Texas Spends $5 Million on Bitcoin. Here’s Why

Texas looks ready to become the first U.S. state to officially put bitcoin on its balance sheet. After months of talk and a new law backing the effort, the state has reportedly fired the starting shot with a $5 million purchase of BlackRock’s IBIT . It is the first step in a $10 million allocation approved earlier this year, and if confirmed, it marks a turning point in how governments treat digital assets.

Why Texas Is Buying Bitcoin Now

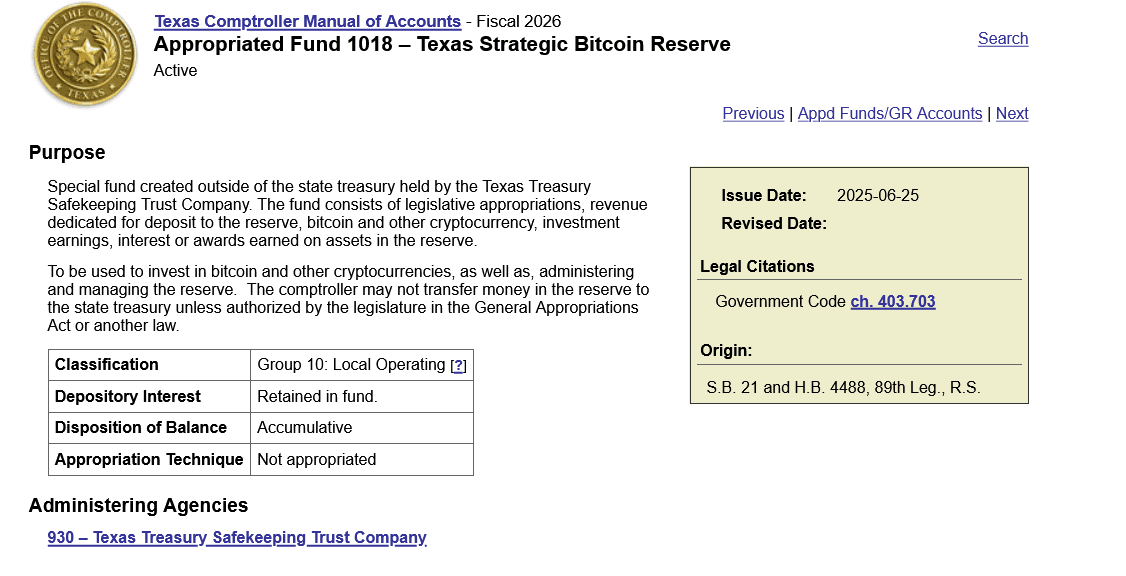

The purchase comes under SB 21 , the law signed by Governor Greg Abbott in June. The bill created the Texas Strategic Bitcoin Reserve, managed by the Texas Treasury Safekeeping Trust Company . Lawmakers behind SB 21 made their intent clear: they wanted bitcoin treated like any long-term asset in the state’s investment portfolio.

Senator Charles Schwertner, who authored the bill, put it bluntly earlier this year when he said the state should be free to consider “the best performing asset over the last 10 years.” Even though bitcoin has had volatile periods, its decade-long returns tell a different story. That pitch carried enough weight to secure a dedicated $10 million allocation.

The First Allocation: A $5 Million IBIT Purchase

According to posts from the Texas Blockchain Council, the state executed a roughly $5 million buy of BlackRock’s IBIT ETF on November 20. If accurate, this is the very first deployment from the bitcoin budget approved under SB 21.

It’s also a symbolic milestone: the council’s president, Lee Bratcher, called it the first-ever bitcoin purchase by a U.S. state . Official confirmation from Treasurer Kelly Hancock hasn’t landed yet, but the timing and details match the budget provisions and the authorization process.

What this really means is Texas isn’t waiting for national clarity. It’s moving ahead with its own blueprint for treating bitcoin as part of a sovereign-style reserve.

