Bitcoin Updates: Bitcoin ETFs See $3.8B Outflows While Solana Gains Momentum as Investors Shift Funds

- U.S. Bitcoin ETFs lost $3.79B in November 2025, with BlackRock's IBIT leading $355.5M outflows amid Bitcoin's six-month low below $95,000. - Outflows driven by profit-taking and macroeconomic pressures, including weak labor markets, sticky inflation, and tighter liquidity conditions. - Solana ETFs attracted $531M in first week, capitalizing on 7% staking yields and lower fees as investors shift to alternatives during Bitcoin's decline. - Analysts remain divided on Bitcoin's trajectory, with Citigroup for

The U.S.

These outflows highlighted a wider market pullback, with Bitcoin falling to $80,657 on November 24—its lowest since April 2025.

This pattern signaled a change in risk tolerance as global markets faced recession concerns and unpredictable monetary policy. Bloomberg’s Rebecca Sin attributed the ETF outflows to hedge funds closing “basis trading” positions and institutions hedging their derivatives exposure

Looking forward, experts are split on Bitcoin’s future direction. Some predict a possible recovery, while others warn that ongoing regulatory uncertainty and economic challenges could extend the slump. Citigroup’s Alex Saunders projected a bearish year-end target of $82,000, while James Butterfill forecasted a range between $80,000 and $150,000 for 2025

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Tether’s Bitcoin Investment Compared to Stability: S&P Raises Concerns Over Unstable Peg

- S&P Global Ratings downgraded Tether's USDT to "weak" due to 5.6% Bitcoin exposure exceeding its 3.9% overcollateralization threshold and limited reserve transparency. - Tether CEO defended the model, citing no redemption refusals and $10B 2025 net profit, while S&P warned Bitcoin/gold price drops could trigger undercollateralization risks. - Market turbulence saw $3.5B Bitcoin ETF outflows and $9.9B Bitcoin holdings, with Tether expanding into gold producers and crypto lending despite regulatory scrutin

Ethereum Updates Today: Blockchain’s Cleanliness Transformation: Privacy Moves from a Choice to a Necessity

- Ethereum co-founder Vitalik Buterin donated to privacy-focused projects Aztec Network and Kohaku, signaling blockchain's shift toward data protection as a core priority. - The Ignition Chain and Kohaku framework aim to address data breaches like SitusAMC by enabling private transactions via zero-knowledge proofs and protocol upgrades. - Ethereum's Fusaka upgrade (2025) and growing $1.2 trillion blockchain messaging market highlight privacy's rising economic and technical importance in decentralized syste

Australia’s Cryptocurrency Regulations Set to Unlock $24 Billion in Value While Enhancing Investor Protections

- Australia introduces 2025 Digital Assets Framework Bill to unlock $24B productivity gains while imposing strict client asset safeguards. - Legislation creates two new crypto financial product categories under Corporations Act, requiring AFSL licensing for platforms and tokenized custody services. - Exemptions for small operators (<$10M volume) balance innovation with regulation, aligning with global trends like U.S. GENIUS Act and SEC's Project Crypto. - Industry debates regulatory proportionality as Aus

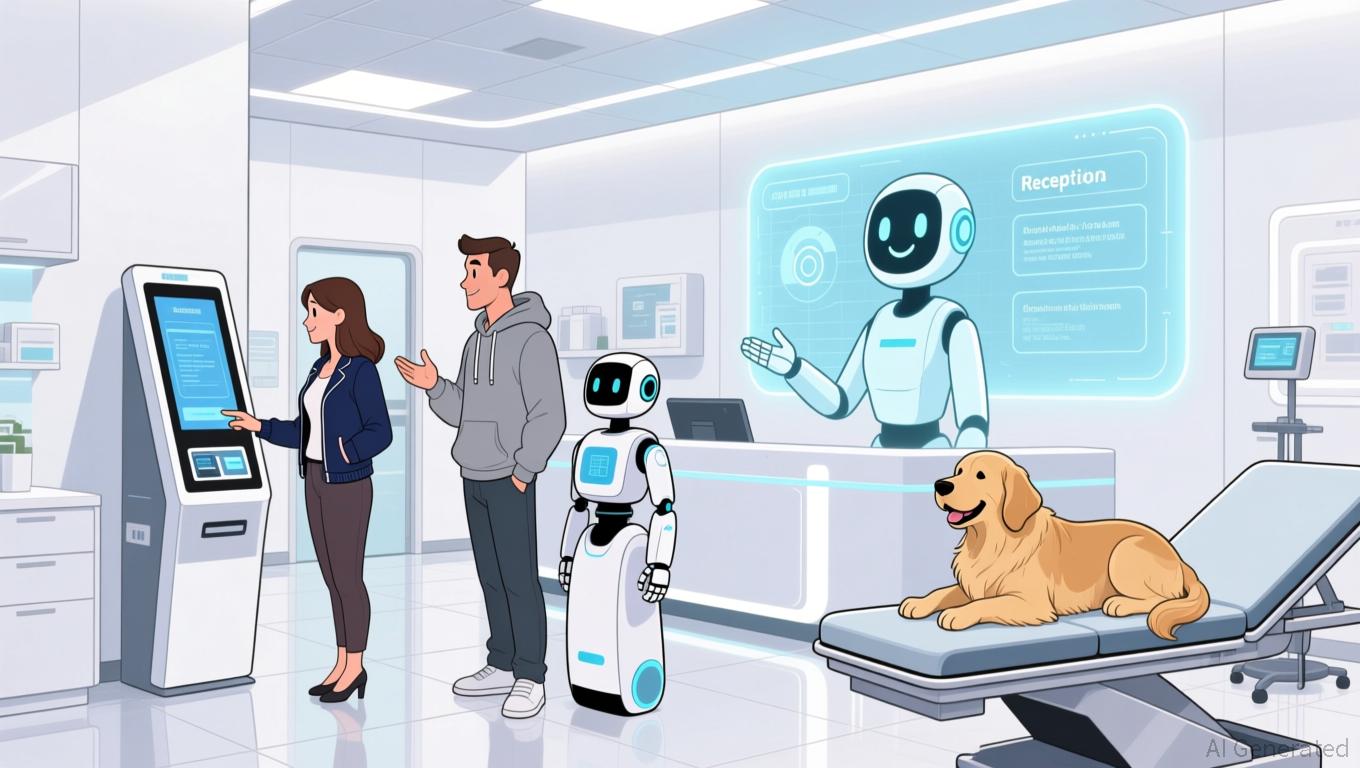

Nexton Connects Traditional Veterinary Clinics with Modern Technology Through $4M AI Investment

- Nexton Solutions secures $4M to launch PetVivo.ai, an AI platform slashing veterinary client acquisition costs by 50–90%. - Beta results show 47 new clients per practice in six months, with a $42.53 CAC—far below industry averages. - Targeting 30,000 U.S. practices, it projects $12M ARR in Year 1, scaling to $360M by Year 5 with SaaS margins of 80–90%. - Strategic AI alliances, like C3.ai-Microsoft and Salesforce’s AI CRM focus, highlight the sector’s growth potential.