declines, DeFi's Mutuum Rises Amid Presale Boom

- Ethereum (ETH) fell below $2,800 on Nov 24, 2025, amid crypto market turmoil driven by rising Japanese bond yields and algorithmic sell-offs. - DeFi project Mutuum Finance (MUTM) raised $18.9M in its presale, with Phase 6 nearing 90% sales at $0.035 per token before a 20% price increase. - Mutuum's dual-lending model and automated interest systems differentiate it, while Ethereum ETFs saw $465M outflows despite institutional Bitcoin/Ethereum deposits. - The project's presale growth remains resilient amid

XRP News Update: Franklin XRP ETF: $1.69 Trillion Titan Signals Crypto Market Evolution

- Franklin Templeton launches XRPZ ETF, first regulated XRP fund on NYSE Arca, reflecting institutional crypto adoption. - SEC's 2025 Ripple settlement cleared XRP's regulatory status, enabling $125M-payout-driven investment products like XRPZ. - XRPZ joins competitive ETF landscape (Bitwise, Grayscale) amid mixed market signals: $2.11 price rebound vs. 200M XRP whale sales. - Franklin's $1.69T AUM entry underscores crypto market maturation, with XRP positioned as foundational asset for cross-border paymen

Hyperliquid News Today: Investors Seek Concrete AI Outcomes, Rejecting Unsubstantiated Hype

- Investor skepticism grows over AI/data-driven ventures' commercial viability, as seen in C3.ai's 27% stock drop and sector-wide profit-taking. - DeFi's 83-95% idle capital in liquidity pools highlights systemic inefficiencies in monetizing AI and data, mirroring broader speculative risks. - Nvidia's muted earnings and Salesforce's struggles underscore market demand for proven AI applications beyond infrastructure providers. - Success in AI sectors now hinges on aligning innovation with regulatory needs a