JPMorgan Offers Capped Upside Notes Tied to Bitcoin ETF Performance

Quick breakdown:

- JPMorgan’s new structured notes link returns to BlackRock’s iShares Bitcoin Trust IBIT, offering at least 16% if the ETF clears preset levels in a year and up to 1.5x BTC upside by 2028.

- Gains are capped, principal is only protected to about a 30% drawdown, and investors take on JPMorgan credit and liquidity risk.

- Buyers are exposed to JPMorgan’s issuer credit risk since the instruments are unsecured obligations, and secondary liquidity is typically limited to over-the-counter dealing.

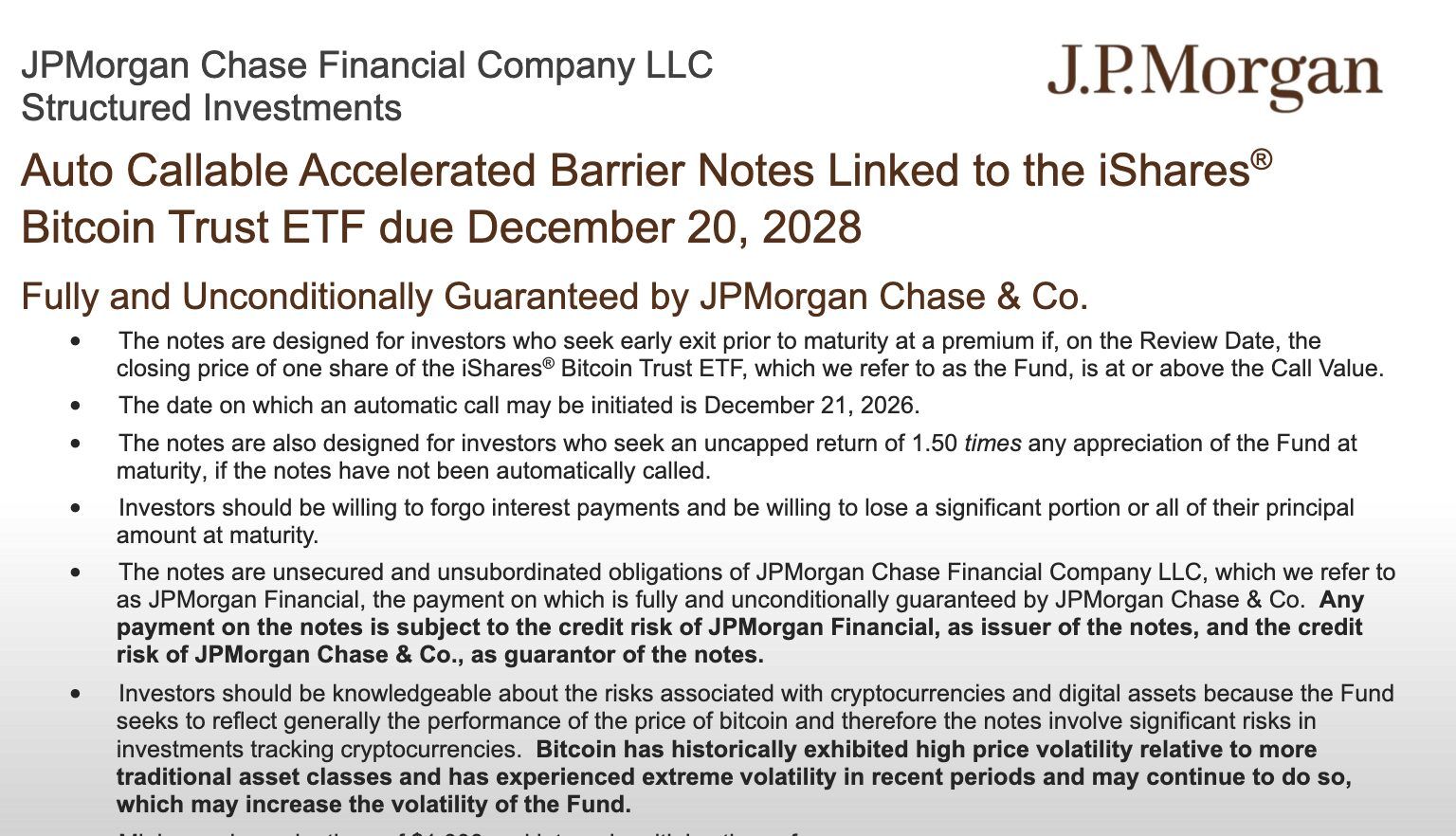

JPMorgan has structured a new batch of Bitcoin-linked notes that could deliver amplified returns if BTC and IBIT rally into 2028, while exposing investors to capped upside, conditional protection, and the bank’s own credit profile. The issuance underscores Wall Street’s push to package Bitcoin exposure into familiar securities instead of direct spot holdings.

