QCP: Bitcoin may face ETF-related selling pressure around $95,000, while the $80,000-$82,000 range remains a key support level.

ChainCatcher News, QCP published an analysis stating that BTC is currently stable at the high level of $90,000, market risk sentiment has improved, and the probability of a rate cut in December has risen to 85%. However, macro signals remain complex, with inflation still high and labor data weak.

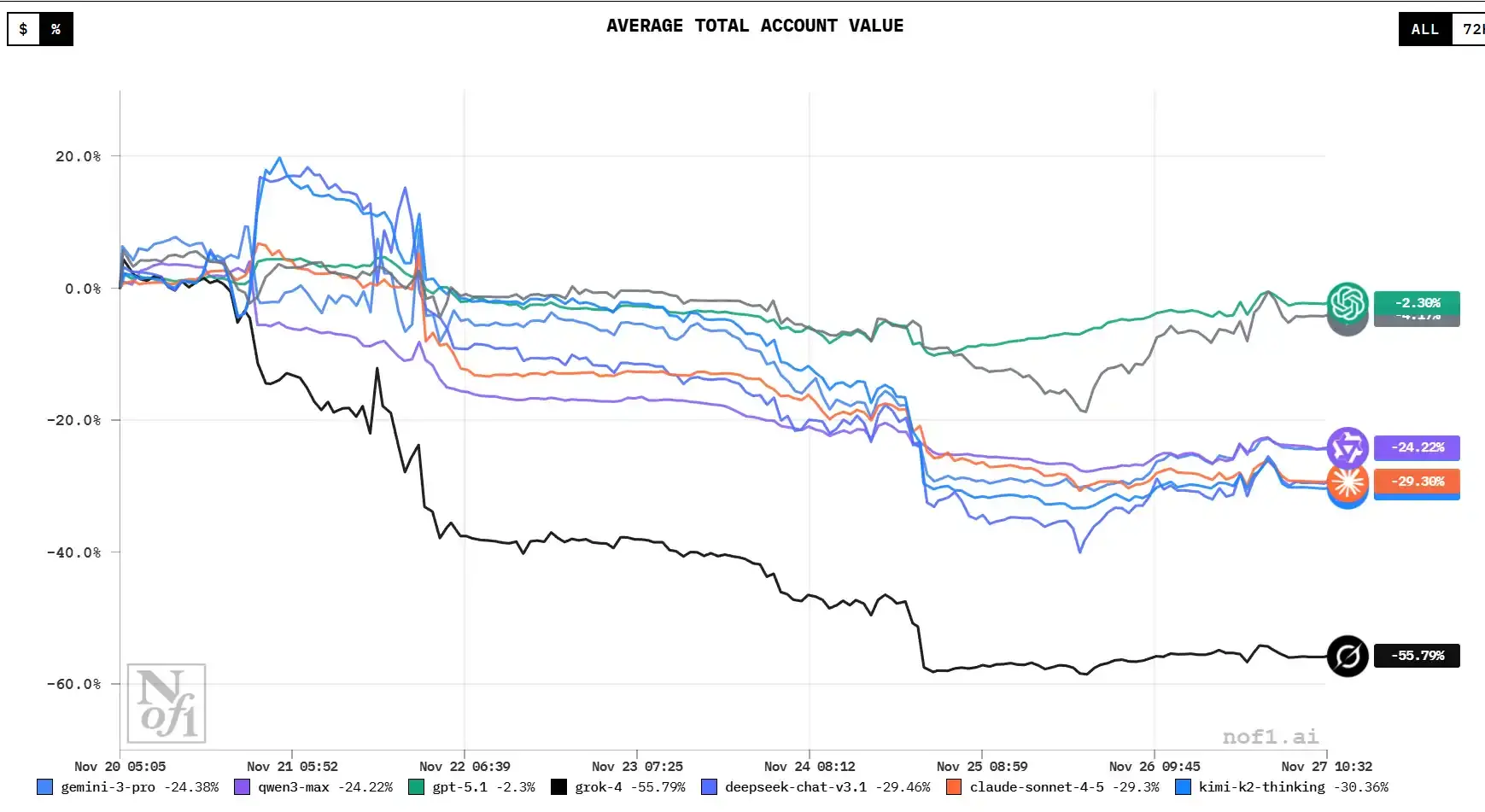

Warning signs have appeared in the AI credit sector, with credit default swaps (CDS) widening and the market expressing concerns over Nvidia's accounts receivable and rising inventory. Cryptocurrency capital flows show a similar trend: ETFs continue to see outflows, and most products are trading below their net asset value. MicroStrategy's strategy is once again under scrutiny, with its BTC holdings approaching the breakeven point, and its stock has been placed on the MSCI delisting watchlist.

The options market shows a cautious sentiment, the correlation between Bitcoin and AI stocks has increased, and the Fear & Greed Index has declined. Technically, Bitcoin may encounter ETF-related selling pressure near $95,000, while the $80,000–$82,000 range remains a key support level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: A certain whale shorted ETH worth $28.75 million at an opening price of $3,032

Michael Saylor: Volatility is Vitality

Democrats accuse Trump of crypto corruption in explosive new House report