How Bitcoin Fits Into the Texas Portfolio

If this transaction is validated, IBIT becomes the third line item in the state’s traditional holdings. The Texas Treasury Safekeeping Trust Company currently reports roughly:

- $667 million in SPY

- $34 million in a Janus Henderson fund

- And now, potentially, a $5 million position in IBIT

It’s a small position in dollar terms, but symbolically, it’s a signal that digital assets are crossing into territory once reserved strictly for equities and bonds.

This is also a rare intersection of institutions. Abu Dhabi’s sovereign wealth fund added IBIT this month. Harvard owns nearly seven million shares and listed it as its largest U.S. holding as of September 30.

Bloomberg’s Eric Balchunas summed it up: IBIT may be the only ETF ever held by Texas, Harvard, and a Gulf sovereign wealth fund at the same time. Not bad for a fund that isn’t even two years old.

Why Everyone Is Watching Texas

Texas tends to move first and worry later, especially when it comes to energy, crypto mining, and financial experimentation. Its growing blockchain ecosystem, combined with political support, makes it a natural testing ground for state-level digital asset policy.

If this $5 million IBIT purchase is confirmed, it won’t stay a state secret for long. Other states will watch the performance, the governance model, and the political reaction. If the reserve grows and the returns justify the experiment, expect others to start asking why they’re sitting out.

This moment isn’t just about an ETF trade . It’s about whether bitcoin can graduate from speculative asset to state-level strategic asset.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Abu Dhabi’s Green Light Establishes UAE as a Pioneer in Stablecoin Development

- Ripple's RLUSD stablecoin gains Abu Dhabi regulatory approval as UAE advances digital finance leadership. - ADGM's "Accepted Fiat-Referenced Token" designation enables institutional use for lending and cross-border payments. - RLUSD's $1.2B market cap growth reflects institutional demand, backed by USD reserves and dual blockchain operations. - UAE's ADGM-DIFC regulatory synergy attracts global fintechs , with Ripple expanding partnerships across Africa and Asia. - Regulatory milestones position RLUSD to

Ethereum Updates: Ethereum Drops to $2,800, Prompting Surge in Demand for ZKP's Hardware-Based Presale

- Ethereum's price fell below $2,800, triggering $6.5M liquidations and testing critical support levels amid declining on-chain demand metrics. - Institutional players like BitMine accumulated 3.62M ETH (~$10.4B) despite the selloff, signaling long-term bullish conviction. - ZKP's hardware-driven presale gained traction with $17M in ready-to-ship Proof Pods and Miami Dolphins partnership for privacy-focused sports analytics. - Mutuum Finance's $19M DeFi presale and ZKP's auction model with $50K wallet caps

Vitalik Buterin Supports ZKsync: What This Means for Layer 2 Scaling

- Vitalik Buterin endorsed ZKsync in late 2025, highlighting its "underrated and valuable" work alongside the Atlas upgrade achieving 15,000 TPS and $0.0001 fees. - ZKsync's zero-knowledge rollups and EVM compatibility enabled institutional adoption by Deutsche Bank , Sony , and Goldman Sachs for cross-chain and enterprise use cases. - The Fusaka upgrade aims to double throughput to 30,000 TPS by December 2025, positioning ZKsync to compete with Polygon zkEVM and StarkNet in Ethereum's Layer 2 landscape. -

The ZK Atlas Enhancement: Revolutionizing Blockchain Scalability?

- ZKsync's 2025 Atlas Upgrade achieves 15,000–43,000 TPS with sub-1-second finality, addressing Ethereum L2 scalability bottlenecks via Airbender proofs and modular OS. - DeFi protocols like Aave and Lido leverage ZKsync's $0.0001/tx costs to unify liquidity, while Deutsche Bank and Sony adopt its trustless cross-chain infrastructure for compliance and transparency. - ZK token surged 150% post-upgrade, with TVL hitting $3.3B and analysts projecting 60.7% CAGR for ZK Layer-2 solutions by 2031 amid instituti