The notes tie their performance to BlackRock’s iShares Bitcoin Trust IBIT, a spot Bitcoin ETF that already holds tens of billions of dollars in assets under management. Investors buy the notes at a fixed price and receive payouts based on IBIT’s level at specific dates rather than traditional coupons.

Source

:

SEC

Source

:

SEC

How the Bitcoin-linked notes work

According to term sheets, the structure typically combines an auto-call feature after about one year with a final maturity in 2028, creating two key decision points for returns.

If IBIT trades at or above a set threshold on the early observation date, the notes get called, and investors receive a mid-teens return, usually around 16% on their principal. If IBIT finishes below that mark, the notes stay in place until 2028 and then track the ETF with an enhanced upside, typically about 1.5x, up to a maximum cap. On the downside, principal is generally protected only as long as IBIT doesn’t drop more than about 30% from its starting level. If it falls beyond that, investors begin taking losses and could see a substantial hit to their capital.

Because the instruments are unsecured obligations, buyers also rely on JPMorgan’s ability to honour payments at maturity, adding issuer credit risk to Bitcoin’s price volatility. Secondary liquidity is typically limited to over-the-counter dealing, which can make exiting the position before maturity difficult or costly.

Who these products target and why they matter

The notes are aimed at investors who expect Bitcoin to grind higher over the next few years but prefer a packaged security linked to a regulated ETF rather than direct crypto custody or derivatives trading. They can fit mandates that allow exposure to bank notes and listed ETFs while still providing a defined payoff profile tied to BTC performance.

At the same time, the design converts a simple asset into a complex payoff that blends options, barriers, and credit, requiring investors to understand scenarios across 2026 and 2028 before allocating capital. The launch adds to a broader shift in which banks use ETF-linked notes to intermediate Bitcoin exposure, signalling that BTC is being treated as a strategic reference asset inside traditional fixed-income and structured-product desks rather than a fringe speculation.

Meanwhile, JPMorgan’s Kinexys unit is piloting JPMD, a permissioned deposit token on the Base Layer 2 network, for institutional clients. This digital representation of commercial bank money offers a regulated, efficient 24/7 on-chain payment alternative to stablecoins. This move signals JPMorgan’s belief that regulated deposit products will be central to the future of digital finance.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Abu Dhabi’s Green Light Establishes UAE as a Pioneer in Stablecoin Development

- Ripple's RLUSD stablecoin gains Abu Dhabi regulatory approval as UAE advances digital finance leadership. - ADGM's "Accepted Fiat-Referenced Token" designation enables institutional use for lending and cross-border payments. - RLUSD's $1.2B market cap growth reflects institutional demand, backed by USD reserves and dual blockchain operations. - UAE's ADGM-DIFC regulatory synergy attracts global fintechs , with Ripple expanding partnerships across Africa and Asia. - Regulatory milestones position RLUSD to

Ethereum Updates: Ethereum Drops to $2,800, Prompting Surge in Demand for ZKP's Hardware-Based Presale

- Ethereum's price fell below $2,800, triggering $6.5M liquidations and testing critical support levels amid declining on-chain demand metrics. - Institutional players like BitMine accumulated 3.62M ETH (~$10.4B) despite the selloff, signaling long-term bullish conviction. - ZKP's hardware-driven presale gained traction with $17M in ready-to-ship Proof Pods and Miami Dolphins partnership for privacy-focused sports analytics. - Mutuum Finance's $19M DeFi presale and ZKP's auction model with $50K wallet caps

Vitalik Buterin Supports ZKsync: What This Means for Layer 2 Scaling

- Vitalik Buterin endorsed ZKsync in late 2025, highlighting its "underrated and valuable" work alongside the Atlas upgrade achieving 15,000 TPS and $0.0001 fees. - ZKsync's zero-knowledge rollups and EVM compatibility enabled institutional adoption by Deutsche Bank , Sony , and Goldman Sachs for cross-chain and enterprise use cases. - The Fusaka upgrade aims to double throughput to 30,000 TPS by December 2025, positioning ZKsync to compete with Polygon zkEVM and StarkNet in Ethereum's Layer 2 landscape. -

The ZK Atlas Enhancement: Revolutionizing Blockchain Scalability?

- ZKsync's 2025 Atlas Upgrade achieves 15,000–43,000 TPS with sub-1-second finality, addressing Ethereum L2 scalability bottlenecks via Airbender proofs and modular OS. - DeFi protocols like Aave and Lido leverage ZKsync's $0.0001/tx costs to unify liquidity, while Deutsche Bank and Sony adopt its trustless cross-chain infrastructure for compliance and transparency. - ZK token surged 150% post-upgrade, with TVL hitting $3.3B and analysts projecting 60.7% CAGR for ZK Layer-2 solutions by 2031 amid instituti